Shock image shows why the worst is set to return

This image is a warning for anyone who thinks they can cruise when it comes to housing and living costs, with the worst set to return.

This image should be a warning for anyone who thinks they can cruise when it comes to housing and living costs, with the worst set to return.

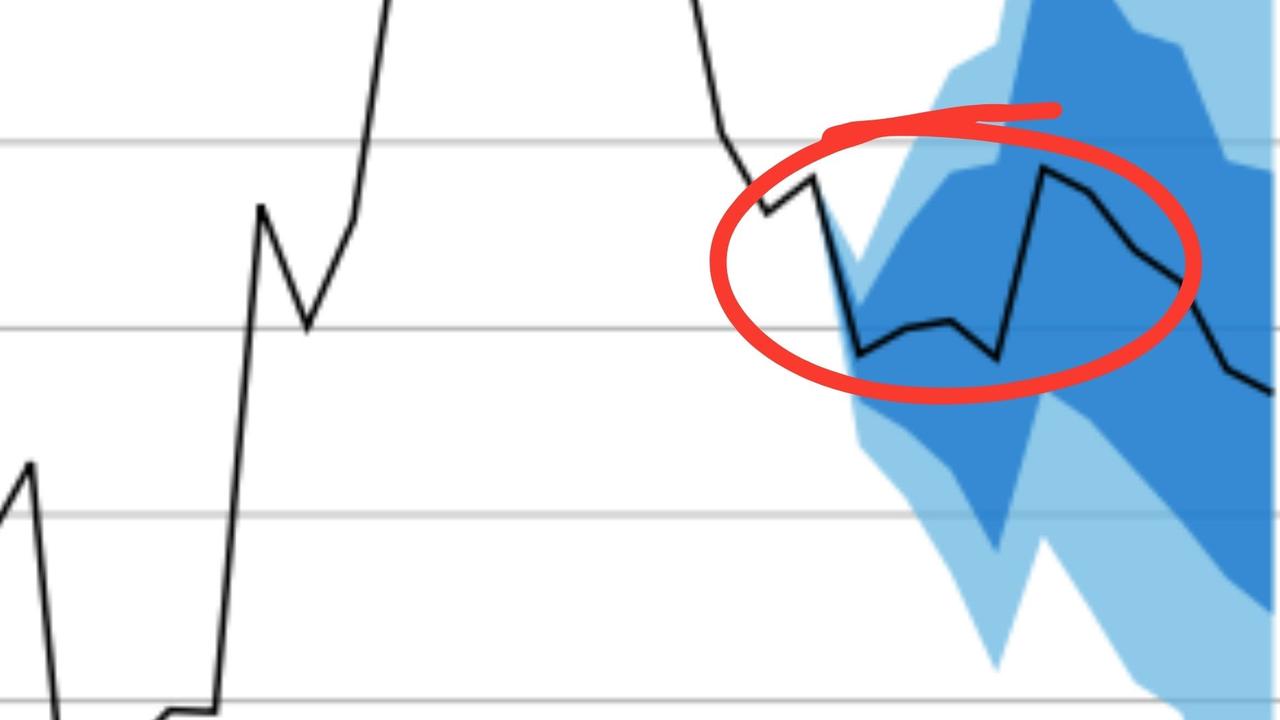

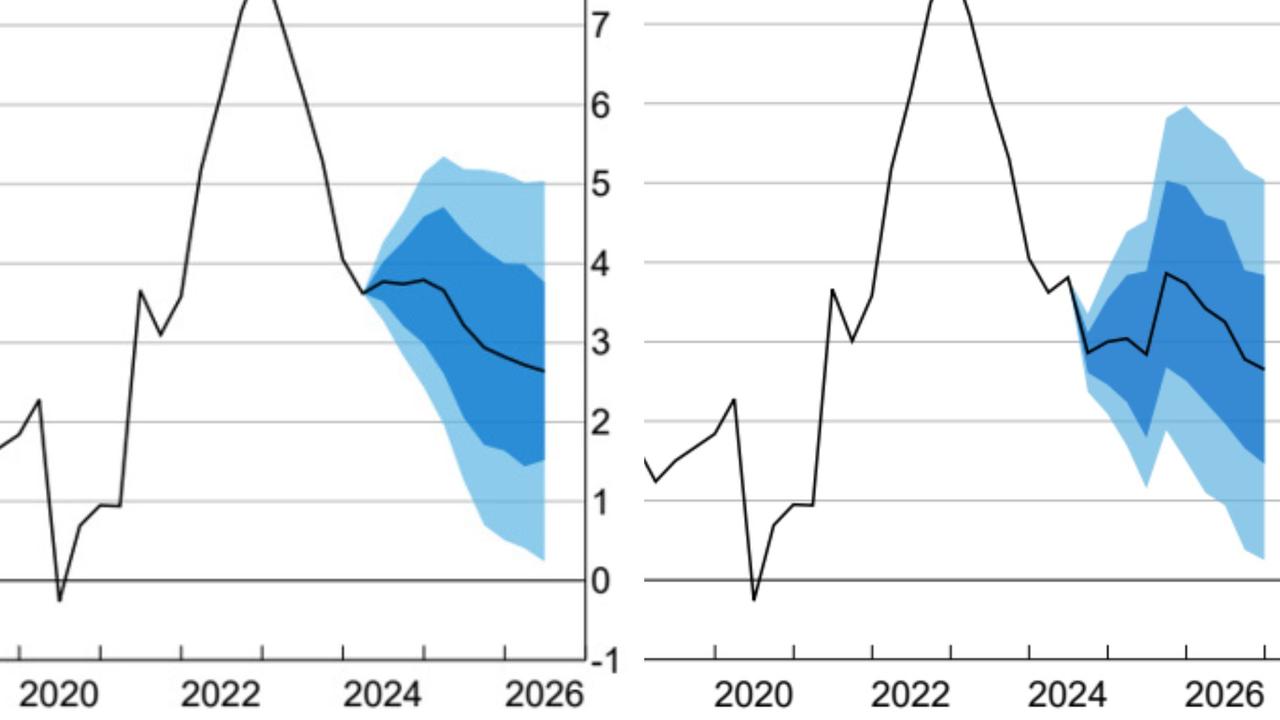

An updated graphic released by the Reserve Bank of Australia shows its economists expect all gains made to reduce inflation levels this year to be wiped out next year when inflation spikes again.

NEWS: Backlash: How MPs fuel housing crisis

Qld mansion favoured by Hollywood royalty up for sale

Stunning mortgagee sales up for grabs as 100 suburbs in trouble

PRD Real Estate chief economist Dr Diaswati (Asti) Mardiasmo was among those with raised brows over the RBA’s latest inflation predictions contained in its August statement of monetary policy.

“Eek, look at that slight bump predicted for later this year and a sharp increase predicted for 2025,” she said. “Back in May SMP it was predicted we will be at target 2-3pc healthy rate by late 2025. Now looks like it won’t be until late 2026.”

Comparing the two graphs – from May SMP and August SMP – shows “quite a change in the space of three months,” Dr Mardiasmo said.

“All smooth sailing on stable and then going down back in May,” she said. “But the August one tells a different story.”

This as some have begun celebrating the second monthly fall in a row of the Consumer Price Indicator – with latest figures showing it hit 3.5 per cent for the year to July, from 3.8 per cent in June. Trimmed inflation, which RBA prefers to watch, was 3.8 per cent in July (down from 4.1pc in June).

But a big chunk of that coming off cheaper electricity after the introduction of government rebates. That saw prices fall 5.1 per cent in the year to July, after rising 7.5 per cent in June, according to RateCity.com.au money editor Laine Gordon.

“Australia is making good progress in the marathon that is tackling inflation, however, even with two consecutive monthly drops in prices, the race is not yet won.”

The RBA’s graph is a warning to consumers, homeowners, borrowers and everyone in between to exercise caution in their spending patterns even if inflation miraculously goes down to 3pc this year – because a hike rebound is ahead.

Dr Mardiasmo said “for those who haven’t bought (property) yet, now would be an ideal time to before you have a double disadvantage.”

She said the first disadvantage was “possibly RBA increasing the cash rate – which is usual with higher inflation rates – which means you can borrow less”.

The second was “everything else costing so much more – which means that you may have to dip into your savings or “let go” of some of the saved up money you were planning on using for a deposit”.

In its explainer on headline inflation changes for August, the RBA said “over the next two years or so, the differences between the forecasts for underlying and headline inflation primarily reflect changes in government policies to provide cost-of-living relief to households”.

“Year-ended headline inflation is forecast to be three-quarters of a percentage point lower than trimmed mean inflation in the September quarter of 2024. Most of this difference can be attributed to the recent introduction of new state and federal energy rebates.”

“By contrast, the year-ended rate of headline inflation in 2025 is forecast to be almost 1 percentage point higher than trimmed mean inflation, reflecting both the legislated unwinding of the 2024 electricity rebate and an increase in the federal tobacco excise.”

Originally published as Shock image shows why the worst is set to return