Aussie renters expose outrageous real estate fees

Fed-up renters have revealed the most outrageous fees real estate agents and landlords have tried to sting them with after moving out.

It seems almost every Aussie renter has a story about a real estate agent trying to make ridiculous claims against their bond or gouge them of extra money at the end of the lease.

With Australia’s rental crisis continuing to worsen, it seems that an increasing number of these tales are coming to light.

As part of a “fun trend” in the face of the growing crisis, members of the Don’t Rent Me Facebook group have shared their stories of the of “dumbest” things they have been charged for by a real estate.

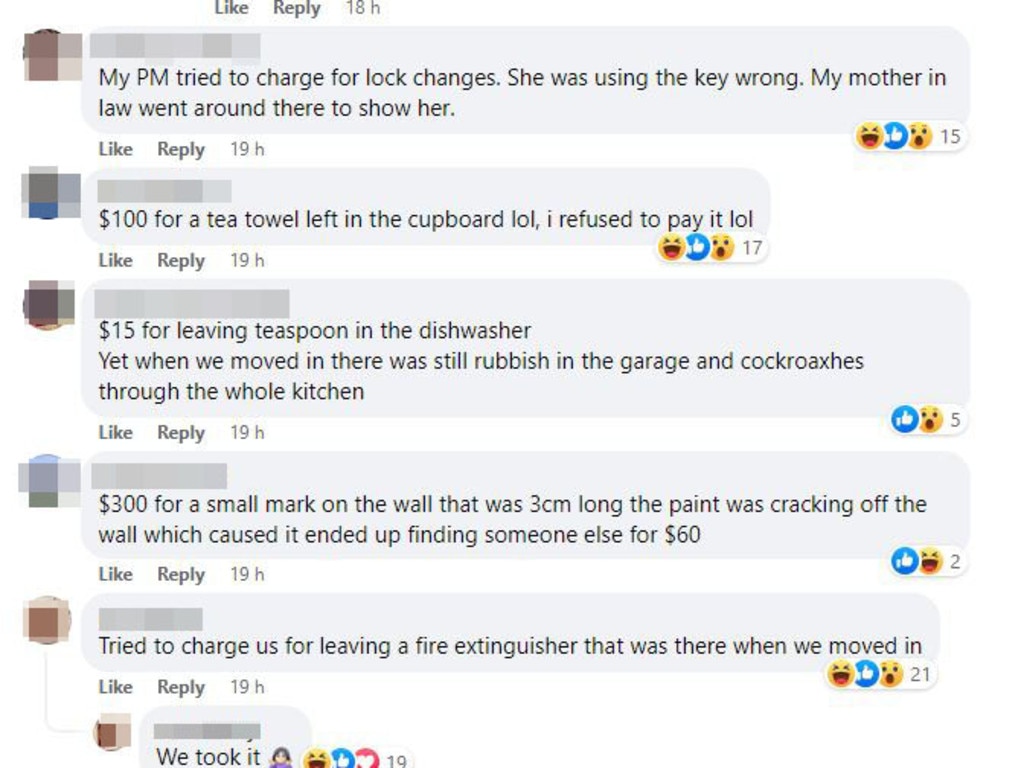

To kick off the post, one renter claimed they were charged $50 for the real estate agent to remove a trolley from the property and push it down the road.

The post quickly racked up dozens of comments, with some of the more ridiculous claims including $100 for a tea towel left in the cupboard after moving out and $15 for “leaving a teaspoon in the dishwasher”.

The latter renter claimed they were charged this despite there being rubbish in the garage and cockroaches throughout the kitchen when they first moved into the property.

There were multiple people who claimed they were told it would cost anywhere between $100 and $300 to change a light bulb.

Another also experienced issues around light bulbs, being charged a “rubbish removal” fee for spare bulbs left in the cupboard when they moved out, despite them being there when they moved in and documented in the condition report.

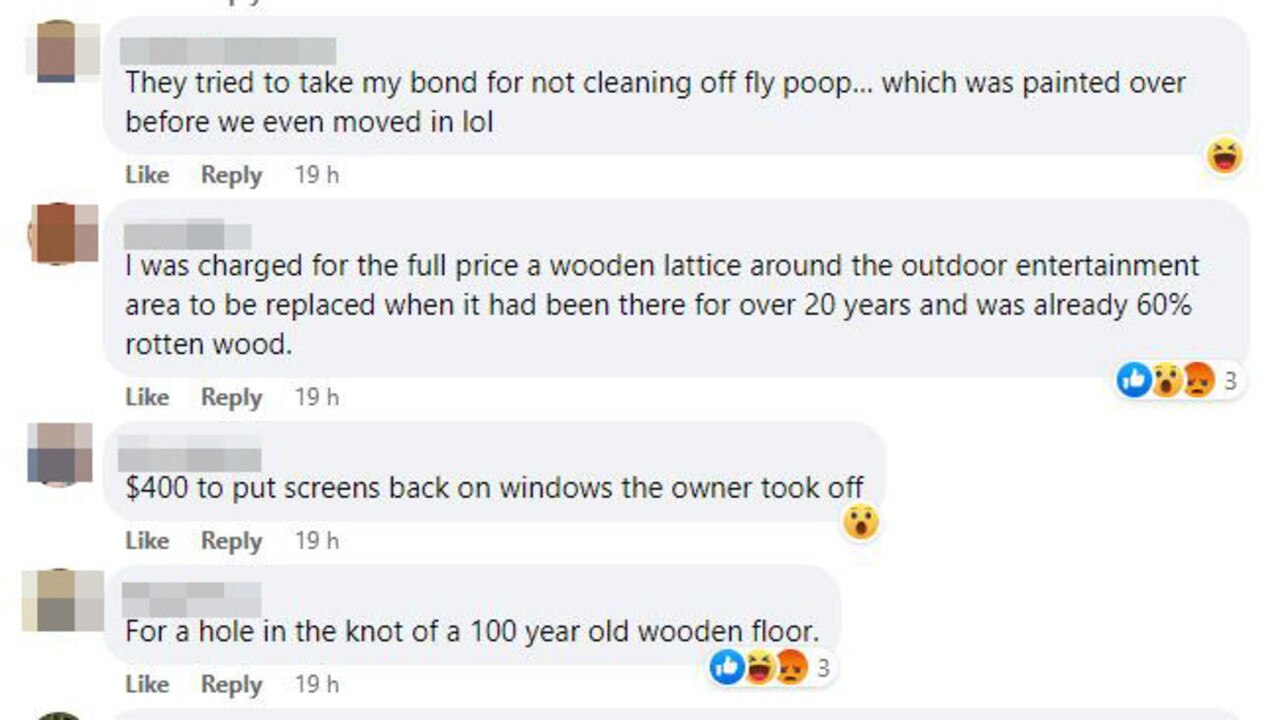

Some of the more shocking examples include one real estate allegedly attempting to take a tenant’s whole $2850 bond over a 6mm mark on “42-year-old carpets”.

“The mark was barely noticeable and was from a pen that leaked a little,” the poster said.

Another person claimed their real estate attempted to charge them $500 three months after they had moved out to mow the small patch of grass that had grown in that time.

One person said their property manager wanted to charge her $1300 for a “final clean” of the rental.

“I said leave the keys and I’ll do it myself then meet you there,” the person said.

“I got back there 10 minutes before we were supposed to meet, then waited for her and went in with her. She said I did a great job cleaning and ticked everything off. I didn’t even clean anything again.”

Some of the other crazy examples included a $150 fee to “remove a seashell left on a retaining wall outside” and $800 for blinds that cost $100 that were “damaged due to break in by not having latches on the windows to stop break ins”.

“Our real estate tried to charge us for unclean shelves in our lounge room. Unfortunately for them we didn’t actually have any shelves in the lounge room,” one person wrote.

“They charged us for a broken tile the real estate agent broke when installing a dishwasher before we even moved in,” another said.

One added: “I got charged $330 because I missed a line of cobweb in the top corner of the window frame.”

In a grim new warning, Australians have been told that skyrocketing rents and ultra-low vacancy rates are going to continue to smash tenants for years to come.

The rental crisis shows no sign of being resolved in the immediate future as tenants are forced to cop rent rises – on average of more than 20 per cent – or to compete in a market where there are barely any properties available, according to rental reports from the Reserve Bank of Australia (RBA).

The grim research showed rental prices will continue to soar due to a high demand for properties, a lack of new building and investment, as well as the increase in immigration.

It found around 240,000 people are expected to migrate to Australia in the coming year – which the research said equates to an extra 96,000 properties needed.

Despite the big increase in demand and higher rents, the growth of new rentals is expected to remain low, according to the RBA, largely due to increases in interest rates.

“Information from liaison with property developers suggests that higher interest rates and construction costs, combined with declining housing prices and apartment pre-sales, are headwinds to growth in the supply of new dwellings,” the report said.

“The decline in the demand for new dwellings is expected to weigh on overall dwelling investment over the next few years.

“As a result, vacancy rates are likely to remain at low levels.”

– With Sarah Sharples