RBA February 2025 meeting: Rate cut a ‘near certainty’

Experts agree the RBA must cut in February, triggering massive flow-on effects for property prices, mortgage payments and bank competition. But is a cut good news for everyone?

The RBA will cut rates at its February meeting, according to a majority of experts, resulting in the return of confidence to home buyers and sellers around the country and big potential property price gains.

Finder’s latest RBA survey has reported 73 per cent of the 37 economists and experts canvassed believed the central bank was set to finally pull the trigger and give mortgage relief to thousands of struggling Aussie households.

AMP’s Shane Oliver was one of those predicting a cut.

“Underlying inflation is falling faster than the RBA expected and has been running around target over the last six months,” he said.

RELATED:Rate cut move that will make you $148k richer

SQM research director Louis Christopher said the rate cut was a “near certainty”.

“They will move in February for sure, because if they don’t, there is a heightened risk of them undershooting the inflation target band,” Christopher said.

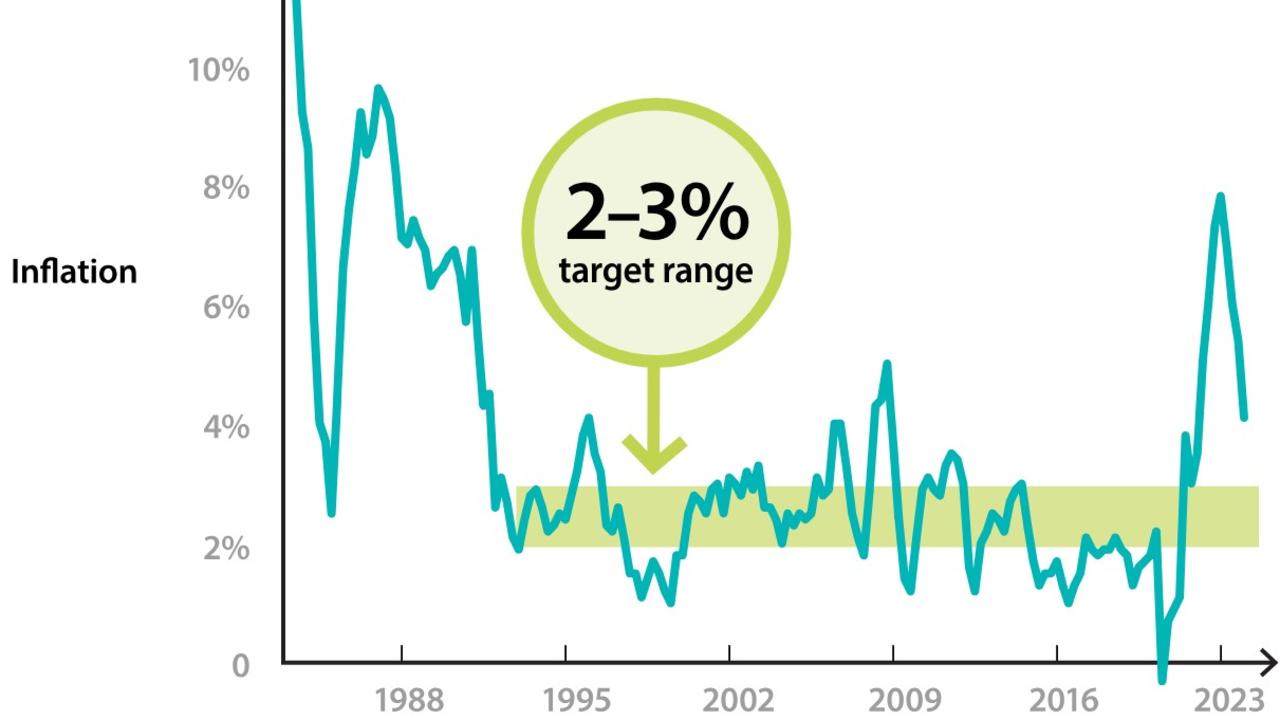

The target band he refers to is the 2 to 3 per cent range that the RBA has repeatedly said it wants inflation to sustainably sit in before it will consider cutting rates.

Christopher says headline inflation has now dropped off so much, there is a chance it will drop below 2 per cent without a rate cut.

“The last two quarterly headline consumer price inflation markers were 0.2 per cent,” he said.

“If we see another 0.2 per cent in March, that’s three straight quarters with a total of 0.6 per cent. There is then a real risk of undershooting.”

MORE:The one mortgage decision that saved me $50k

What about unemployment?

The RBA has repeatedly indicated it would like to see the unemployment rate at 4.5 per cent before cutting, meaning an estimated 80,000 people would need to lose their jobs.

Christopher believes the unemployment target has now been superseded by the RBA’s commitment to its inflation band.

“The RBA has been very consistent in wanting the unemployment figures to rise, but what will force their hand is the risk of undershooting the target band.”

Double the confidence for buyers but at what cost?

“A cut will see confidence return for both home buyers and sellers. Almost immediately, we’ll see clearance rates pick up,” Christopher said, explaining that the first cut of a cycle can have a bigger effect because it also officially signifies the end of the hiking cycle.

“People have been waiting on the sidelines for the RBA to stop its hiking cycle. They have been worried rates would still go up further,” he said. “They will now re-enter the market with confidence.”

Research from Westpac has indicated there is no shortage of potential buyers ready to wade in once rates are cut. The bank’s annual Home Ownership Report showed the share of Aussies who indicated plans to buy a home by year-end had risen to 13 per cent, up from 10 per cent in early 2024.

A Westpac release explained this increase would result in “just over half a million more prospective buyers than in 2024.”

Westpac senior economist Matthew Hassan said interest rates were a significant motivator for buyers.

“Last year high rates deterred buyers, but the possibility rates will move lower appears to be shaping would-be buyer plans,” Hassan said.

While renewed interest in the market is great news for sellers, house hunters already struggling to find homes within their budget are set to face increased competition and property prices that could spiral further out of reach.

RELATED:Surprise way a February rate cut could backfire

Massive mortgage savings

Homeowners could save thousands on their mortgages if the RBA cuts in February and then three more times this year, as predicted by three of the big four banks.

PropTrack calculated how much a homeowner could expect to get back with each cut in every capital city, revealing thousands in potential savings was on the cards.

In many areas, the savings will be much larger than in previous years when rate cuts were announced – due mostly to the much higher debt levels recent homeowners required to purchase their properties.

This was especially true for those who bought in the pandemic-era housing boom in 2020-2022, when more homes were bought with larger loans relative to the value of the properties.

The analysis revealed house owners could get average savings of nearly $500 off their monthly mortgage repayments in Brisbane, Adelaide and Melbourne if there were four cuts this year.

Sydney house owners would save nearly $800 a month in repayments with four cuts.

“All else equal, rate cuts are going to help improve affordability, give borrowers a bit more to spend and support home prices,” REA Group economist Angus Moore said.

MORE:Rate cut predicted. Why you won’t get it

Price boom in top markets

The latest Property Pulse, by CoreLogic head of research Eliza Owen, predicts rate reductions would see a solid upturn for property prices.

“Lower interest rates are set to boost the housing market in 2025,” Owen writes. “CoreLogic estimates based on previous periods of rate reductions that national dwelling values would increase an average of 6.1 per cent for each one percentage point decline in the cash rate.”

The cities to benefit the most would be Sydney and Melbourne, Owen claimed.

“In (Sydney suburb) Leichhardt, a 1 per cent reduction in interest rates is associated with a 19 per cent increase in house values historically,” she wrote. “In Sydney, Melbourne, Hobart and Canberra, many of the markets with a solid response to rate reductions are also seeing values well below their peak under recent interest rate rises, so easier access to credit may trigger a recovery trend in these markets.”

Brisbane suburbs with $1 million plus medians also had historic form in strong reactions to rate cuts, Owen noted, while Adelaide and Perth prices were not expected to react as strongly.

RELATED:How borrowers can maximise savings after a rate cut

Bank competition heats up

Banks have already been trying to attract new customers before a rate cut, offering thousands in cashbacks, frequent flyer points and other rewards.

Lenders are also offering fixed rates at up to 0.5 per cent less than variable rate charges.

“Lenders are being strategic here, looking to lock in borrowers before any anticipated rate cuts,” said Rachel Wastell, money expert at mortgage comparison group Mozo.

Ms Wastell noted that seven lenders- ANZ, BankVic, Greater Bank, ME, IMB Bank, Regional Australia Bank and Newcastle Permanent- were currently offering cashbacks for new borrowers and refinancers, ranging from $2000 to $4000.

Meanwhile, Qantas Money, an online brand backed by Bendigo and Adelaide Bank, was offering 175,000 Qantas points upfront.

More buyers entering the market would likely see competition between lenders ramp up.

Finder’s head of consumer research Graham Cooke said homeowners should be proactive with their lenders, regardless of RBA movements.

“If you’re not getting the most competitive rate, why stick with your current lender?” Cooke asked. “You can call your bank to see if they’ll offer you a better deal. If they can’t help, it might be time to go home loan shopping.”

MORE:150 suburbs where home values have doubled

Maximising savings is a long game

Once borrowers get a rate cut, Cooke said there was a simple way to maximise long term savings.

“While lower repayments free up extra cash, keeping your monthly repayments at their current level, rather than reducing them in line with the new interest rate, could shave years off your mortgage – especially with multiple cuts,” he said. “If a homeowner with an average 30-year loan keeps their repayments at $3983 per month instead of reducing them to $3578 after four 0.25 percentage point cuts, they could pay off their mortgage six years earlier (and) save tens of thousands of dollars in interest over the life of the loan.”

Cooke warned against opting for a fixed-rate loan, however.

“Banks are already pricing in expected rate cuts, which is why fixed rates have been falling,” he said. “Locking in now could mean missing out on further reductions if the RBA lowers rates multiple times throughout the year.”

+ By Tim McIntyre and Aidan Devine

Originally published as RBA February 2025 meeting: Rate cut a ‘near certainty’