Our weakest link: Australian suburbs most at risk

IN THE event of a housing market crash, which even the PM concedes is a possibility, the effects won’t be felt equally across the nation.

NOW even the Prime Minister is talking about it.

An Australian housing crash is no longer a wild hypothesis pushed by a few people, it is a major talking point. The TV program 60 Minutes did a big investigation last week and now PM Scott Morrison has been out warning we could have a devastating house price crash if a few policies are tweaked. (Is it wise for him to talk like that when these things run on confidence? That’s another question.)

Are you going to see a removal truck in your street one day and discover the bank has taken your neighbour’s house? Could the bank come for your house? The data show a concerning picture.

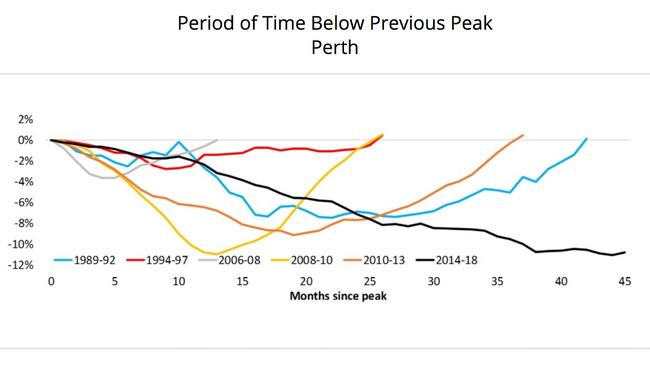

At the beginning, house price falls were isolated. Perth was having trouble, but that was the mining boom’s fault. Then Sydney had a month where prices fell. Soon it had two months of falls. Eventually other cities joined in too, and the prices started registering as not just lower than a few months ago, but lower than a year ago.

Now it is really official. The Australian Bureau of Statistics, which moves slow and does not exaggerate, reports that on average Australian property prices are now lower than they were a year ago. Not by a lot — just 0.6 per cent lower. But the falls don’t look like stopping yet.

At the moment, we see medium-sized falls in the price of the most expensive homes. Posh suburbs have falling prices while for the rest prices are still getting more expensive, slowly.

The question is where gets hurt the most. And that depends on how bad the falls are.

SCENARIO ONE: STATUS QUO

Maybe prices fall gently for a few more months. But they hold steady for a few years after that — not falling, but not rising much either. That would be a pretty good scenario for the economy, with housing getting more affordable — slowly — as wages start to increase.

Very few people default on their home loans, but houses remain expensive.

SCENARIO TWO: SLOW TO LOW

House prices might just keep slowly falling, Perth-style.

This could eventually force some people to default on their mortgage. The people most at risk here are the people who are already in severe mortgage stress, which is mostly the very well-off who took on great big loans.

“Stress is not limited to the batters or fringe of our cities — in fact the more affluent suburbs are also registering stress, thanks to big income but also big loans and (interest-only) loans and multiple investment mortgages,” says Martin North, who runs property consultancy DFA analytics.

While mortgage stress is widespread in the less fancy suburbs, severe mortgage stress is highest in suburbs with lots of highly paid professionals. Think of Lane Cove on the north side of Sydney Harbour. And suburbs like it all over Australia. The kind of places where a BMW glides into the double garage and parks by a Range Rover, but you’re not sure if they’re bought on credit. Places like Miamin on the Gold Coast, Wembley in Perth, Brighton in Melbourne, or equally Brighton in Adelaide.

Some of these people have apparently taken on great big loans, and they could suffer. With luck though, these losses are not widespread, and the hit to the economy is not so severe.

SCENARIO 3 — OH NO

You sometimes hear certain young people wishing for a really big housing crash. But when house prices fall far enough they spill over into the rest of the economy. What you get is a really big disaster.

Housing market analyst Martin North says there is a 20 per cent chance that house prices could fall by 40 per cent in the next few years.

Will they really? North was challenged to a bet on that by another economist and didn’t want to put his money where his mouth is. Most economists think being willing to back your forecast with money is the only real way to prove you believe in it. (Are economists bad people for wanting to bet on these sort of things that could drive families to the wall? Maybe.)

Is North right that the risk of an imminent big crash is 20 per cent? I think the chance is lower.

But it is still worth thinking about, because the downside is high. If it comes to the bad scenario, you get a feedback loop from the price of houses to spending in the economy. If people stop spending, that affects employment and incomes. If people lose their jobs their ability to afford their mortgage gets even worse.

In this scenario, the RBA would cut interest rates to reduce mortgage pressures, but it might not be enough. Pressure on mortgages would spread beyond the wealthy suburbs that are already under severe mortgage stress. It would hits the battler suburbs first.

Martin North has data on which suburbs have the most widespread mortgage stress (albeit not yet the severe kind), and they are those battler suburbs. Not Range Rover suburbs so much as Commodore and Falcon suburbs. We’re talking about Campbelltown or Moorebank in Sydney, Frankston and Pakenham in Melbourne. Places where unemployment is no stranger. You might also think of Ashby, Wanneroo, Clarkson, in Perth, or Ashby, Mount Lofty and Rangeville in Toowoomba.

If the big housing crash ScoMo has been talking about comes to pass it will be ordinary Australians in ordinary suburbs who bear the brunt.