More Aussies living in share houses, with relatives as rents growing at fastest pace in a decade, new figures reveal

One simple detail in recent household behaviour has exposed the reality of the Aussie rental crisis, as rents continue to grow at their fastest pace in more than a decade.

The reality of the Aussie rental crisis has been laid bare, with new figures revealing more people are choosing to live in shared houses or with relatives as rents continue to soar.

Commonwealth Bank Australia’s (CBA) latest economic insights report reveals rents are growing at their fastest pace in more than a decade as demand for housing outstrips supply.

Household behaviours have begun to adapt as a result - many “economising” and choosing shared houses over single or partnered living.

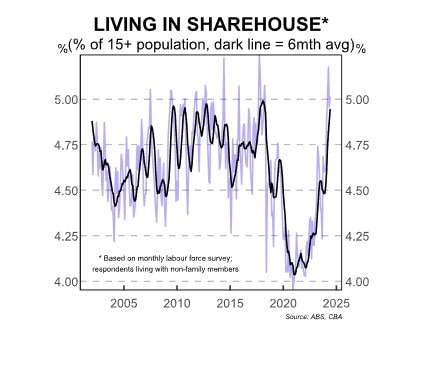

The current share of people living in shared houses sits at about five per cent of the Australian population over age 15, according to the report.

It marks a one per cent jump over the 2020-2021 period, or about 200,000 people.

Economist Stephen Wu said there had also been an increase in those living with other related individuals, such as siblings, cousins and grandparents.

“With the ongoing slowing in population growth, shifts in household formation are increasing average household size and beginning to moderate the demand for housing while supply growth remains constricted,” Mr Wu said.

“Advertised rents add to the weight of evidence that rents inflation can slow (albeit gradually) from here.”

The marked change in household formations are in addition to rents growing at an annualised pace of nine per cent - the fastest since 2008.

Mr Wu said this was owed to at or near-record low rental vacancy rates across the capital cities.

“Housing demand is outstripping supply,” he said.

“With supply unable to respond quickly, adjustments are having to occur on the demand side, and by extension prices.”

However advertised rent growth has slowed in Sydney and Melbourne, the country’s two largest rental markets.

Mr Wu said rent inflation should moderate from their elevated pace of growth but it would be a “gradual” trend.

The report follows Reserve Bank governor Michele Bullock warning the RBA would not hesitate to hike interest rates to avoid exposing hurting families to prolonged high inflation.

Earlier this week rates were kept steady at 4.35 per cent.

Ms Bullock warned this could be short-lived if the gap between aggregate demand and aggregate supply is not closed

“On balance, the board decided to keep interest rates on hold, judging that such an outcome would still meet the board’s mandate to balance its inflation and employment objectives,” she said.

“I know this is not what people want to hear, but the alternative of persistently high inflation is worse. It hurts everyone.”