The two most dangerous words in real estate

AUSTRALIA’S biggest housing markets are falling quickly. And sellers have a lot to answer for.

WANT to know the most dangerous words in the market right now? “Passed in.”

Ever been to an auction where nobody bids? If buyers and sellers can’t agree on a price, the house is passed in. Usually if a house is passed in it remains unsold — sometimes for months.

This is a real estate agent’s nightmare. Their marketing campaign for the house has failed, they don’t get any commission and their client is cross. Worse, they have to keep working on selling the place.

A passed-in house will still be on the market next weekend, when the real estate agent is trying to sell other properties. And the weekend after, as more and more other houses are put up for sale.

As Australia’s auction clearance rates fall to a dismal 41 per cent, the more stock builds up in the market, and the more options buyers have to choose from.

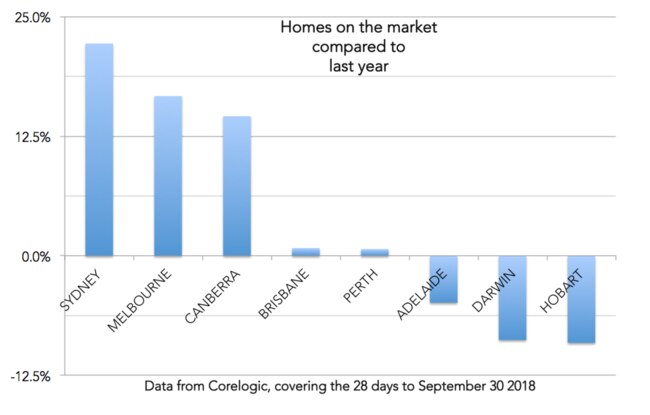

This next graph shows just how much more stock is in the market than this time last year, and it is bad news for anyone selling their property — especially in Australia’s two biggest housing markets of Sydney and Melbourne.

Thousands of places are building up, creating a buyer’s market. In Sydney, the number of places for sale is the highest in many years, and rising still.

Any shopkeeper can tell you when stock starts building up too high, it is time to have a clearance sale. And in real estate the markdowns have begun. The price of houses is not only falling across most of Australia, but falling faster and faster. (Exclusions in Adelaide and Hobart, which never quite got so bubbly and are still doing rather well.) Is it enough? We will only know once the stock of homes on the market starts shrinking.

PIPELINE

Homes that got passed in are not the only ones clogging up the results pages when you search for real estate. New homes keep being finished, and that adds to supply.

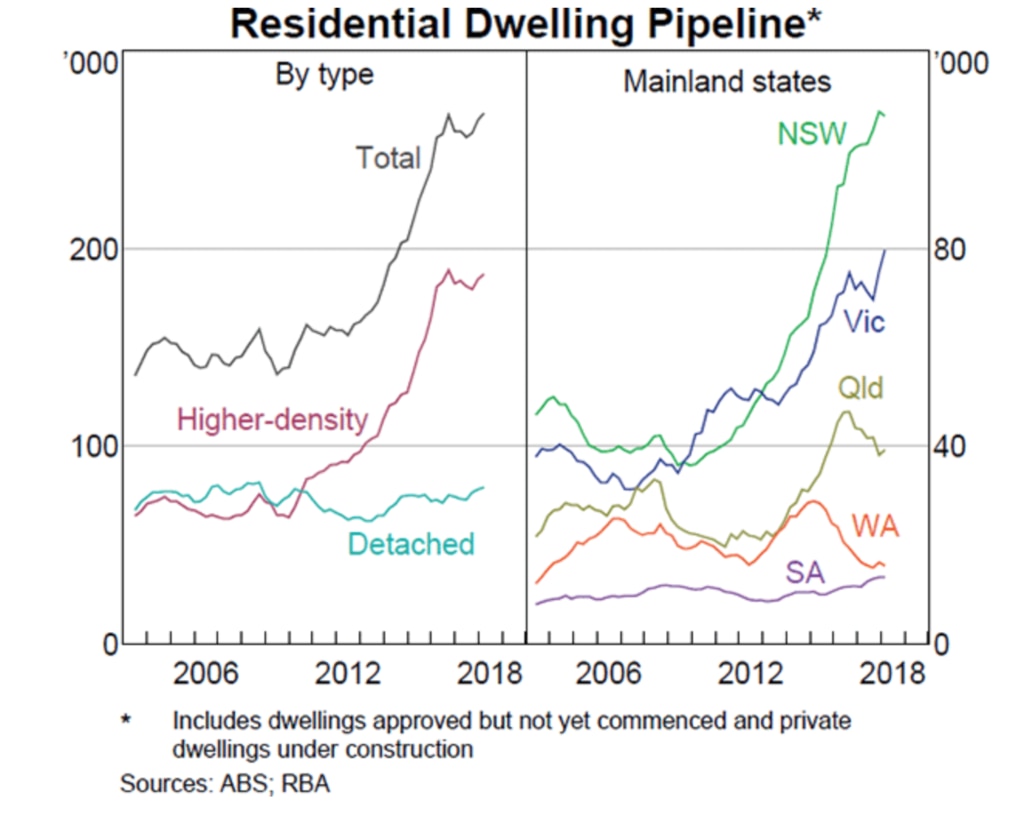

Near my house, what was an excavation site two years ago is finally being turned into finished apartments. I see waves and waves of moving trucks coming along, spewing out excited new residents and their furniture. This is happening all across Australia. And as the next graph shows, it’s not over. A lot more homes are still being built.

On the left side of this graph you can see a line marked higher density, zooming upwards. That refers mostly to apartments, which are a particularly interesting part of the supply situation.

Off-plan apartments are mostly sold before building commences. But those sales face a particular risk — settlement. You can put down a $10,000 deposit on a $400,000 apartment. But when it finishes construction you still need to get your loan. If the bank decides the falling market means the apartment is now worth $350,000, they might not be willing to make the loan, and you will be unable to settle.

MORE: House prices could fall by 15 per cent

MORE: Australian suburbs most at risk of a housing crash

Developers can then find sold apartments suddenly turn back into unsold, adding to supply.

Even when they do sell without a hitch, new apartments can create a cascade of new supply. If the apartments are small ones for students, they might free up a sharehouse somewhere. If they are luxury apartments for wealthy people to downsize into, they might free up a nice family home in a leafy suburb somewhere.

Think of it as a chain reaction. Apartment supply can help lift supply across the whole market so it can affect prices you care about — even if you’re not in the market for an apartment.

INTEREST-ONLY CLIFF

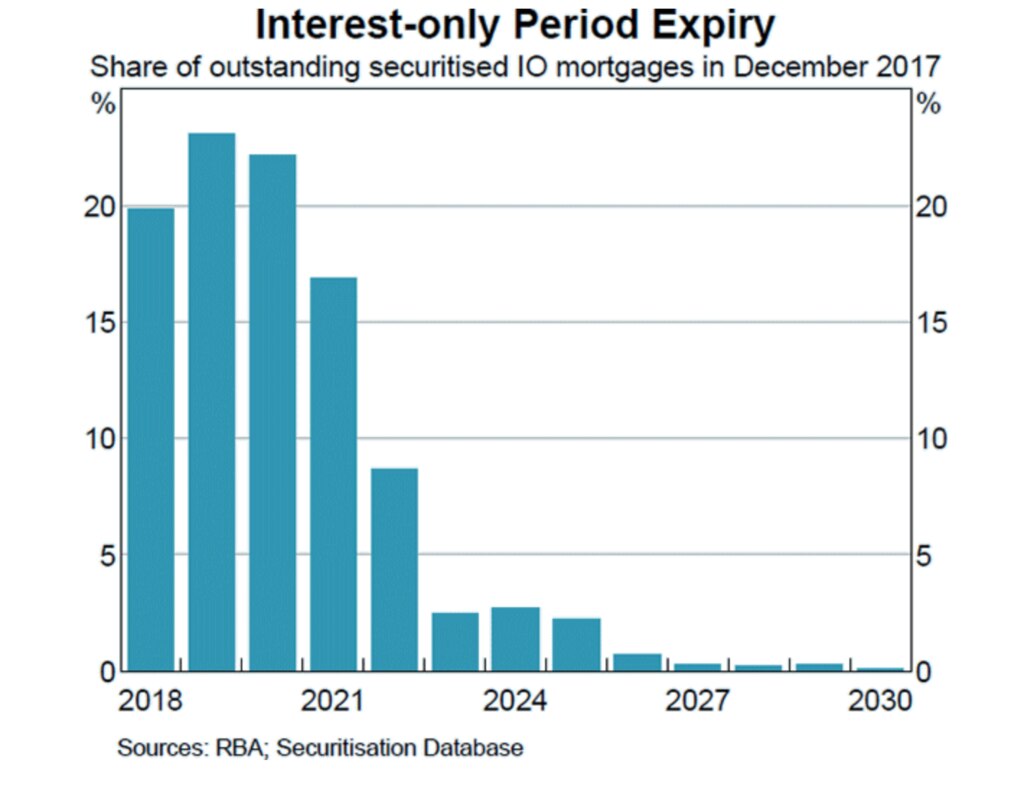

This is a smaller source of supply but it is one to watch.

As the next graphic shows, many property investors have to move their home loan from interest-only to principal plus interest, which will raise their repayments. The number of people who have to make that move will peak in 2019, but it won’t really slow down until 2022.

The higher repayments are likely to cause some property investors to sell their properties and could cause a further flurry of homes being put on the market.

CLINGING

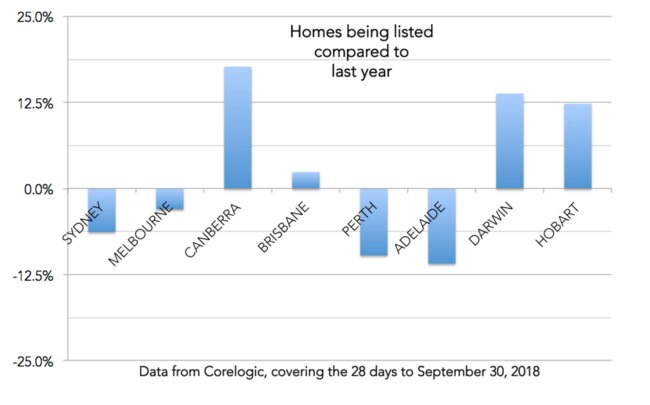

Sellers are not stupid. They don’t sell houses into a falling market if they can avoid it. The reaction to lower prices is fewer listings, as this next graphic shows:

Exceptions for Canberra, Darwin and Hobart — but the vast bulk of Australia’s property market is in those two bars on the left side, where new listings are trickling in more slowly than 2017.

Putting fewer houses up for sale is, however, not enough to prevent stock building up right now. Sellers are reluctant, but buyers are even more reluctant. Nationwide, the number of sales is down 10 per cent compared to 2017, and by as much as 18.5 per cent in Sydney.

The number selling at a loss has risen to 10 per cent, but it might need to go higher to clear the decks. How do we break this stand-off?

The way to think about this is with the concept of “anchoring”. We get used to a certain price level and we use it as an “anchor”. Maybe you saw a house in your suburb sell for $900,000 and that is now your anchor. You won’t sell for less.

But over time, anchors rust. They don’t work any more, and they need to be thrown away.

God knows that happened to buyers on the way up. Buyers had to be willing to toss their old anchors overboard every weekend. If your anchor was stick $600,000, you lost a lot of auctions until you were willing to admit your new anchor should be $700,000.

It is possible to change your mind about where your anchor should be, and sellers might have to do that soon. The concept of loss aversion means they might be a little slower to do so than buyers were, but if we are in a falling market, there will be little alternative than sucking it up.

Jason Murphy is an economist. Follow him on Twitter: @jasemurphy