Experts say underwhelming auction a reflection of troubled market

THE Block’s penthouses failed to fetch top dollar this year. And some say it’s further evidence Australian house prices are toppling.

WHEN the Gatwick Hotel went under the hammer last weekend, plenty of eyebrows were raised over the properties’ underwhelming results.

In fact, both of The Block 2018’s penthouses ended up selling for significantly less than predicted, with both falling short of the $3 million mark.

And while the sale prices were hardly loose change — with Bianca and Carla’s penthouse fetching $2,991,000 and Norm and Jess’ selling for $2,859,000 — contestants and property experts alike say it’s further proof of Australia’s tumbling house prices.

• ‘Matt Damon’s house’ sells for $3.8m

• Weird reason behind $2m sale

After the sale, Bianca told news.com.au the market was “not favourable for properties like this at the moment”, while Norm agreed “the market was down in Melbourne”.

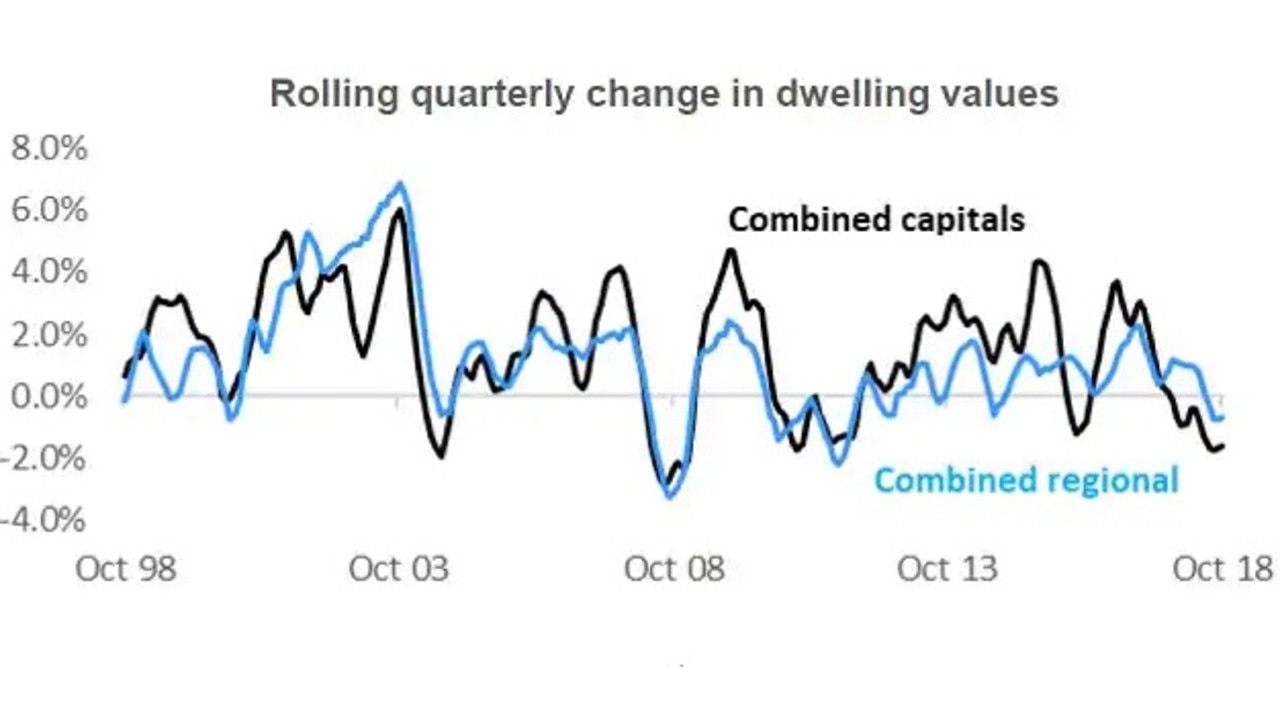

Their comments were backed up by CoreLogic data released on Thursday which showed national dwelling values fell 0.5 per cent in October to bring the annual decline to 3.5 per cent, “signalling the weakest macro-housing market conditions since February 2012”.

According to CoreLogic, the median house price in Sydney has fallen by $72,041 in a year, while Melbourne has lost $45,376 in the same period.

Property expert Wendy Chamberlain from Melbourne’s Chamberlain Property Advocates said the banks had tightened up lending as a result of the royal commission, which had resulted in fewer buyers — and lower prices.

“It’s absolutely had a flow on effect on prices because if people can’t get enough money for a house there will be more houses available for sale with not as many people around to actually buy them,” she said.

“If you haven’t got as many buyers you have to bring your price back to a level to meet the buyers who are around.”

Ms Chamberlain said the market had peaked in Melbourne last October and November before heading into the quiet holiday period.

Since then, uncertainty surrounding the banks, upcoming federal election and possible changes to negative gearing had led to a “wait and see” scenario, with less people turning up to auctions.

As a result, people who are interested are failing to bid, instead waiting for the property to pass in and then negotiating a better deal.

She said that explained why The Block penthouses had sold for less than expected, and that reserves could also have been too high, putting potential buyers off.

Melbourne buyer and vendor advocate Jane Slack-Smith, host of Your Property Success Podcast, said The Block results were not unexpected.

“The construction finished in April and the market has come off three per cent since then, by approximately $100,000,” she said.

“The Australian market moves in cycles. Sydney and Melbourne … are the biggest markets and the markets that lead the booms and the declines.

“Over the last 15 years the time frames between peaks and recoveries in these two markets has varied from six to 28 months, and the recovery periods have in some instances lasted three, four, five-plus years.”

She said she expected prices to rally again in 2019 after the election was called, and urged potential DIY-ers to think twice.

“In essence this downturn is just part of the market and those who want to buy, renovate and sell like The Block have to be mindful of their numbers — they need to know the profit they will make and then allow in a dropping market to wipe up to 10 per cent off that and see if there is still money to be made — if not, then this strategy is highly risky,” she said.

It’s a sentiment shared by property developer, educator and mentor Rob Flux from Property Developer Network, who said not enough value was added to The Block properties to counter the decline in the market.

“The market is always going to have cycles and right now is a correction, which they are predicting will be up to 20 per cent against the peak we had 12-odd months ago,” he said.

“You have to be cognisant of the trends going against you, so the value you add has to be that 20 per cent plus to get a profit.”

Mr Flux said not every deal would be profitable, and that the show had not taken current market trends into consideration as well as putting novice investors into a difficult position to get ahead.

Meanwhile, economist John Adams claimed The Block “mania” gave ordinary Aussies a false impression of what the market and the economy was actually like today.

In a video released on YouTube with data scientist Martin North, Mr Adams, who has long predicted a looming economic collapse, said it was unrealistic to expect to buy a property and renovate it for the same “astronomical” profits seen on the show, even if prices were slightly down on previous years.