The hidden cost of the house price crash

AUSTRALIA’S biggest housing markets are falling quickly. While sellers might be panicking, the biggest cost will be felt by everyone.

STATE governments love splashing the cash, especially at election time.

New road? There’s $4 billion to you. What about that long-promised rail link between the airport and the city? Another few billion.

But the well of cash is running dry, and it’s all because we’ve stopped buying houses.

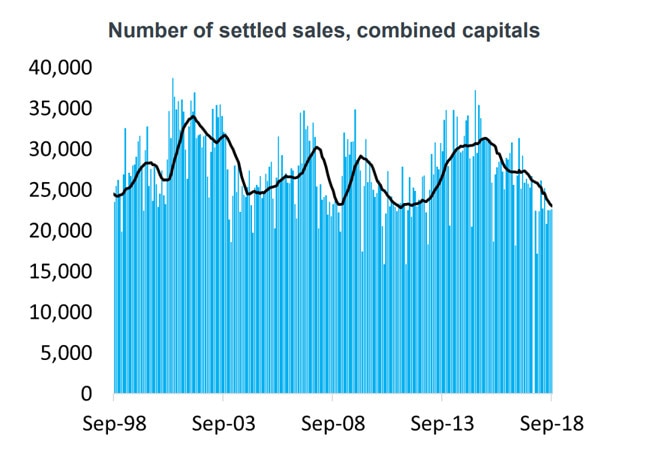

CoreLogic data shows the clearance rate is at its lowest point since December 2012, with houses in many suburbs failing to sell and values down 4.3 per cent in the last 12 months from a high in September last year.

The number of settled sales is also down 10 per cent nationally, 18.5 per cent in Sydney 15.8 per cent in Melbourne. This represents a significant drop off in land transfer duty revenue, Tim Lawless, CoreLogic head of research, told news.com.au.

“Clearly there’s a double whammy of less turnover and fewer stamp duty events,” he said.

“That’s going to have to have an impact on budgets and revenues for a state government.”

While the market was booming, people just swallowed the cost, and kept buying up.

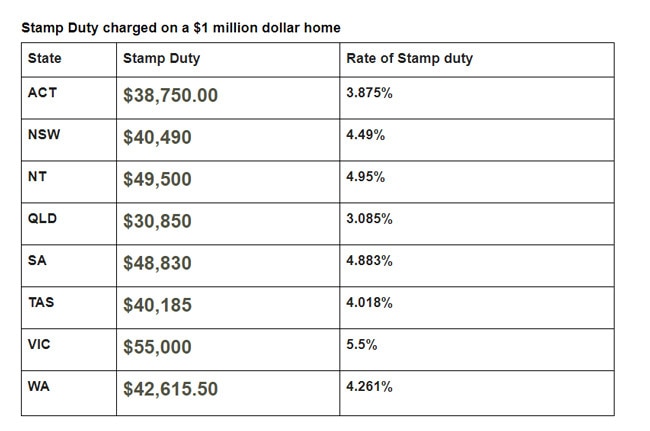

Every established home that was sold netted tens of thousands of dollars to the state’s coffers, depending on the cost of the home, and which state it was in.

But as the market cools, not only are prices tumbling, but more importantly, the volume of sales is hugely down. And that means there’s a lot less cash coming in, in the form of stamp duty.

As residents of these states that have relied on that cash, we’re about to feel the pain.

WHAT IS STAMP DUTY?

Stamp duty is levied on the purchase of existing homes, it is not paid on apartments or houses bought off the plan.

First home buyers, too, have also been largely exempt from paying stamp duty in recent years, as the cost was a barrier for them getting in the market all together. But a vast majority of buyers can’t avoid the tax.

A $1 million home in Victoria, for example, will set you back an extra $55,000 in stamp duty.

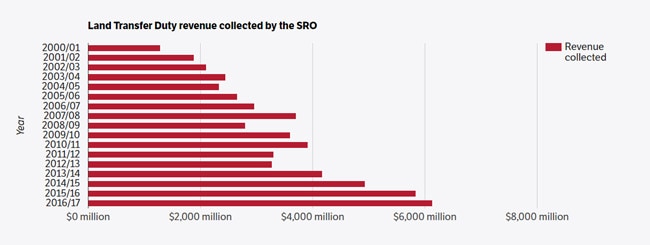

Stamp Duty is a huge percentage of revenue in the states. In Victoria, it’s the second largest source of income, just shy of the $6.3 billion collected from the state’s biggest source of income, payroll tax. The fall in houses sold will hit everyone in that state hard.

LOOK WEST FOR A HISTORY LESSON

Those in the eastern states need not look far away to see just what happens when the stamp duty well runs dry.

In the good times (think: mining boom), WA was flying. House prices were rising quickly and people were investing. Billions of dollars in stamp duty was padding out state budgets.

But in the decade since the boom, things have turned dramatically. House prices have fallen 25 per cent from the peak in 2007 and a fall in sales volumes are 17 per cent below the long term average.

MORE: ‘Passed in’ are the two most dangerous words in real estate

MORE: The worst suburbs in Australia to auction your home

In boom times, the state was enjoying over $2 billion a year in stamp duty.

Ten years later, they’re only seeing $1.5 billion. Keep in mind, we’re not adjusting for inflation here. Even though the cost of living has been rising, the amount of money the government has to spend has been steadily falling.

WA Premier, Mark McGowan, in 2017 described his own state’s financial situation “the worst since the Great Depression”.

And the results on the ground are being felt now, a long awaited upgrade to Royal Perth Hospital has once again been put off, and the much needed Metronet public transport project to Ellenbrook continues to live in limbo.

WHICH STATES ARE IN TROUBLE

The Grattan Institute’s Brendan Coates told news.com.au that Victoria and NSW had relied too heavily on stamp duty to pay for government expenditure, which could prove costly as stamp duty moved around so much each year.

“Victoria and NSW have essentially become addicted to rising stamp duty revenues,” he said.

He added the two states had been “forecasting relatively modest declines in prices, but the declines have been larger than what most economists expected.”

Mr Coates said the NSW government had predicted a turnover decline in the order of 10 per cent, but current CoreLogic figures show the real decline to be 18.5 per cent in Sydney.

Both states have relied heavily on stamp duty to pay for big projects over recent decades. But AMP Capital’s Chief Economist Shane Oliver says something has to give.

He’s worried that if the downturn runs long or grows deeper then paying for the infrastructure needs of the future was in doubt.

WHAT’S THE SOLUTION?

But there is a solution to the problem of stamp duty volatility, and the ACT is planning on doing it over the next 20 years: get rid of stamp duty.

A report in June of this year found Australia stood to gain $24.3 billion every year in GDP from 2047 if state governments replaced stamp duty with a broadbased land tax.

Several Australia states already levy land tax on commercial property and second homes, but do not extend it to the family home. The problem is that many people see any move to get rid of stamp duty as a sting in the tail — they paid their ‘fair share’ when they bought.

But Brendan Coates said stamp duty discriminated against people who moved more often in favour of those who stayed in their own homes their entire lives.

It’s not impossible to implement a land tax, even if the voting public might baulk at the first mention of a new tax.

Several countries, regions, and cities around the world have scrapped stamp duty in favour of land tax.

But in Victoria at least — the state with the highest stamp duty — there are no plans to change the structure of property tax.

When news.com.au questioned Victorian treasurer Tim Pallas, he confirmed “there is no plan for a broad based land-tax.”

Tempting as the pay-off might be in the long term, many politicians in Australia are hamstrung by the political reality.

If they propose a tax that will hurt in the short and medium term, voters are unlikely to accept it — even if they’ll be far better off in the long run.

But the idea might not be gone forever. Just ask John Howard, who convinced Australians to vote for a GST, only a few short years after his party dropped the policy after a devastating defeat.

A land tax might be unpopular, but maybe Australians can be convinced yet.

David Ross is a contributor to news.com.au. Follow him on Twitter: @FakeDavidRoss