Aussie landlord told to ‘suck it up’ by fellow property investors

A group of Aussie landlords have told a fellow investor to “suck it up” after she claimed she was being left “out of pocket” despite raising her tenant’s rent.

An Aussie landlord has been taken down a peg by fellow property owners after complaining she is still being left “out of pocket”, despite raising the rent to the “higher end” of the current market value.

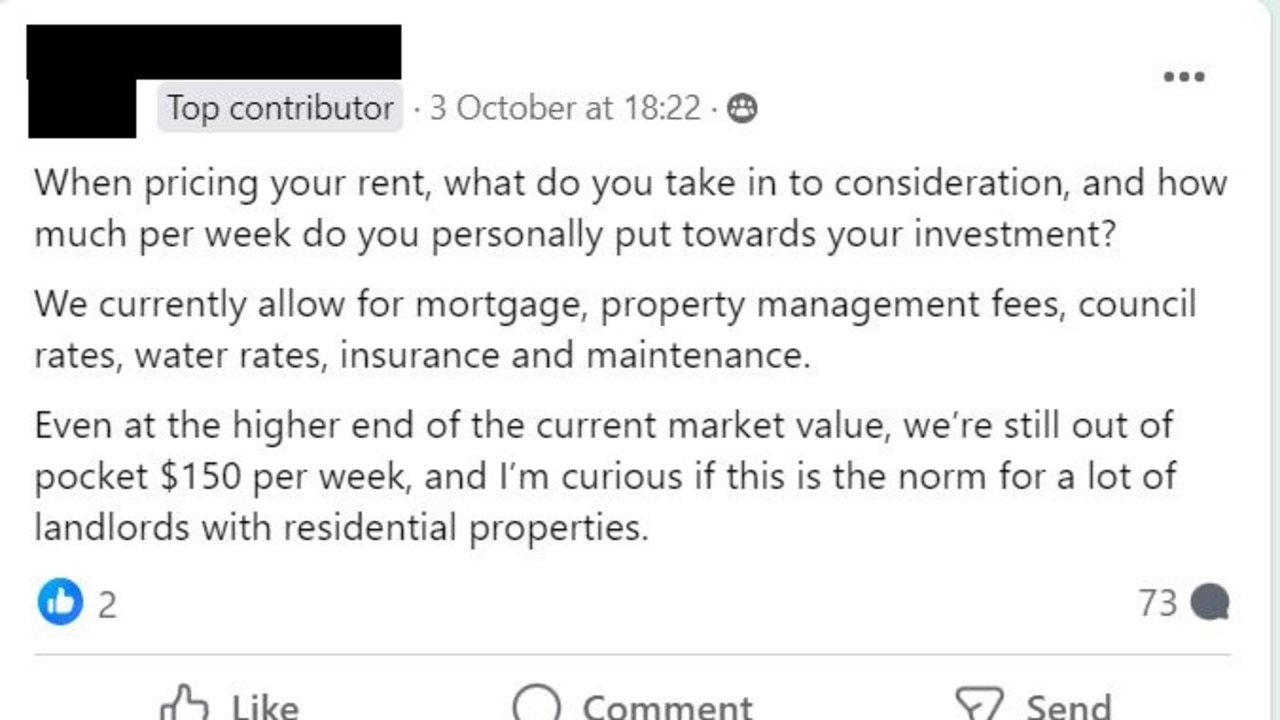

The woman recently took to a landlord advice Facebook group to ask what factors people take into consideration when pricing their rent and how much money each week they are personally having to put into their investment.

She claimed that when setting her weekly rent rate she factors in her mortgage repayments, property management fees, council rates, water rates, insurance and maintenance.

“Even at the higher end of the current market value, we’re still out of pocket $150 per week, and I’m curious if this is the norm for a lot of landlords with residential properties,” she asked.

The post garnered dozens of comments from her fellow landlords, but it turns out there were many who weren’t impressed with her approach to owning a rental property.

Many people were quick to point out the only factor that should be determining her rental return is the current market rate, with the rest being expenses that she personally needs to manage – not the tenant.

“The only determinant of rent is the market, and the supply and demand of that market. The rent is completely independent and separate from your holding costs,” one person pointed out.

“Market forces are what determine your rent. The reality of an investment is you do have to absorb some of the cost, if you can’t afford it sell it, it’s a harsh reality check but it’s just the way it is,” another said.

Others said her costs were “irrelevant” to how much rent she should be getting.

“I don’t know anyone with a recent mortgage on an IP who isn’t negatively geared if bought in a decent city,” they said.

“Your investment is about how much the property will be worth in the future, not about the current rental yield (although it has to be taken into account). Sorry but your way of thinking is pre-2000s.”

Other landlords said it was more important to have good tenants in the property and keep than happy than to get the highest rental return possible.

One person suggested that if they do decide to raise the rent, then it should be by no more than $50 at a time, though they prefer to keep it under $20.

“If you keep increasing at high levels you’ll be left with tenants that have no time to look after the place as they’ll be working 3 jobs just to pay rent and will hate you for it,” they said.

Other investors took issue with the woman’s use of the phrase “out of pocket”, saying she is simply contributing $150 a week to her investment.

“If I put $150 into a savings account I’m not out of pocket because I’ll get that money back eventually, just like you will by putting it towards a mortgage,” they said.

Other landlords had simpler advice, with one saying: “It’s an investment, suck it up.”

It comes as Aussie renters have been hit with even more bad news, with rents expected to continue skyrocketing in major cities.

New data from PropTrack shows the average rent in Sydney jumped 18 per cent to $650 a week for the year to September 30.

For Melbourne, the average weekly rent increased 14 per cent to $500, while Brisbane prices as increased 12 per cent to $550.

Other capital cities to experience major increases are Perth, up 15 per cent to $540 and Adelaide, up 11 per cent to $500.

Cameron Kusher, director of economic research at PropTrack, told news.com.au that the combination of population growth due to migration, coupled with a “persistent reduction” in the number of properties available for rent, will continue to drive rents higher.

He issued an ominous warning for capital cities like Sydney and Melbourne, claiming renters may be forced “back into share houses” or may need to rent out spare rooms or extra space to cope with the escalating costs.

“I think there’ll be further growth in the next quarter and into next year in major capitals, but it’s hard to imagine they’ll increase as much as in the past year.”

He added: “It’s hard to imagine rents going up 36 per cent in two years in case of Sydney.”