Sydney auctions: video raises debate over price guides in real estate industry

Just how house sales in Sydney’s tight property market are ending up way above price guides shows the power imbalance faced by buyers.

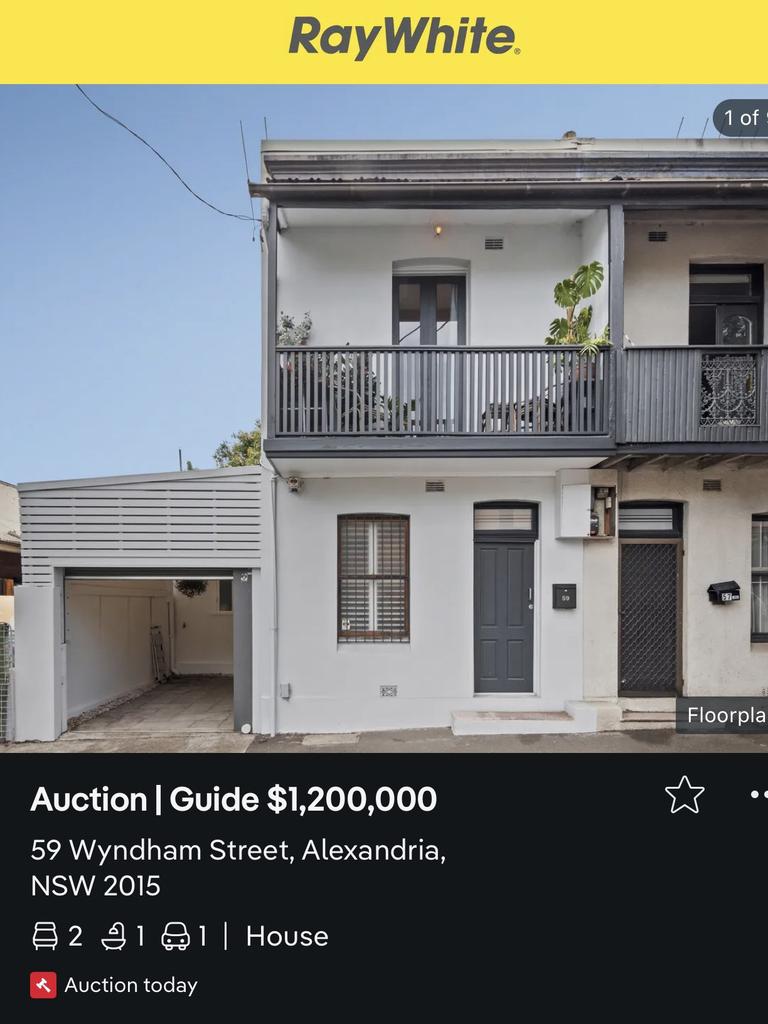

Just how a terrace home in one of Sydney’s most sought after suburbs was passed in at auction $250,000 over its price guide has sparked debate about power imbalance faced by buyers.

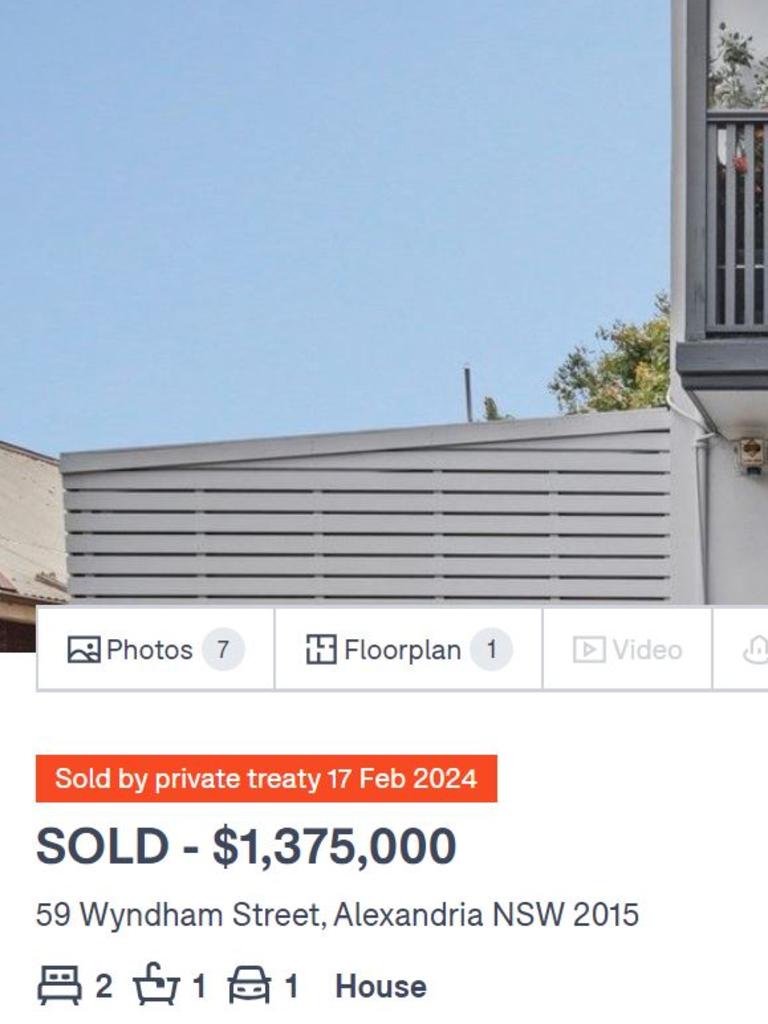

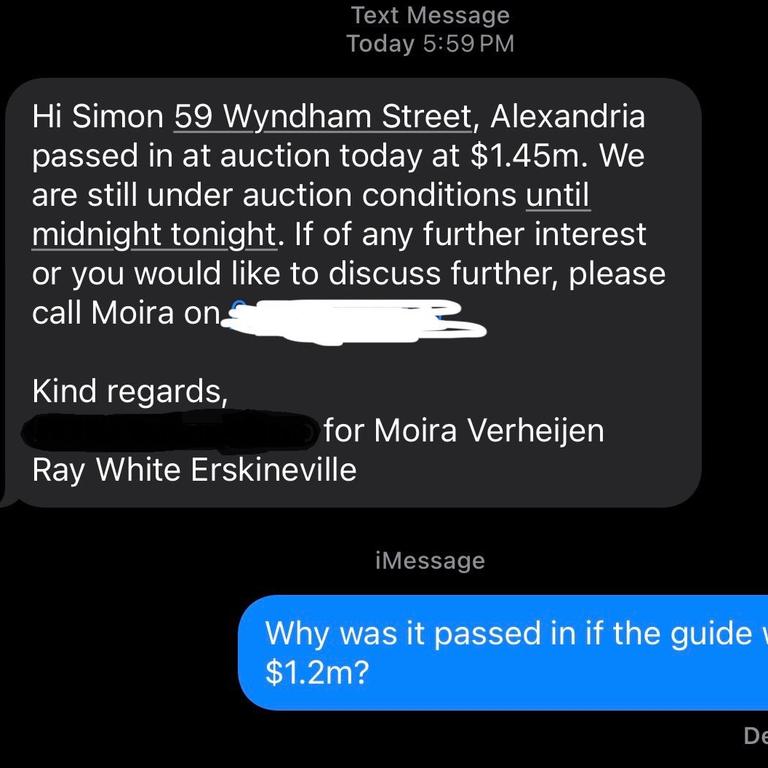

Guides listed the two-bedroom home in Alexandria at $1.2m but it was passed in at $1.45m, before selling privately the same day for $75,000 less.

Agency Ray White, however, said the top offer at auction was actually a vendor bid – a perfectly legal tactic used to drive up the haggling closer to the owner’s desired sale price.

Vendor bids are common practice around the country.

In NSW sellers are only allowed to make one bid that must be clearly announced, unlike in other states where vendor bids can be unlimited.

The Wyndham St auction caught the attention of TikToker Simon Berry, who used the result to discuss how price guides work in Sydney.

He said prospective home buyers had no way of verifying the data used to set estimated selling prices because it was not publicly available, which skews the balance of power against them.

Mr Berry said people spent time and money chasing homes they believed were in their price range “only to be left disappointed because the price guide used to advertise the property is materially lower than a seller is actually willing to accept for the property”.

“The system in NSW is fundamentally flawed because the buyer’s and seller’s interests are not aligned based on a standardised and publicly available document … like the Statement of Information used in Victoria,” he said.

“While it’s not perfect there, it certainly seems like pricing transparency has shifted the balance of power a little closer to the prospective buyer. I’d love to see NSW take a page out of Victoria’s book.”

In NSW selling agents are allowed to advertise price guide range that does not exceed 10 per cent when listing a property for sale.

For example a property could have an advertised price range of $800,000 to $880,000.

Mr Berry posted two videos about the Alexandria listing, one of which included a text sent by an agent on Saturday stating the home was passed in but did not disclose the highest bid was from the owners.

“We are still under auction conditions under midnight tonight,” it read.

The text stated to call the lead agent if the property was “of any further interest or you would like to discuss further”.

News.com.au does not suggest the agents or agency engaged in any wrongdoing.

Ray White Erskineville agent Moira Verheijen explained the auction had ground to a halt with just three bidders and a top offer of $1.1m.

“The auction stalled as there were no bids and my vendors, expats who live in the UK, told me to pass the property in at $1.45 million to a vendor bid,” Ms Verheijen said.

She said a price guide was set with comparable sales in the area but the reserve was set by the vendors on the day – and that was not met during the auction.

“In this case the vendors’ expectations were not in line with the feedback in the market which is reflected by the ultimate sale price. The property was sold later that night for $1.375 million,” Ms Verheijen said.

The median price for a two-bedroom home in Alexandria is hovering just below $1.798m, according to realestate.com.au.

Buyer’s agent Linda Johnson said the discrepancies between price guides and sales were driven by the market and people paying “silly prices” out of desperation in a tight market.

The NSW representative of the Real Estate Buyers Agents Association of Australia said she believed the vast majority of agents did not engage in the unlawful act of underquoting.

“It’s actually not just as simple as underquoting,” she said.

“In most cases it is actually the market or buyers who are driving the prices.”

Ms Johnson said there was still a school of agents who followed an age old saying in real estate, “start them low and watch them go”, which was misleading and frustrating for buyers.

NSW Fair Trading’s website says underquoting laws were introduced to ensure buyers don’t waste time and money attending auctions and inspections for properties that will likely be out of their budget.

“An agent is underquoting the selling price of a residential property if they make a statement or publish an advertisement about its price that is less than their reasonable estimate of the property’s likely selling price,” it states.

Agents face a fine of up to $22,000 and potentially a loss of commission if found to have engaged in the practice.

Ms Johnson from Spring Buyers Agency said price guides tended to include a “huge range” between the maximum and minimum, which confused people looking for properties.

That and vendors “blindsiding” everyone with “unrealistic” expectations set on the day of an auction.

“That price then sets the benchmark for that suburb or street,” she said.

“It’s market driven and it’s out of desperation, lack of stock, FOMO (fear of missing out).”

On Mr Berry’s first video, watched by 257,000 people, some users were quick to point out that the Alexandria sale was not a case of underquoting.

Commentors asked what he expected to happen if the owners were not happy with offers.

“What should the agent do? Stop the bidding at the guide price?” one asked.

Others vented their frustration at being caught out by guides that were well below the final price in other sales.

More Coverage

A person responding to Mr Berry’s post on X, formerly Twitter, said he had seen a house in Glebe go for $500,000 over the price guide.

“It was clearly under quoted and wasted everyone’s time,” he said. “My friends offered the guide price and were laughed at.”

NSW Fair Trading were contacted for comment.