Housing market conditions weakest since 2012

SYDNEY house prices are plummeting at their fastest rate since 1990, with Aussies facing a collective wealth wipe-out of $700 billion.

THE median house price in Sydney has fallen by $72,041 in a year, while Melbourne has lost $45,376 in the same period.

CoreLogic data released on Thursday showed national dwelling values fell 0.5 per cent in October to bring the annual decline to 3.5 per cent, “signalling the weakest macro-housing market conditions since February 2012”.

Sydney and Melbourne both fell 0.7 per cent over the month, bringing their annual declines to 7.4 per cent and 4.7 per cent respectively. The drop in Sydney was the worst since February 1990, when prices fell 7.9 per cent.

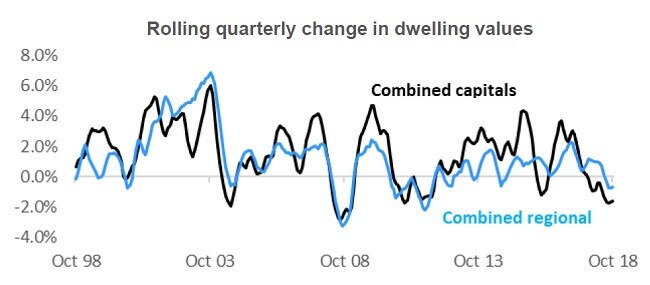

The combined capital cities were down 1.6 per cent on a rolling quarterly basis while regional areas were down 0.7 per cent.

“With such broadbased weakness in housing market conditions, it’s clear that tighter credit availability is acting as a drag on housing demand and impacting adversely on the performance of housing values across most areas of the country,” CoreLogic head of research Tim Lawless said.

Brisbane, Darwin and Canberra were unchanged over the month, Perth was down 0.8 per cent, while Adelaide and Hobart were up 0.2 per cent and 0.9 per cent respectively. The median value in each city at the end of October was:

• Sydney $833,876

• Melbourne $665,044

• Brisbane $491,925

• Adelaide $431,554

• Perth $451,148

• Hobart $445,655

• Darwin $433,818

• Canberra $589,415

• National $538,668

More expensive homes have led the price falls, with values in the top quarter down 6.6 per cent over the year, compared with a 0.5 per cent rise in values in the bottom quarter.

CoreLogic said the downturn had been “relatively mild” so far, with a 3.5 per cent decline coming on the back of a 34 per cent rise in this growth cycle. Further falls are expected through spring and summer as credit availability remains tight and inventory levels rise.

“Annual growth in housing credit slipped to 5.2 per cent in September, the lowest reading in almost five years,” CoreLogic said.

“While investment credit growth has been trending lower for several years, credit for owner occupiers has more recently contracted as lenders seek out borrowers with more substantial deposits and lift their serviceability criteria.”

Mortgage arrears data from Standard & Poor’s shows loans more than 90 days past due were trending higher but remained well below 1 per cent.

A report by Morgan Stanley this week warned Australia “leads the world in dangerous debt” and was facing a collective wealth wipe-out of $700 billion.

“Australia looks most exposed, combining high household and external leverage, weak domestic housing conditions and potential further macroprudential and structural/tax policy adjustments ahead,” the report said.

Last month, AMP Capital downgraded its forecast for the housing market to 20 per cent top-to-bottom falls in Sydney and Melbourne spread out to 2020, with chief economist Dr Shane Oliver describing it as “a perfect storm”.

Deloitte Access Economics partner Chris Richardson was more optimistic, predicting another 5-10 per cent in Sydney and Melbourne but arguing it was the “house price fall we had to have”.