Aussie home prices get ‘nightmare’ growth after another surge in buyer demand

Aussie home prices have recorded an unusual change during the normally quieter winter period – driven by activity in three capitals.

Australian home prices have continued to grow during the normally quiet winter period amid sluggish construction and a surge in buyer demand fuelled by tax cuts and wage increases.

PropTrack’s latest Home Price Index showed national home prices hit a new peak after inching up 0.08 per cent over July. Prices are now an average of 6.3 per cent higher than a year ago.

National prices were now also about 43 per cent higher than they were at the start of the pandemic in 2020, PropTrack noted.

PropTrack economist Paul Ryan said home buyer demand was continuing to rise despite interest rate hikes crippling many people’s spending power.

This coincided with a severe shortage of housing in many locations, which meant competition for the scant supply of available homes was fierce – even in the normally quieter winter months, Mr Ryan said.

Many of the most active buyers in the market were upgraders using equity to fund their purchases or investors, he added. Many of these buyers were in a good financial position after getting wage increases and spending boost from tax cuts announced this year.

MORE: Insane homes of Aussie OnlyFans stars

“These are buyers who are not as affected by interest rate rises,” Mr Ryan said.

“They are in a good position to buy and they would have been supported by good economic conditions and certainty in their job prospects.”

The recent surge in prices – unusual for July, when buying activity has historically been more subdued – was led by strong activity in Perth, Brisbane and Adelaide, along with Sydney’s outer suburbs.

Prices in Melbourne, Hobart and Darwin, as well as many regional areas, fell for the month.

Perth remained the hottest capital city market in the country with monthly growth of nearly 1 per cent. The median dwelling price in the city is now $736,000 – 23 per cent higher than a year ago.

MORE: Wild way Trump win could make Aussies poorer

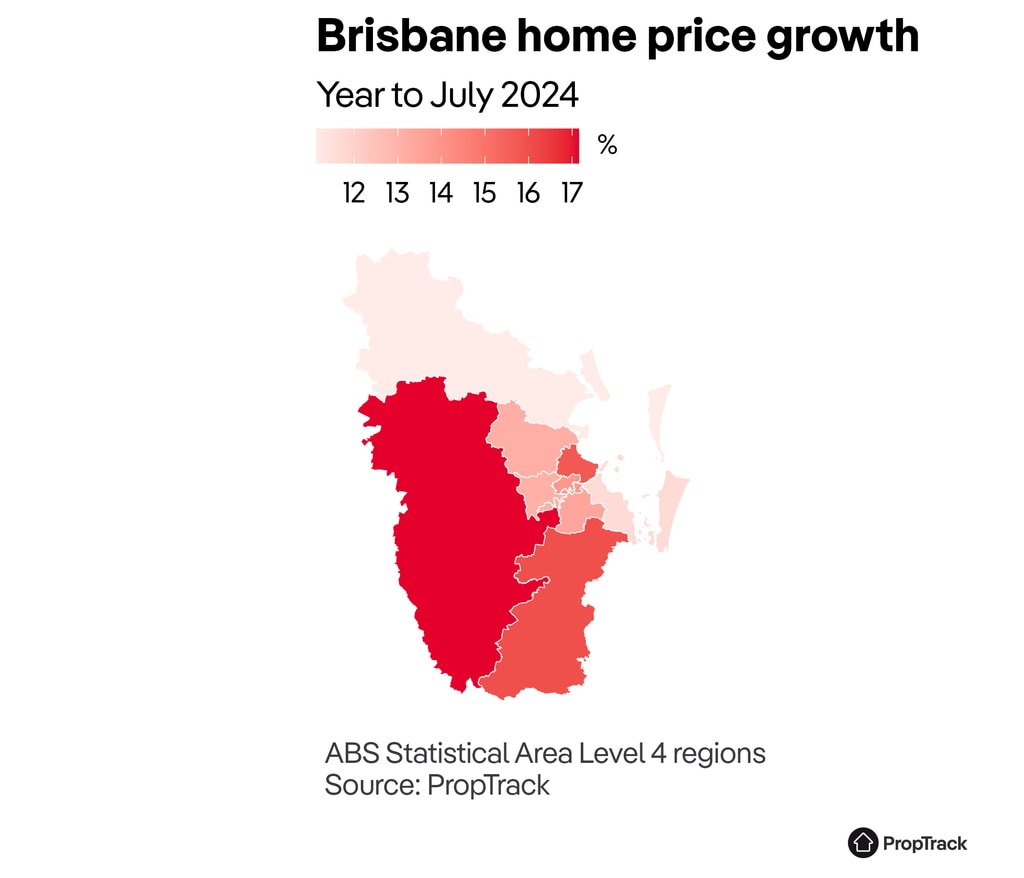

Adelaide prices rose 0.58 per cent and are now about 15 per cent higher than at this time last year, while Brisbane’s 0.34 per cent monthly rise pushed annual growth up to 14 per cent.

Relative affordability compared to larger capitals was a factor in the price increases in these cities, Mr Ryan said.

MORE: How bus driver became mortgage free in 9 months

Perth and Adelaide were also drawing renewed interest from eastern state investors, further fuelling demand, he said.

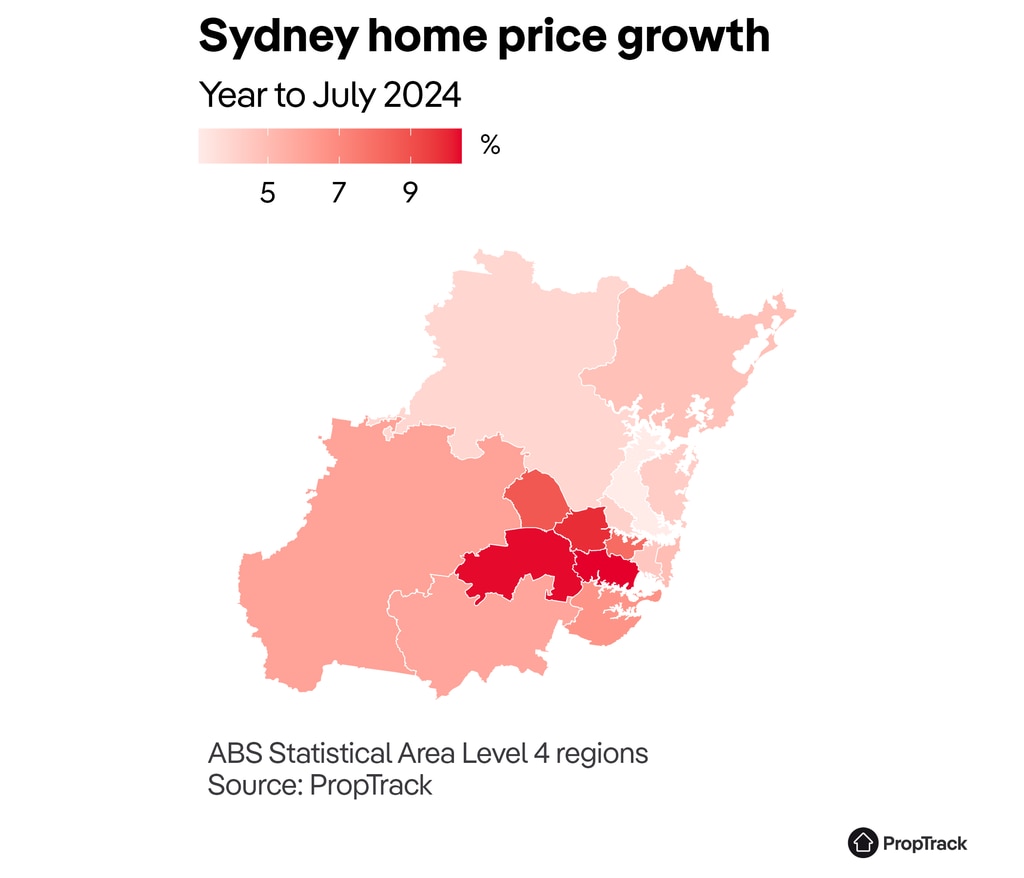

Sydney prices increased 0.12 per cent over July and are now up 6 per cent for the year, but the citywide growth disguised huge variability across different city regions.

Much of the Sydney growth was driven by increases in more affordable western areas, including the Canterbury-Bankstown and Parramatta regions.

Pricier markets such as the eastern suburbs, north shore and northern beaches recorded flatter growth by comparison.

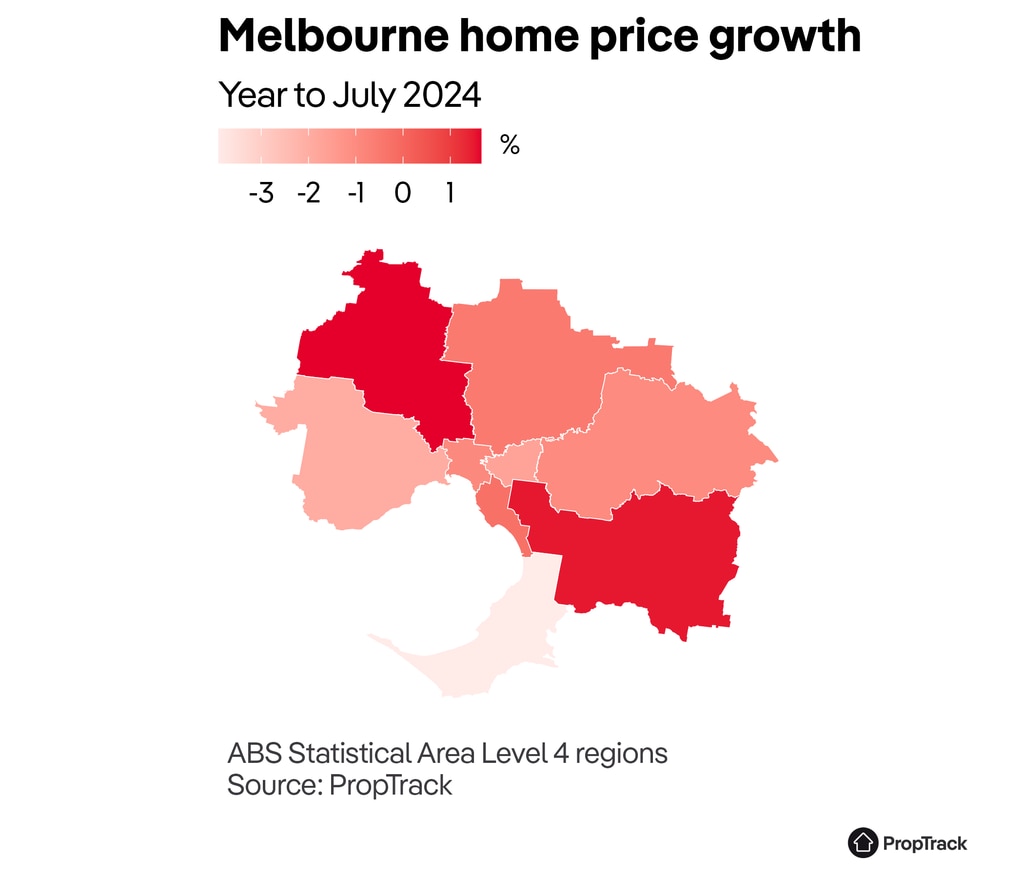

Melbourne’s 0.21 per cent fall in prices over July also disguised varied performance across city areas.

MORE: Shock bank balance you now need to be ‘rich’

Prices across the Victorian capital were an average of 0.82 per cent lower than a year ago, but in the city’s northwest and southeast prices were about 1.5 per cent higher.

Mr Ryan attributed Melbourne’s price fall to a greater supply of housing and interest rate hikes curtailing buyers’ spending power.

“Sydney, by comparison, has not done as good a job of constructing new housing and that’s pushing prices higher there,” he said.

Recent price rises were a “nightmare” for first-home buyers who were getting hit on two fronts – their borrowing power was diminishing while the amount they needed to spend was rising, according to Mr Ryan.

“First-home buyers don’t have the benefit of equity behind them. They’re trying to borrow as much as they can, but they have to spend more,” Mr Ryan said.

“First-home buyers have to pay the same rates as what we saw back in 2011 but prices are now double what they were then. It makes it incredibly tough.”

It comes as ABS figures released Tuesday showed inflation rose 3.8 per cent over the year to June.

Experts said this reading, while high, would make another interest rate hike in August unlikely, but an additional hike further into the future was not off the cards.

With interest rates staying level, Mr Ryan said he expected prices to continue growing “moderately” over the coming months.

“This would change if there was another rate hike but at the moment this is looking unlikely.”

Canstar group executive financial services Steve Mickenbecker said the Reserve Bank had some tricky decisions ahead.

“The Reserve Bank target band is looking a long way off and another quarter with a 1.0 percent rise will almost demand another cash rate increase. At that rate we’re tracking towards 4.0 percent annual inflation by the end of the year,” he said.

“The Reserve Bank will be weighing up the risk of losing control of the inflation agenda and allowing inflation expectations to become entrenched against raising rates now and slowing the economy to the point of major job losses.

Another 0.25 percent rate increase would cost a borrower on a $600,000 loan around $100 extra per month, according to Canstar.

Originally published as Aussie home prices get ‘nightmare’ growth after another surge in buyer demand