New housing approvals slip dangerously far behind National Housing Accord

The dream of a quarter-acre block was dashed for millions of Aussies long ago, but it appears even tiny apartments are quickly falling off the table too.

Australia’s housing shortage has taken another turn, with new data from the Australian Bureau of Statistics showing a sharp decline in overall dwelling approvals.

The drop has been fuelled largely by a collapse in apartment construction, raising fresh concerns for young Australians already locked out of the housing market.

The “Australian dream” of a quarter-acre block was dashed for millions of Aussies long ago, but now it appears even the smallest of apartments are quickly falling off the table as well.

For those born after 1990, who weren’t gifted a trust fund, house deposit, or struck it big with a wild crypto gamble, the following figures will come as tough reading.

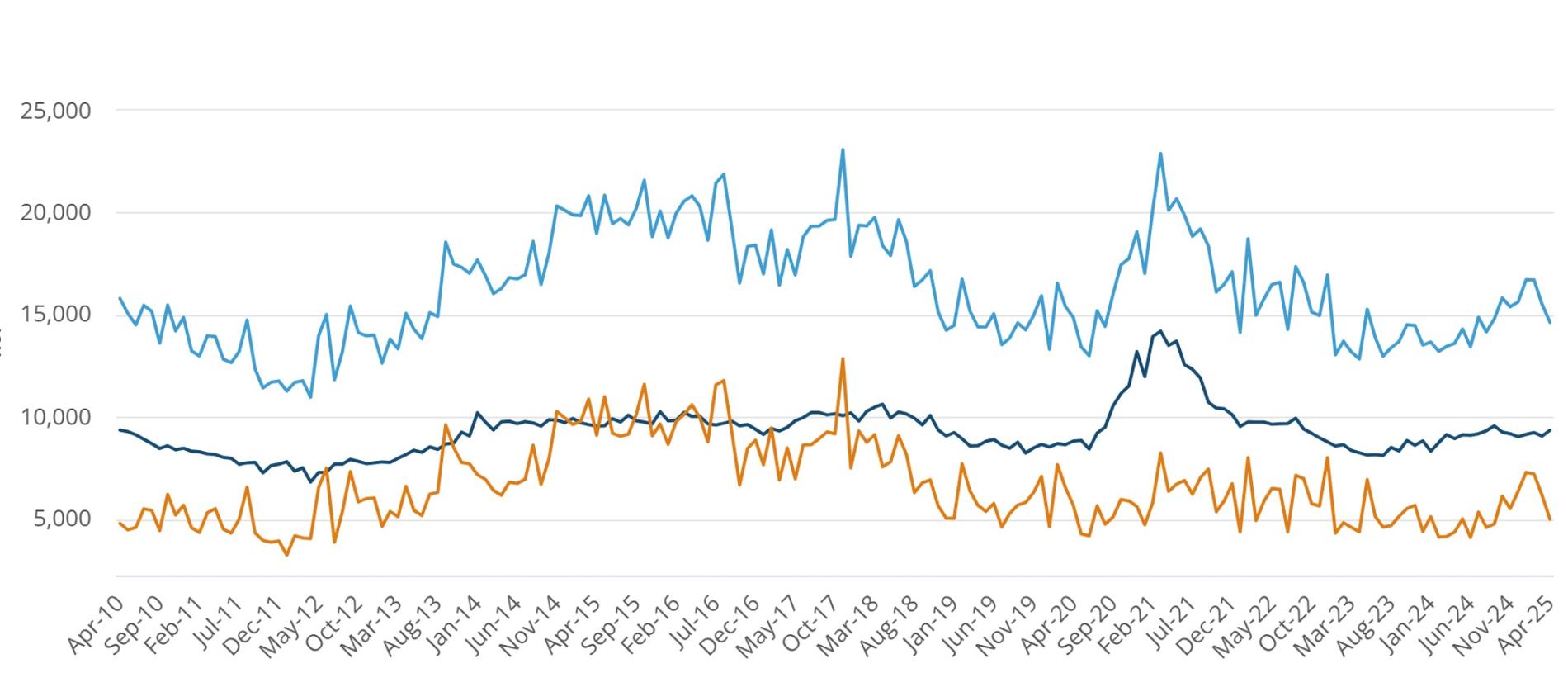

The ABS figures, released on Thursday, revealed the total number of dwellings approved in April fell by 5.7 per cent to 14,633. The drop was driven primarily by a 19 per cent fall in approvals for private sector homes excluding standalone houses, which include apartments and townhouses.

“A drop in apartment approvals drove a 19.0 per cent fall in private dwellings excluding houses,” said Daniel Rossi, ABS Head of Construction Statistics.

“Meanwhile, private sector house approvals were up 3.1 per cent.”

MORE: Home loan trap taking years to escape

The collapse in higher-density approvals comes as Australia’s population continues to surge, exacerbating what economists, social researchers and rental advocates have long warned is an unsustainable imbalance between supply and demand.

According to CoreLogic, the national median dwelling value has increased more than 30 per cent since the start of the pandemic, while rental vacancies remain near historic lows.

But new homes, particularly more affordable and urban apartments best suited for first homebuyers, aren’t being built at a rate that reflects demand.

The situation leaves younger Australians, who already face stagnant wages, high interest rates and record living costs throughout their working life, in an increasingly untenable position.

MORE: What your home will be worth in 2030

Even April’s modest rise in private sector house approvals, driven by 7.3 per cent increases in both New South Wales and Queensland, is unlikely to shift the dial.

At 9,349 approvals, the result represents a 4.6 per cent year-on-year increase but does little to compensate for the decline in apartment projects.

“New South Wales had over 2,000 private sector houses approved for the first time since December 2023,” Rossi said, suggesting demand remains high in key states.

However, critics argue that standalone homes are becoming increasingly unaffordable or geographically inaccessible for most first-time buyers, especially in capital cities.

“A key driver of recent movements has been the increased value of non-residential projects rather than the number,” Rossi explained.

The numbers land amid calls for bold federal and state intervention to fast-track housing construction and cut red tape for medium- and high-density developments — reforms that housing experts argue are long overdue.

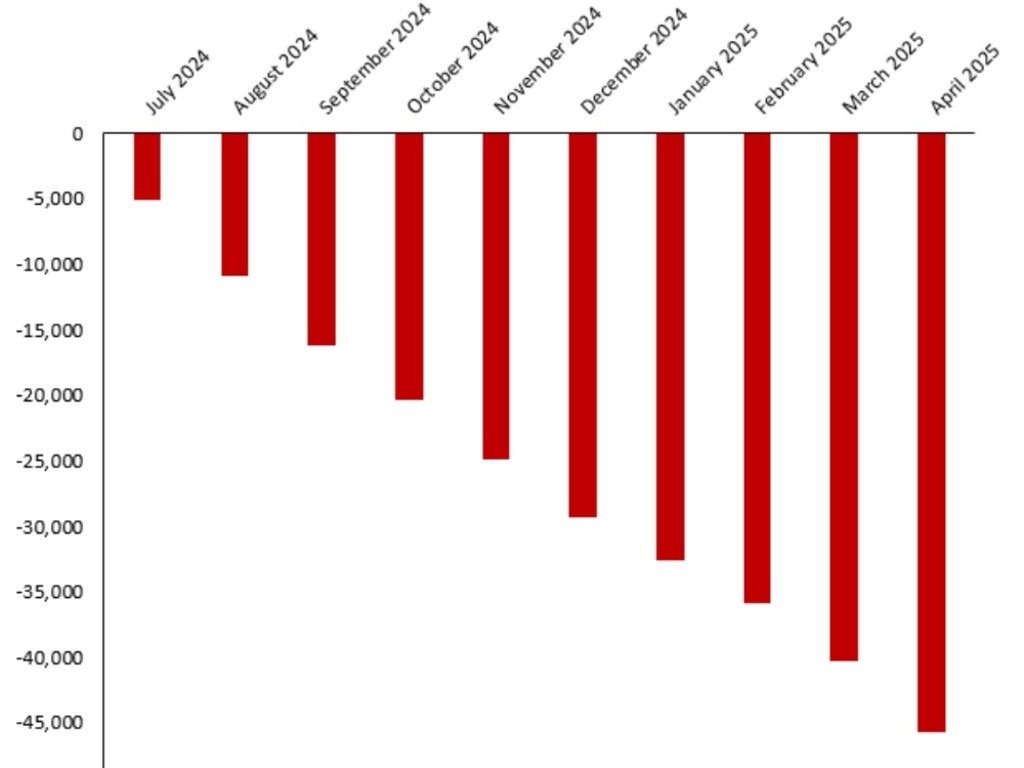

“Data confirms the federal government’s failure on housing, as new housing approvals slip further behind National Housing Accord targets. The Accord has failed to deliver the level of new houses promised for the tenth consecutive month,” said Morgan Begg, Director of Research at the Institute of Public Affairs.

“Over the first ten months of the federal government’s Accord, housing approvals have failed to hit a single target and are now 27 per cent behind where they were promised to be,” Mr Begg said.

“With housing approvals so low, Australia is being set up for a disaster, as in the last three years to June 2025, net migration is on track to be 1.3 million, meaning the gap between demand and supply is drifting further apart.

“Today’s new figures reinforce the depth of Australia’s housing crisis, brought about by out-of-control migration, a construction sector burdened by red tape, and competition for resources from large, expensive, and inefficient taxpayer-funded construction projects.”

But it gets even worse.

The IPA claims the time it takes to build a house, from approval to completion, has increased by a whopping 50 per cent over the last 10 years.

It has shifted from an average of just over eight months in 2014 to almost 13 months by 2024.

“The federal government clearly does not understand Australia’s housing market. It has overestimated the capacity to build new homes, while it has continually underestimated its migration intake forecasts,” Mr Begg said.

“It has created the perfect storm of rising prices and rents in the housing market that has put the great Australian dream of homeownership out of reach.”