Crucial factor driving end of rental crisis

Australia’s rental market has hit a near 18-month high, with desperate tenants getting an unexpected boost from this key change.

Australia’s embattled tenants have been given some much needed relief after rental vacancy rates jumped nationally to the highest level in 16 months over October.

PropTrack figures released Wednesday showed the number of rental properties available to lease was the highest since July 2023.

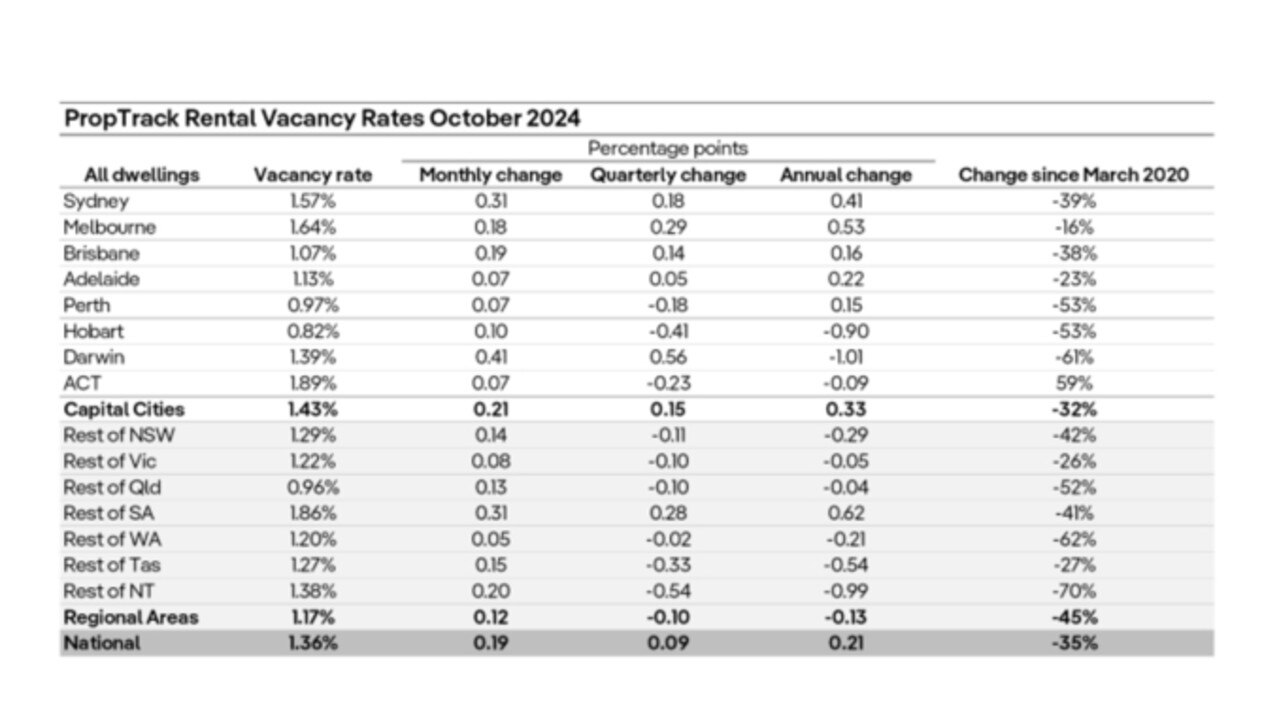

About 1.36 per cent of the country’s total rental stock was available to rent at the end of October, an increase of about 0.21 per cent from the same time last year.

PropTrack noted that rental conditions improved in all capital cities and regional markets over the month.

REA Group senior economist Anne Flaherty said the increased supply was due to higher investor activity, more renters moving into share houses and many tenants becoming first-home buyers.

MORE: ‘Concerning’ surge in homes bought with cash

“A lot of renters are considering moving into share houses or moving back into the family home,” Ms Flaherty said.

“It’s also possible, and we have seen in a market like Melbourne, a big increase in first homebuyer activity.”

MORE: Weird advice helps battlers buy 8 homes

Victoria had the biggest uplift in first-home buyer activity, with a 14 per cent rise in new loan commitments compared to the same period last year.

REAL ESTATE INVESTOR ACTIVITY CRUCIAL

The rental vacancy in Melbourne increased by 0.18 percentage points over October, now at 1.64 per cent. It remained higher than other major cities including Sydney, Brisbane, Adelaide and Perth.

“If we look at a lot of the other states, nationally there has been a 19 per cent increase in new loans for investors, so that is a key factor.”

MORE: Aussie shop’s baffling X-rated service

Often derided as the villains of the housing crisis, investor activity now looks to be bringing some balance back to the rental market.Sydney recorded the second largest jump in vacancy rates among capitals, rising 0.31 per cent to 1.57 per cent. Darwin had the biggest rise at 0.41 per cent to 1.39 per cent.

The best rental availability remains in the ACT at 1.89 per cent.

“Despite the improvement, rental supply remains well below pre-pandemic levels, with

35 per cent fewer properties available for rent,” Ms Flaherty added.

Although rental supply had improved across the board, a vacancy rate of at least a 2.5 per cent was considered a healthy amount of available supply.

MORE: AFL star’s huge $5m win

“If we look at overseas migration figures, its started to slow but its still very high compared to historic levels which is one thing that grows demand for rental properties,” Ms Flaherty said.

While rental supply improved across both capital city and regional markets in October,

there has been greater relief for renters in cities.

“Compared to March 2020, there were 45 per cent fewer properties available for rent in Australia’s regional areas compared to a 32 drop in the capital cities.”

Over the past year, vacancy rates in capital cities rose by 0.33 percentage points, while the combined regional areas remain 0.13 per cent lower than a year ago, according to the economist.

“We are not building enough homes to meet the needs of our growing population, you would expect from that we would continue to see very low vacancy rates,” Ms Flaherty said.

“It will be a long time before we are back at a time where we will see a market balanced.”

MORE: Ex-Roosters star’s final move before NRL exit

Originally published as Crucial factor driving end of rental crisis