Aussie house prices ‘set to soar 15 per cent’: KPMG

Home prices are set to explode over the next year and a half, with housing affordability to be hit hard, according to a new report.

House prices across the country are set to soar over the next 18 months, according to big four accounting firm KPMG.

In a new report released Monday, KPMG also predicts housing affordability will get tougher for struggling home buyers, as prices push back past pre-rate hike and pre-pandemic levels

In the report, Residential Property Market Outlook, September 2023, Dr Brendan Rynne, KPMG Chief Economist said there were a number of factors expected to push up prices.

MORE: Beach pad with star links attracts first home buyers

“Despite high interest rates, constrained supply will likely dominate the factors influencing property prices in the short term and result in continued price gains in most markets during FY24,” he said.

“House and unit prices will then accelerate further in the next financial year as dwelling supply continues to be limited, due to scarcity of available land, falling levels of approvals and slower or more costly construction activity.”

The post-pandemic recovery in immigration is also expected to add significant pressure to housing demand.

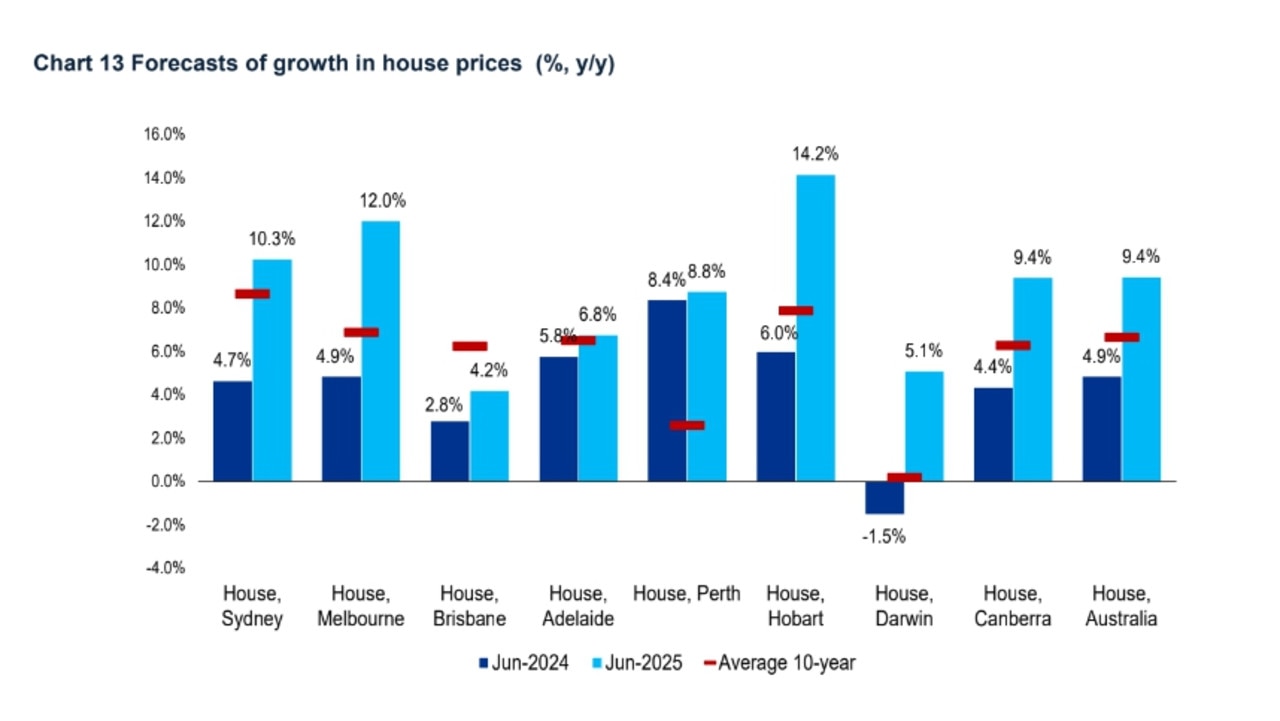

House prices will rise nationally by 4.9 per cent over the next 9 months and then surge by 9.4 per cent in the year to June 2025, according to KPMG’s new property report on Australia’s capital cities.

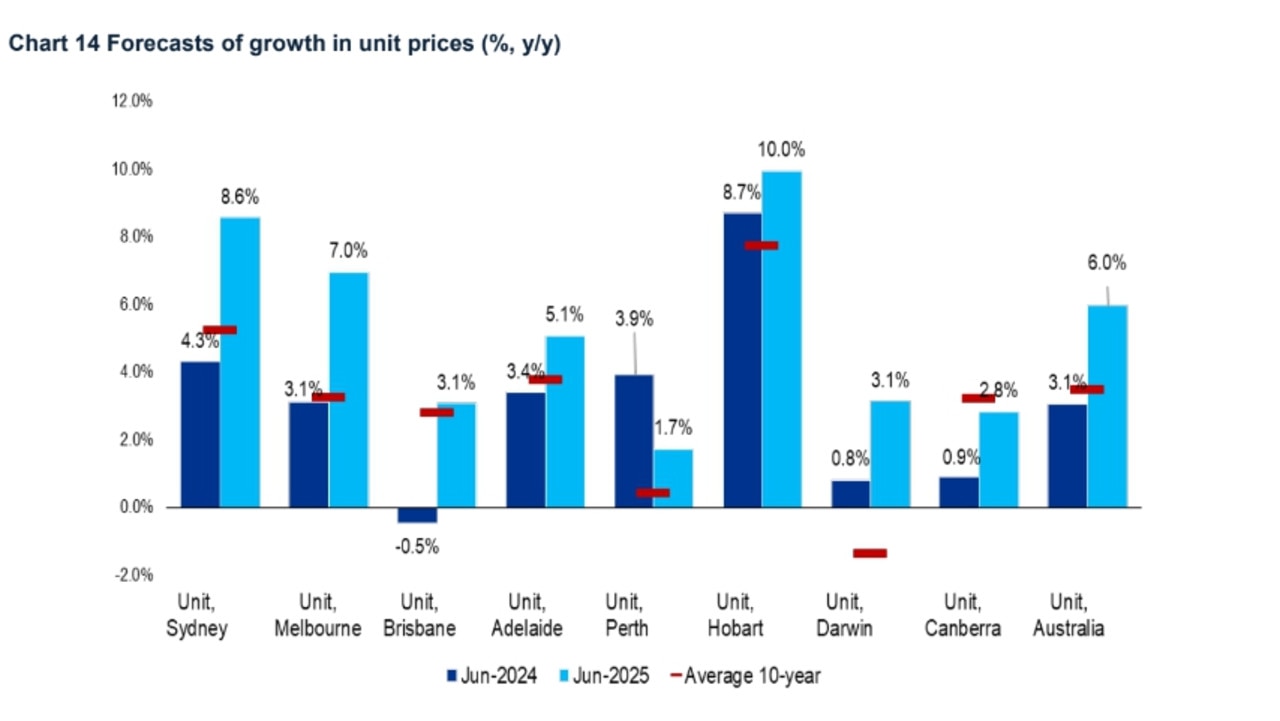

Apartment prices are also expected to rise at a slightly lower rate of 3.1 per cent by June, then another six per cent in the next 12 months

As the housing market recovers from consecutive rate increases, mortgage owners may be relieved to hear KPMG have predicted rate cuts by the next financial year.

“The supply issue will combine with several other factors to push asset prices up - higher demand due to heavier migration, anticipated rate cuts moving into financial year 2025 and potentially relaxed lending conditions,” Dr Rynne said.

High rental costs and low vacancy rates, may make owning a home more appealing to Australians, according to KPMG.

“If renting is more affordable, it can exert downward pressure on housing prices,” the report revealed.

MORE: How untouched 1970s unit sold for over $2.4m

Family’s shock auction result shows ‘strength’ in market

“When the cost of renting is comparable to the cost of buying and owning a similar property, households may opt for homeownership, potentially driving up house prices.”

Units in Sydney, Melbourne and Hobart are likely to experience larger gains than the national average in the next two years.

The report revealed shrinking home building approvals and rising building material costs are also constraining housing supply.

There were some factors that were pushing the other way, Dr Rynne said.

“The main one being mortgage stress,” he said.

“First-time buyers now need to use around half their earnings on mortgage payments, a significant rise from a third just three years ago,”

Half of all fixed rate credit is estimated to expire this year, approximately 880,000 Australian households, according to Dr Rynne.

“Some homeowners who previously locked in low rates might be unable to pay, and won’t be able to refinance to a lower and competitive rate,” he said.

Despite this, Dr Rynne said “the factors pushing prices up will more than counter those restraining them.”

MORE: Labor’s dithering on rental solution hurting tenants

‘Compelling’ and ‘scarce’ site listed in Sydney’s north

How those earning as little as $27k are buying homes

Originally published as Aussie house prices ‘set to soar 15 per cent’: KPMG