Sydney homeowner forced to slash $250,000 to sell Paddington home

A Sydney homeowner had a “hard pill to swallow” after having to cut their asking price dramatically, despite 90 people viewing their property.

A Sydney homeowner was forced to slash a whopping $250,000 from their asking price after their property failed to sell at auction.

The 2.5-bed terrace house on a 116sq m block in the upscale inner city suburb of Paddington had already been renovated but still had potential to add more value by extending either downstairs or by extending into the roof.

On the market for four weeks prior to the auction, real estate agent Randal Kemp from Ray White Woollahra-Paddington expected the property to fetch between $2.6 million and $2.7 million.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

But despite 90 potential buyers viewing the property, the Paddington property was passed in at auction.

Mr Kemp said the property was a “little bit overpriced from initial expectations”.

“We’ve got multiple buyers still wanting to buy, it’s just we’ve got a situation where you have three to four people standing at an auction and no one bids,” he told the Australian Financial Review.

“Everyone is looking for value in the market at the moment. Buyers are just very nervous.

You’ve got to stay on top of what is available in the market and have a price guide in line with where buyers see value.

“Gone are the days in which someone will pay 10 per cent on top of what the last one sold for so no-one else will buy it.”

The homeowner was comfortable to sell the property for between $2.6 and $2.65 million, but this dropped to $2.5 million as the “bottom line” while the home was on the market, he added.

At the auction, there were four registered parties with two of them bidding – but the highest bid was just $2.35 million.

The property was passed in on a vendor bid of $2.4 million.

“To have a discussion with a vendor to say their house, their property, is devalued by 10 per cent to 15 per cent in a matter of weeks is a hard pill to swallow,” he said.

“But, unfortunately, that is the reality at the moment. There have been a number of properties that have not sold and come off the market.

“A lot of people have tested the market to see if they can get a price and if they haven’t got that price they have opted to stay or rent the property out.”

The property last sold for $1.33 million in October 2013, still netting the homeowner a sizeable profit.

Sydney sees largest property price falls

Sydney has been one of the hardest hit markets as property prices start to plunge.

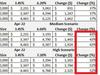

Prices dropped by 0.49 per cent in August in Sydney, but the capital city experienced a dramatic drop in particular in the past six months, according to a PropTrack report released earlier this month.

“All capital city markets are now below their price peaks, with Sydney prices down 0.87 per cent compared to August 2021, making it the only capital city to see a decline over the year,” said report author and PropTrack senior economist Paul Ryan.

“This follows persistent price falls since March this year, with prices now 4.8 per cent below their February price peak. Higher interest rates are affecting regions with the highest price points and Sydney – the most expensive market – has so far seen the largest price falls.”

Overall, Australian house prices have fallen by 2.7 per cent nationally since their peak and any rises from early 2022 have all but disappeared.

More Coverage

A global bank has also warned that Australia’s housing market is set for a much bigger crash than elsewhere in the world as fears of a global recession mount.

Unlike the latest global recession of 2008, Australia’s real estate sector is expected to take a larger hit, while the US will emerge largely unscathed.

Australian properties will plunge by a whopping 18 per cent after the bubble bursts, if the report is right.