Troubling sign for renters as market tightens with number of listings plummeting

Those moving to these capital cities will soon find it much harder, with data revealing renters will soon struggle even more.

Rental availability across Australia’s major cities has hit a 20-year low, with warnings the tight market is set to worsen through 2023.

Strong demand for properties has met with low supply to cause a headache for Australians hunting for a home, according to the new PropTrack report.

“With low volumes of stock available for rent at a time when demand for rentals is strong and is likely to increase further, we expect the market to remain extremely challenging for renters,” PropTrack director of economics research Cameron Kusher said.

Across the nation, the total rental listings are now at their lowest level since 2003, with the capital cities recording a 26.3 per cent fall in the number of available properties.

That was led by the most populous cities, with Melbourne listings falling by 36.5 per cent, followed by Sydney at 25.8 per cent and Brisbane at 17.8 per cent.

“In Sydney and Melbourne, the two largest rental markets in the country, rental stock is reducing quickly and demand for rental properties is increasing,” Mr Kusher said.

“Most of the overseas migration that will occur over the coming years will be in these two cities, which will increase demand for rental accommodation.”

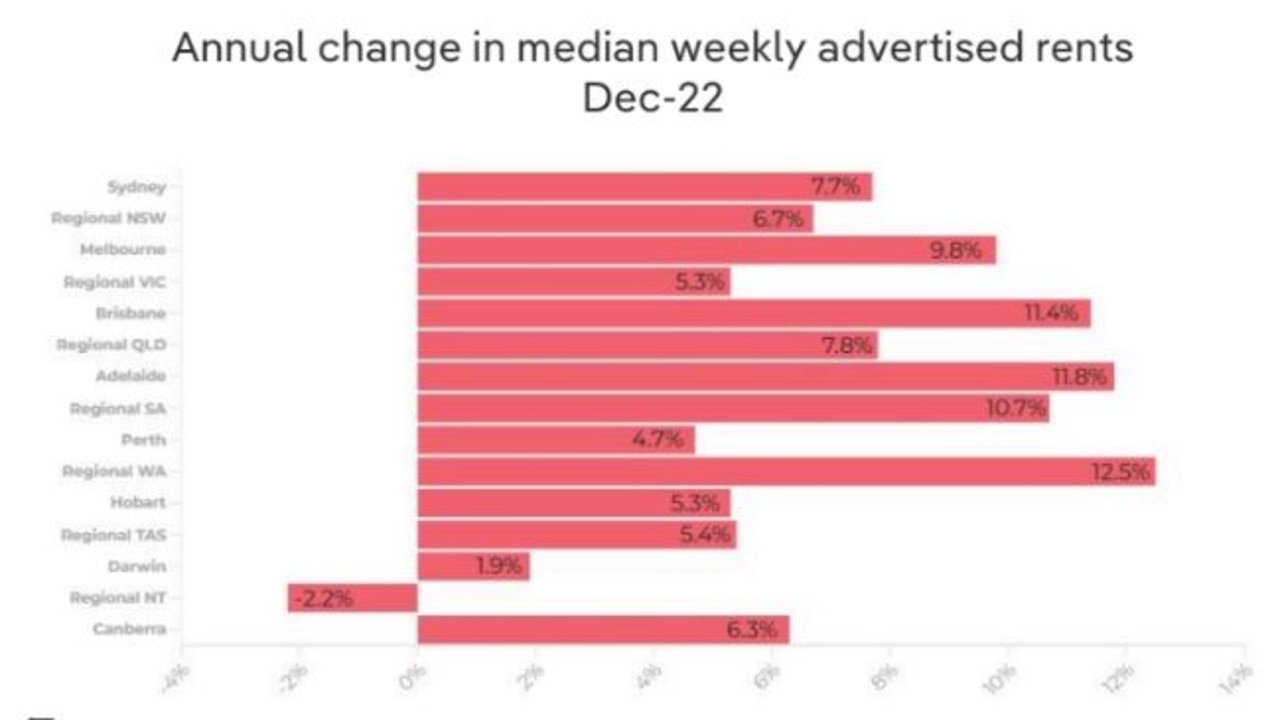

The surging demand for rental properties is seeing prices skyrocket across the capitals, with rents up 10 per cent year-on-year in December 2022 and the median rent nationally now $480 per week.

Sydney saw 7.7 per cent growth in rental prices, Melbourne recorded a 9.8 per cent increase, Brisbane’s prices rose by 11.4 per cent and Adelaide copped an 11.8 per cent rise.

Mr Kusher said things will “only become more difficult” in the capitals in 2023, with the report finding higher interest rates, people moving back to the city and overseas migration contribute to an increase in demand.

“There remains an immense need for more rental accommodation, particularly in the major capital cities,” he said.

“It’s critical that we find ways to create more supply – either through increased investment or more build-to-rent projects – or we reduce demand, which seems unlikely.”

Long lines of prospective renters waiting outside property inspections are expected to continue, with the number of inquiries for listings also soaring.

The number of inquiries per listing has risen by 31.6 per cent in the past year in the capital cities, paired with a 30 per cent fall in inquiries for regional listings.

There are now an average of 19 inquiries per listing, a figure that surges to 21 in Melbourne, 29 in Brisbane and 36 in Perth.

In what’s been described as “ideal” conditions for landlords, properties are also leasing in record time due to Australians snapping up the dwindling number of properties on the market.

The median number of days a property was available for rent on realestate.com.au was a record-low 18 days in December 2022 compared to 21 days in December 2021.

Properties in Sydney currently stay on the market for an average of 20 days, Melbourne properties are available for 22 days before they’re rented out and renters in Brisbane, Adelaide, and Perth have only 16 days to snap up a property on average.