‘Beyond disappointed’: Grim posts reveal mass exodus as real estate crisis forces families to flee

Australia is in the grip of a brutal rental nightmare, with a string of grim social media posts revealing just how dire the situation has become.

Once upon a time, the inner Sydney suburb of Zetland ticked all the boxes – conveniently located, family-friendly, diverse and relatively reasonably priced.

But those days are long gone.

As Australia’s cost of living crisis explodes, with inflation pairing with stagnating wages to make everyday life increasingly unaffordable, scores of devastated tenants have been hit with astronomical rent increases in recent months, with many being forced out of the area altogether as a result.

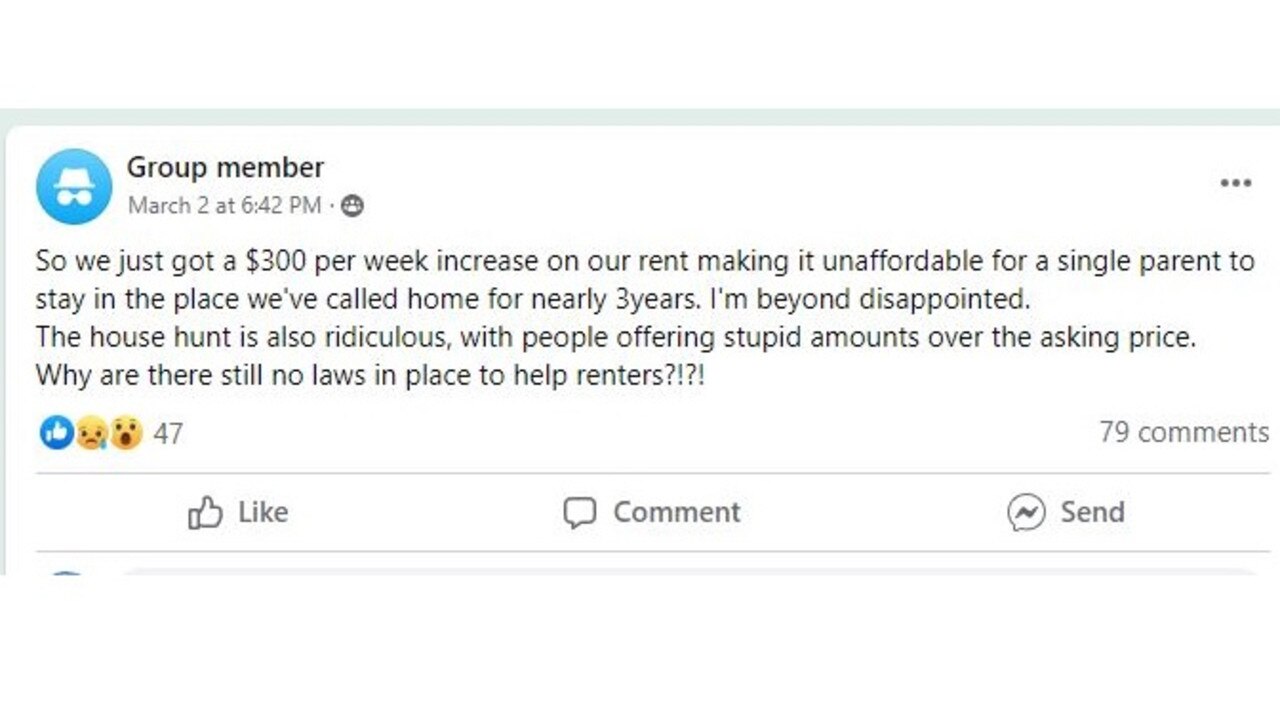

“So we just got a $300 per week increase on our rent making it unaffordable for a single parent to stay in the place we’ve called home for nearly three years. I’m beyond disappointed,” one desperate local posted in a community Facebook page this month, with fellow social media users slamming the “disgusting” hike.

Several weeks earlier, another resident shared that their rent had skyrocketed from $680 to $1150, representing a 70 per cent increase, and asked if anyone had had any luck fighting brutal increases in the NSW Civil and Administrative Tribunal.

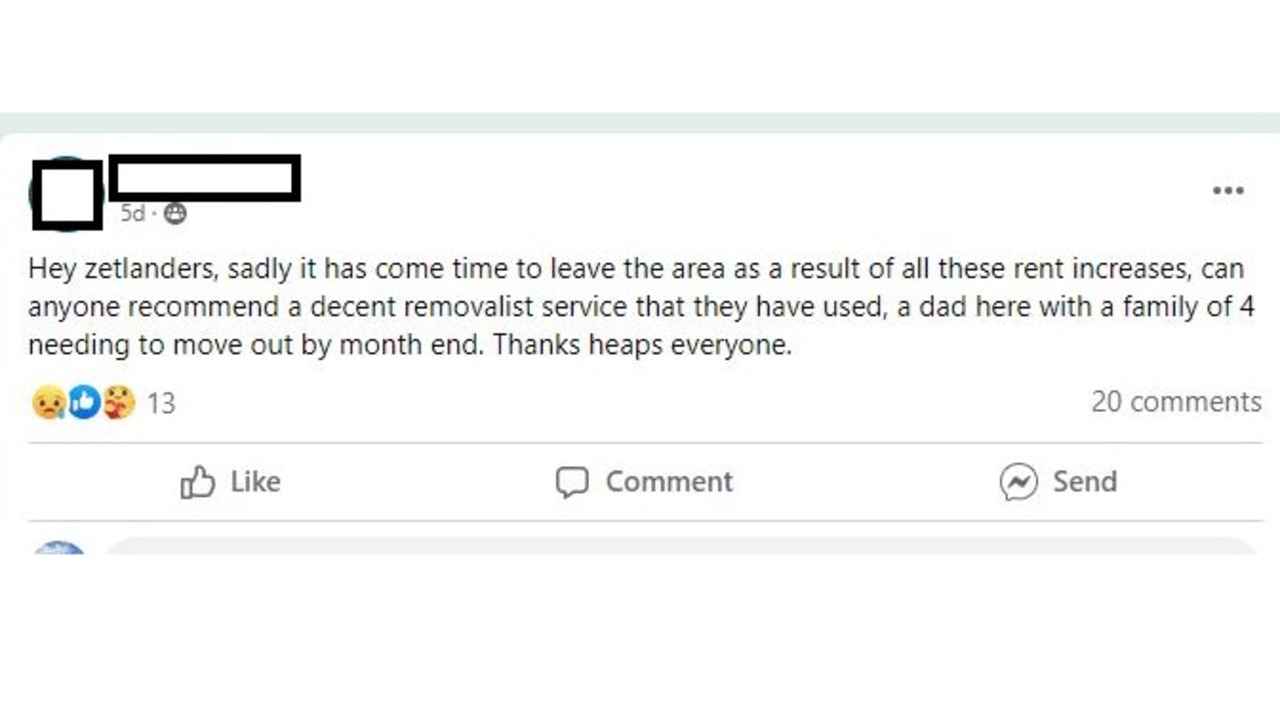

“Hey Zetlanders, sadly it has come time to leave the area as a result of all these rent increases … a dad here with a family of four needing to move out by month end,” yet another renter posted just days later, with another bewildered resident this month asking where all the locals fleeing the rent hikes were actually moving to.

Another claimed many landlords were choosing to evict tenants at the end of their lease in order to make more money on short-term accommodation platforms like Airbnb, while others speculated that a major factor driving the trend was “greedy landlords” pushing out locals in favour of international students with deeper pockets.

The area has become a microcosm of the whole city – and indeed the entire country – which is now in the midst of a devastating rental crisis caused by demand well and truly outstripping supply, leading to a mass exodus in certain areas.

According to the latest PropTrack figures, the beachside suburb of Clovelly in Sydney’s eastern suburbs tops the list of the 10 Australian suburbs that saw the largest dollar increase in median weekly rents year-on-year in February for both houses and units, with a current median weekly rent of $1995 – and a change in median rental price of $633.

In exclusive Rose Bay, it was only slightly less at $600.

Three Queensland suburbs also made the list, including Surfers Paradise, Paradise Point and Clear Island Waters, where rent prices have increased by between $400 and $430 respectively.

But the trend wasn’t just seen in ritzy beachside suburbs, with plenty of ordinary inner Sydney areas making the list, including Balmain East, where rents have risen by $375, Eveleigh, where they have jumped by $208, and Zetland, where the current median weekly rent is $780, representing an increase of $150, and reflecting the despair seen on social media.

But PropTrack senior economist Eleanor Creagh told news.com.au it was a “critical issue” affecting regions across the country, and not just those in the top 10.

“There’s a lack of rentals and very strong demand, which is outstripping supply, driving weekly rents higher and vacancy rates lower,” she explained.

“Since the pandemic, vacancy rates have plunged by half, which illustrates just how tight rental conditions are.”

She said during the pandemic, rental households got smaller, with the share of people living alone increasing. At the same time, many investors also sold off their properties, and few were buying, which kept supplies constrained.

And thirdly, migration is now rebounding strongly, along with a rebound in international students, which is stretching the already struggling system even further.

“Unfortunately I don’t have good news – we know the main issue is lack of supply … and unfortunately there’s nothing meaningful on the horizon that suggests an increase,” Ms Creagh said. “There really isn’t a release vale at the moment so there’s no reprieve for renters.

“Investor activity is not at the level it needs to be to match demand … and there’s no easy fix or silver bullet.”

Doug Driscoll, chief executive of real estate firm Starr Partners, told news.com.au he had come face-to-face with the rental crisis just this week when he saw what he believed to be a building evacuation underway on Sydney’s north shore – only to realise the masses of people were actually there for a rental open home.

“It starts at the very top at the salubrious suburbs, with people no longer able to live there either because they can’t afford it, or because there are so few properties available, which means there is so much demand,” he explained.

“They then move to other suburbs and it keeps trickling all the way down. It starts in metropolitan Sydney, with people going from the inner ring to more of an outer ring … and then more and more west.

“Then they start going out of the metropolitan areas altogether because they can’t afford even the outer ring, so they move to regional towns, and that causes real issues.”

While on a personal level, moving outside the city causes commuter chaos for those travelling long distances for work, it has devastating consequences for less well-off locals.

“Ultimately what this leads to is homelessness in some areas at the end of the line,” he said.

“There’s a ripple effect happening everywhere, and this ripple effect is like a horrible, almost dystopian game of dominoes.”

And it seems the latest data is backing up Mr Driscoll’s claims, with new ABS data released on Wednesday revealing one in 210 Australians, or 122,494 people, are experiencing homelessness – up 5.2 per cent since 2016.

Meanwhile, Orange Sky, the world’s first free mobile laundry service for people experiencing homelessness, has also noted that more people than ever before are now accessing their services, with a 38 per cent increase in regional areas across the country and 13 per cent growth in metro.

Mr Driscoll said the current trend of soaring rents pushing locals out could rapidly accelerate gentrification in some areas, while others could lose their distinctive local flavour, such as Leichhardt’s traditional Italian influence.

In other suburbs, the average demographic was likely to remain the same, such as young singles or working families, although the average income would rise, meaning it would become unaffordable for a greater number of people, while the list of areas considered to be more exclusive and up-market would grow.

“Things change all the time for better or for worse, for example, when a new metro is being built, all of a sudden the area is more appealing to commuters,” he said.

“But what’s happening now is darker and more sinister and there’s a genuine human consequence when people can’t afford rent.

“I feel for these people being pushed out of places where they were born and grew up, where their friends and family are, where their job is – there’s a dire human impact which we forget when we talk about the dollars and cents – we don’t see the impact it is having, which is pushing the end person out on the street.

“That’s how the story ends – for somebody somewhere, we will run out of properties, so what happens to them? To single mums with babies and young children? It’s very upsetting.”

Mr Driscoll said it was a “burgeoning problem” that needed to be addressed by governments, especially given real estate crises tended to be cyclical, meaning while the current problem would eventually ease, another would likely be just around the corner.

However, he acknowledged it was a “complex” issue that couldn’t be fixed by one factor alone – such as increasing social housing, tariffs or regulation of planing and developments.

And unfortunately, he said more pain was clearly on the horizon.

“We’re now seeing far more landlords looking to sell their properties because they can’t afford to keep them anymore,” he explained.

“We can definitely expect more rate rises, we also know there’s a looming mortgage cliff, so sadly I think it will get worse before it gets better.”