Sydney blocks with live electricity substations deemed ‘prime’ land

A string of real estate listings for slivers of land have drawn wild reactions from observers due to one eyebrow-raising feature.

Slivers of land occupied by electricity substations are being sold off as “prime” home building sites across parts of Sydney in a move that’s stirred bemused and angry reactions online.

The narrow lots are being offered with live green boxes bolted to the ground and easements that allow maintenance workers access to the electricity kiosks for repairs and upkeep.

Some have labelled the sales “disgusting” and an example of “greed”, while others have expressed concerns about the potential noise and disruption of living around functioning electricity infrastructure.

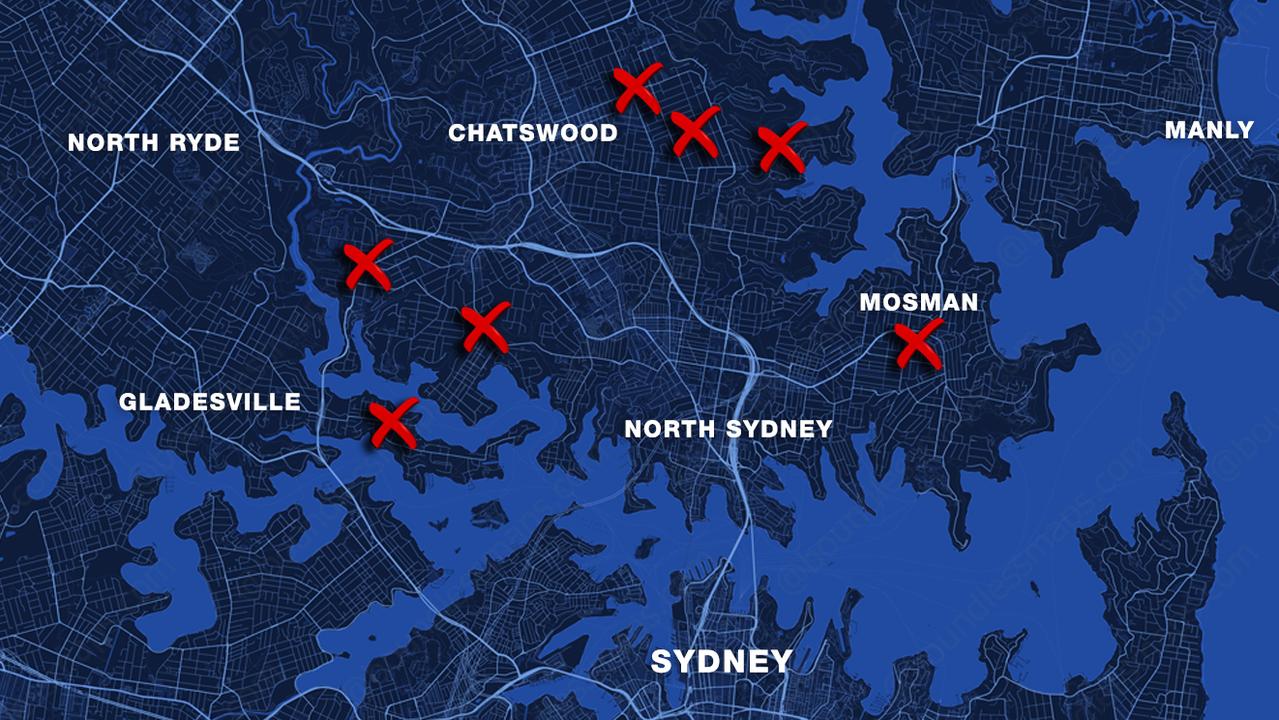

The properties – most of which are about 100 sqm – are spread across prestigious north shore suburbs including Hunters Hill, Longueville, Willoughby, Mosman and Chatswood.

MORE: Wild reason some Aussie homes just don’t sell

MORE: Nuns, showgirls: real estate agent’s bizarre house ad

Three of the eight sites go to auction this weekend. No price guides have been released ahead of the auctions but local sources indicated at least one could sell for more than $700,000.

The 101 sqm Mosman block, which goes to auction April 30, has a guide price of $475,000. The listing describes it as offering “untapped potential”.

It’s understood the properties are being sold off by a subsidiary of Ausgrid, which no longer needs them. They are zoned R2 for low density residential.

Belle Property agent Simon Harrison, the agent co-ordinating most of the sales, said the sites were “too unique” to price.

MORE: Aussie landlord’s horror after 12 homes stolen

MORE: $15m baby! 19yo reveals property empire

“There’s nothing to compare them to,” he said. “I’ve never sold anything like them.”

The properties were attracting “a lot of interest” because they were an opportunity to get into popular north shore suburbs for a cheaper price, Mr Harrison said.

“We are getting some interest from first-home buyers and mum and dad-types who want to build something. You’d have to be very creative,” he said.

Social media has erupted over one of the listings – a Longueville block that goes to auction Saturday – with comments ranging from puzzled to furious.

The listing for the Kenneth St property claims the “compact block offers endless potential for those with vision”.

“This has to be a late April fool’s joke,” said one comment. Another said: “God they are desperate”.

MORE: ‘Finally’: When to expect multiple RBA cuts

A common theme was disappointment that the site was not being used for open space instead.

“How about planting trees and flora, create a small park for wild life and people to access. That block is not suitable for a home or town house. That would be a shoebox of a unit with no yard. Absolutely ridiculous. It’s all about $$$. What a joke,” one social media user said.

Others poked fun at the listing, with comments like “Living the Australian dream” and “Kentucky Fried Tenant when the substation explodes”.

Mr Harrison explained that the properties were being sold with easements for the continued operation of the electricity kiosks. He said they did not “make noise” and “were safe”.

MORE: Aussies to get $5k back amid US tariffs

Some of the strongest interest was from direct neighbours wanting to expand the sizes of their blocks, he added.

This was especially true for the substation site in Hunters Hill, a much smaller L-shaped block on Foss St.

“That’s one of the trickier ones,” he said. “There’s one in Lane Cove West that would be wide enough for a driveway.

“For most of these, you could build smaller one- to two-bedroom houses but it needs creativity.”

RBA pours cold water on rate cut hopes

The bizarre trend comes amid increasing desperation from some to get into the housing market — especially as rates are tipped to come down this year.

Reserve Bank governor Michele Bullock has poured cold water over predictions of a double interest rate cut next month insisting it’s “too early” to make hard calls on the impact of Donald Trump’s tariff chaos.

Just three days ago there were predictions homeowners could have their mortgage repayments slashed by $6000 a year if a global recession is triggered by Donald Trump’s trade war chaos — including a double rate cut in May alone.

MORE: Aussies to get $5k back amid US tariffs

But as the ASX200 rallied following President Trump’s decision to pause reciprocal tariffs, Ms Bullock altered a prepared speech to warn the path ahead was not yet clear.

In a speech to Chief Executive Women in Melbourne on Thursday evening, she said the bank will take into consideration a range of factors.

MORE: Home loan trap taking years to escape

“We are mindful of not adding to the uncertainty, and to that end, it’s too early for us to determine what the path will be for interest rates. Our focus remains on our dual mandate for price stability and full employment,’’ Ms Bullock said.

“There are a lot of moving parts. We are bringing all this together to form an objective assessment of what it means for the outlook for domestic activity and inflation here at home.

“Inevitably, there will be a period of uncertainty and adjustment as countries respond to the ongoing tariff announcements by the United States administration,’’ she said.

Ms Bullock said it was going to “take some time to see how all of this plays out and the added unpredictability means we need to be patient as we work through how all of this could affect demand and supply globally.”

“Financial market and economic volatility can be expected as this process unfolds. But there are two points I want to make on this. First, we’re not currently seeing the same degree of impact as previous market events like in 2008 for example,’’ she said.

“And second, the Australian financial system is strong and well placed to absorb shocks from abroad.”

As the fallout from the US President’s new trade war engulfs stock markets worldwide, there were fresh predictions this week of a US recession and rapid interest rate cuts.

But Mr Trump then announced a 90-day pause on his announced tariffs.

“’Unpredictable’ is the word,” Shane Oliver, chief economist and head of investment strategy at AMP, told news.com.au.

“By the same token, I’m not surprised. Donald Trump is just so unpredictable that these things are par for the course.”

“I think everyone went into hyper drive a little,” Dr Oliver said. “That was probably a bit far.

“This development pulls back a little bit on those expectations, but I think we’re still going to get at least 25 basis points in May, and there’s maybe a 50 per cent chance we’ll get 50 basis points.

Data from comparison service Canstar shows a standard rate cut next month would slash $76 per month off the repayments on a $500,000 mortgage.

If it was super-sized, that figure would leap to $151 per month, providing some good breathing room for stretched household budgets.

Four rate cuts in next 12 months

Despite fears of a US recession, the economic fallout could have a silver lining for Aussie homeowners slashing up to $400 a month from the average mortgage over the next year.

The ANZ is now forecasting four 0.25 per cent interest rate cuts that could save homeowners with a $600,000 loan around $76 to $156 per month depending on loan size.

A variable rate borrower with a $500,000 home loan could see their monthly repayments drop by around $76, while a borrower with a $1 million loan could see a reduction of $153.

For families with a larger $1 million loan size the savings could be worth $9000 a year.

ANZ chief economist Richard Yetsenga said he was not ruling out a 50 basis point cut – a double rate cut – in May.

“We now expect the RBA to ease in May, July and August – 25 basis points at each meeting,’’ he said.

“This would see the cash rate at 3.35 per cent in August. We do not rule out a 50bp cut in May if sentiment sours and the global growth outlook deteriorates sufficiently.

“The tariffs are disproportionately stiffer for Asia. The impact on mainland China’s economy will be limited. Malaysia, Thailand and Vietnam will be more vulnerable. US tariffs can significantly disrupt India’s exports.

“We expect Asian currencies to bear the brunt of the adjustment to the announced tariffs.”

The Reserve Bank of Australia (RBA) cut the cash rate by 25 basis points in February, saving Australian homeowners with variable interest rate mortgages around $100 to $150 per month, potentially amounting to $1200 or more annually.

Next RBA meeting could deliver a rate cut

In a stunning prediction, Treasurer Jim Chalmers said the dive in the value of the Australian dollar – currently about 60 cents for $US1 – hinted at “around four interest rate cuts in Australia this calendar year”.

And he’s predicted there could be a double rate cut as early as next month.

“The next Reserve Bank interest rate cut in May might be as big as 50 basis points,” he said.

“Forecasting is difficult enough in more stable times, but especially so in uncertain times.

“Clearly a series of decisions are still to be taken around the world when it comes to how countries may or may not retaliate to the decisions taken and announced by President Donald Trump in the last week or so.

“So, there is an element of uncertainty around the modelling and there’s an element of uncertainty on the economic impacts more broadly.”

Releasing Treasury’s third updated forecasts on the impacts of the tariffs, he warned now was not the time to change the government.

“Australia is better placed and better prepared than our peers,” he said. “This would be the worst time to risk a change of government, to a Coalition government, which would make wages lower, taxes higher, and who has secret cuts to pay for nuclear reactors.”

Treasurer Jim Chalmers said he wanted to assure people that in a world of volatility and uncertainty, Australia is better placed and better prepared than our peers.

“Everyone with a super fund, everyone with shares, I think probably every Australian, is seeing what’s happening on global share markets and in our own share market with a degree of trepidation about all of this uncertainty,” he said.

“So yes, we are concerned, and we’ll continue to engage. I’m concerned about the impact in Asia. If you look at the impact of some of the tariffs on Asia, some of them were quite high.”

— with Sam Maiden