Renters enraged by detail in real estate’s ‘late rent policy’ document

A “gross” detail in a rental document sent out by a Sydney real estate agency has enraged tenants who have accused the company of being on a “power trip”.

A document from a real estate agency appearing to suggest tenants get a bank loan or use credit cards in order to pay their rent on time has enraged Aussie renters.

The document from Ray White Bankstown in Sydney was recently shared to a tenant support Facebook group by a person claiming to rent their home through the agency.

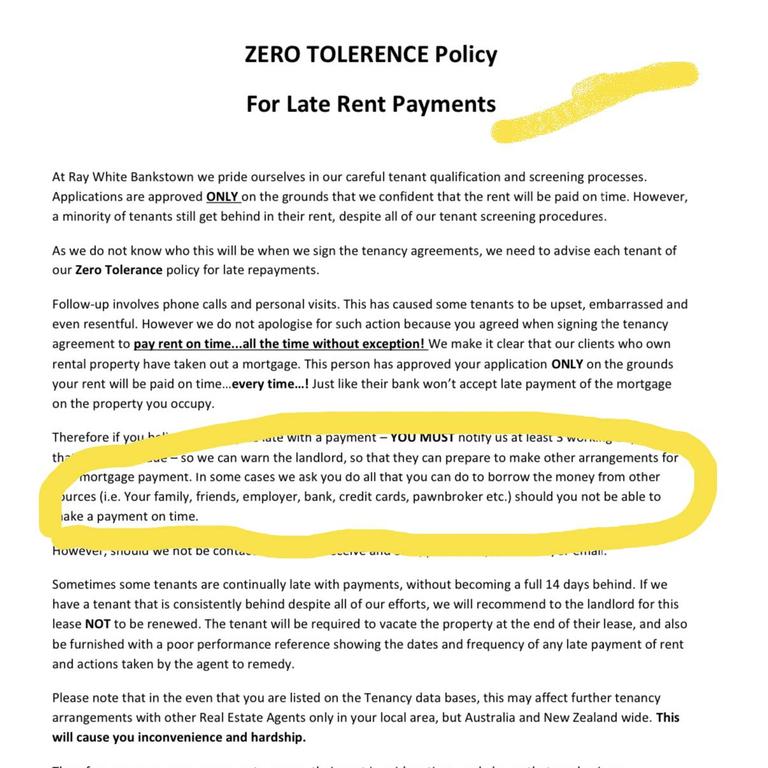

The letter, which the renter said they received as part of their tenancy agreement documents, outlines the company’s “zero tolerance policy” for late rent payments and advises renters what will happen if they fall behind.

“Follow-up involves phone calls and personal visits. This has caused some tenants to be upset, embarrassed and even resentful. However we do not apologise for such action because you agreed when signing the tenancy agreement to pay rent on time … all the time without exception!” the document states.

“We make it clear that our clients who own (the) rental property have taken out a mortgage. This person has approved your application ONLY on the grounds your rent will be paid on time … every time …!”

MORE: Man moves into DIY tiny house to avoid paying rent

However, the section of the document that social media users really took issue with was where the real estate agency said there would be instances where they would ask renters to “do all that you can to borrow money from other sources”, in order to pay rent on time.

It even made suggestions, including borrowing money from family, friends or your employer. Other options were for renters to reach out to a bank to borrow the funds, use credit cards or visit a pawnbroker.

The letter states that for tenants who are consistently late with payments, but do not ever become a full 14 days behind, the agency will recommend the landlord not renew the lease.

Once the lease ends, Ray White Bankstown said it would then give the renters a “poor performance reference”, which the agency warned could “affect further tenancy arrangements with other real estate agents (not) only in your local area, but Australia and New Zealand wide”.

Speaking to news.com.au, a Ray White Bankstown spokesperson said the company has had a “zero tolerance policy” on rent arrears for many years.

They said the document that has been circulating is an old version and has since been updated.

“Every tenant signs the policy at the start of a lease and this renter is in fact not in arrears. This letter circulating on social media today has been updated, it’s an old letter,” they said.

“We are sorry for any distress the letter has caused. The business is sympathetic to the challenges of all its tenants, especially with today’s cost of living pressures but the business’ commitment is support its landlords and its tenants with understanding and care has never changed.”

The screenshot of the document quickly gained traction online, attracting more than a hundred comments from horrified renters.

MORE: Half of renters experiencing financial difficulties

Commenters branded the letter “really poor form”, “disgusting” and “just cruel”.

“That’s gross. Don’t have an investment property if you can’t afford it. We are in rentals because we can’t afford to buy a house,” one renter said.

One person branded the document a “power trip”, while another simply said, “Damn Ray White Bankstown, who hurt you?”

However, there were some commenters who viewed the situation from the perspective of the landlord.

“In fairness though why should my financial hardship impact someone other than myself.

If I sign a contract to pay rent on time than I will do everything in my power to do that,” one person said.

“I don’t think it’s fair to expect my landlord to be willing to go into financial difficulties themselves just because I have difficulty paying my rent.”

Another conceded that, while the letter was “poorly written”, tenant still need to pay their rent on time.

“I’d read this, roll my eyes then sign it. Having said that I’d hate to be with a real estate that started the relationship on this footing. In this climate most people just have to take what they can get,” they wrote.

Even other real estate agents have been left less than impressed by the document, with founder of A-Class Estate Agents, Amir Jahan, branding it “disgusting behaviour”.

Asked whether, in his opinion, there would ever be a reason for an agent to suggest to a tenant they borrow money from family or a bank in order to pay rent, he said, “definitely not”.

“It is disrespectful. As the agent, yes, you have the authority to manage the property on behalf of the owner, but at the same time, you’re also here as a property manager,” Mr Jahan told news.com.au.

“You’re here as a problem solver, not to be the one causing the problem.”

Real Estate Institute of NSW chief executive Tim McKibbin told news.com.au that paying rent is a fundamental term of the residential rental agreement.

How that is done, he noted, has “nothing to do with the landlord” or the real estate agent.

“They should not be giving you ideas about how you would go about doing that,” he said.

Mr McKibbin said he didn’t believe anything is achieved by the agency asking renters to sign a document acknowledging they have a zero-tolerance policy for late rent.

He noted that the residential tenancy agreement is a prescribed document, meaning it is provided by the government.

And, as paying rent is a fundamental term of the lease, not doing so can result in eviction from the property,

“But, having said that, the act, the Residential Tenancy Act, also has provisions in it to deal with circumstances where tenants don’t pay the rent. So that would apply. I haven’t never come across a situation where somebody has said that we have ‘zero tolerance’ for it. I don’t think that has any application,” Mr McKibbin said.

“Both of those documents, the document being the agreement and the Act, would apply, and not the not the position taken by the agent.”

It is no secret that it is a tough time for renters.

The current median rent for a house in an Australian capital is now $650 per week. In regional Australia it is $550 per week.

Nationally, rents rose 4.8 per cent in 2024, following on from a massive 8.1 per cent rise in 2023.

Speaking to news.com.au, Tenants’ Union of NSW policy and advocacy manager, Eloise Parrab, said renters across the network are voicing their struggles about the lack of affordable rentals in NSW.

“Rents are continuing to escalate, with many facing substantial increases in one go. This puts low income renters at particular risk in relation to eviction, and eviction into homelessness,” Ms Parrab said.

“We’re seeing more people being forced into difficult and precarious living situations and circumstances. Renters shouldn’t be forced to spend large portions of their income on a roof over their heads.

“Too many are spending too much on rent, with little left over to cover off on other basic necessities.”

She noted that people with mortgages who face difficulty have a range of hardship provisions provided to them to ensure they do not lose their home too easily.

“Utilities and credit generally work to ensure a fair resolution to temporary money problems that doesn’t cause ongoing financial harm,” Ms Parrab said.

More Coverage

“Renters aren’t supported in the same way, because rented homes aren’t respected as a home. This needs to change.”

The Tenants’ Union encourages tenants to communicate with their real estate agent or landlords if they are going to be late with their rent payment and to try and negotiate a “realistic” repayment plan.

Tenants can also seek help from a financial counselling service such as the National Debt Helpline (1800 007 007).