Australians have the world’s riskiest household debt levels, a concerning new report has revealed

A CONCERNING new report has revealed Aussies face a $700 billion cut to their wealth. And it’s coming sooner than you think.

A CONCERNING new report has revealed Australians face a collective $700 billion cut to their wealth.

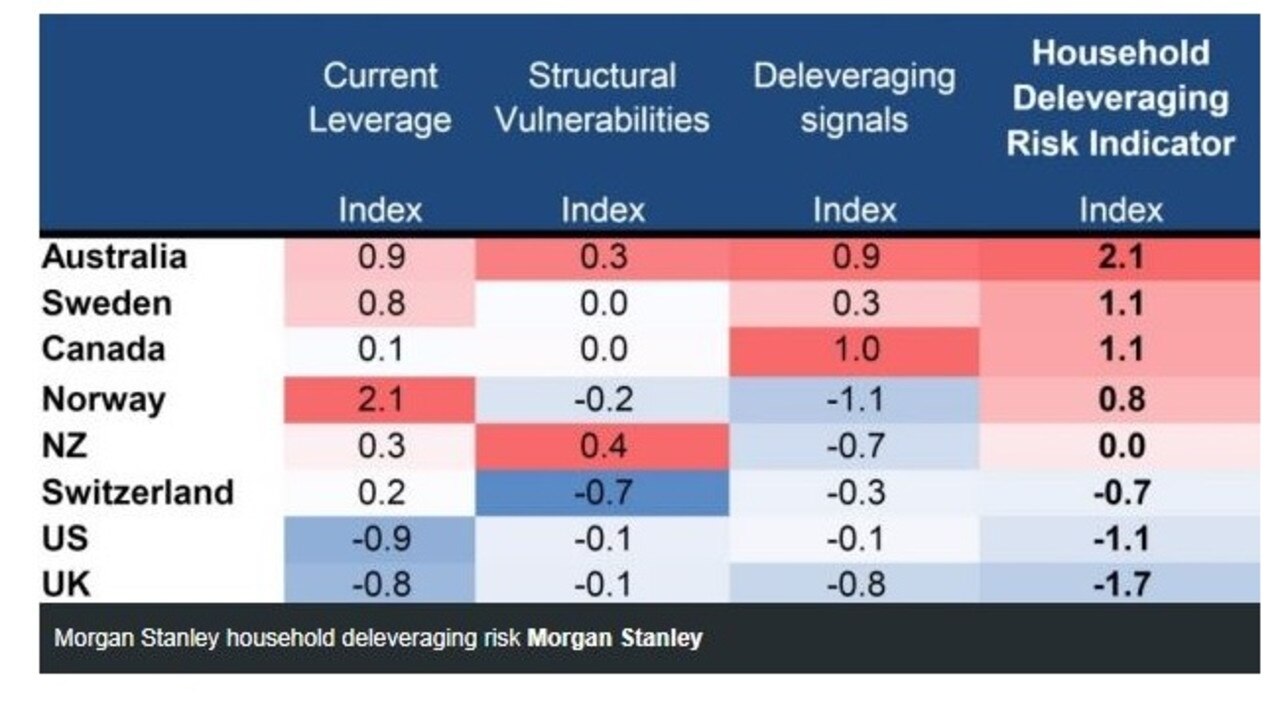

The Household Deleveraging Risk Indicator, put together by US investment banking giant Morgan Stanley, has warned Australia “leads the world in dangerous debt”, noting that of all the G10 countries, we’re most at risk of a deleveraging of household debt.

Ominously enough, the banking giant said there was an “imminent risk” this could happen as early as next year.

AUSTRALIA ‘MOST EXPOSED’ TO WEALTH WIPE-OUT

Analysts Daniel Blake and Chris Read said Australia looks “most exposed” to a wealth wipe-out, citing high debt levels as well as falling house prices.

The report analysed household debt burdens across all G10 country economies.

“Australia looks most exposed, combining high household and external leverage, weak domestic housing conditions and potential further macroprudential and structural/tax policy adjustments ahead,” the report said.

“Strength in the global economy and support from public infrastructure spend are mitigating these headwinds, but the risk of a longer/deeper than usual balance sheet recession remains elevated, if these conditions change.”

The study put Sweden and Canada second-highest at risk, followed by Norway.

“These economies now face a crucial juncture as housing markets weaken, forcing a reappraisal of leverage and wealth, and global financial conditions tighten, increasing the consumption drag from debt service and rising savings,” the bank’s strategists said.

Australian housing prices are expected to tumble even further following the royal commission into banking.

At the same time, the household savings rate is just a one per cent fraction of disposable income.

“Most concerning about the potential impact of a deleveraging phase for Australian households is the narrow savings buffer that is currently carried,” Morgan Stanley commented.

“From the perspective of wealth effects, our forecast 10-to-15 per cent real house price decline would combine with 20 per cent debt/asset gearing levels to inflict a serious dent in net worth.

“If mapped across the value of all land/property owned by households, it would equate to $700 billion of wealth devaluation.”

DEBT BUILDING FOR OVER A DECADE

In terms of household debt, the report noted a split in the G10 countries since the mid-2000s.

While households in the US, Japan, the European Union and the UK have cut their debt since the global financial crisis, record debt has simultaneously been building in Australia, Canada, New Zealand, Sweden and Switzerland.

Morgan Stanley noted that most mortgages in Australia “are on a floating mortgage rate (set by the banks), and so any change in interest rates flows through quickly to debt servicing”.

The researchers also considered debt levels in other areas of the economy, and the extent to which a country relies financially on offshore funding.

“With this combined indicator, NZ and Australia stand out as the most structurally vulnerable, driven by sensitive debt servicing and large external exposure,” the report said.

The local household debt-to-income ratio has reached a peak of almost 200 per cent — a doubling in the past two decades.

Dwelling prices have dropped 2.7 per cent nationwide, with larger drops in Sydney (by 6.1 per cent) and Melbourne (by 3.4 per cent).

The Morgan Stanley report looks at three key measures of household debt — the debt-to-income ratio, debt-to-assets and the debt-servicing ratio — in cultivating its global risk indicator.

Australia sits at or near the top for all three measures, with the nation’s debt-to-income ratio sitting at a whopping 189 per cent — behind only Switzerland and Norway.

“Our Household Deleveraging Risk Indicator suggests that Australia is the economy most at risk of household deleveraging, coming in near the top across all three aspects,” the report warns.

“Leverage and debt-service is high and the second-most externally funded, while falling house prices and slowing credit growth suggest more imminent risks of deleveraging.”

The International Monetary Fund has long warned Australia faces risks from high household debt and inflated house prices.

Earlier this month, it listed Australia among the countries where household leverage is a noteworthy concern.

“Household leverage stands out as a key area of concern, with the ratio of household debt to GDP on an upward trajectory in a number of countries, especially those that have experienced increases in house prices (notably Australia, Canada, and the Nordic countries),” the IMF noted in its Global Financial Stability Report in October.