Homeowners face ‘tough’ debt decision after Albo election win

Three quarters of homeowners face a “troubling” issue with their loans in the aftermath of Albo’s election victory, new data shows.

Newly re-elected Prime Minister Anthony Albanese has been urged to make cost of living support an urgent priority as alarming new polling shows debt problems have pushed many Aussies to the edge.

The study showed mortgage repayments were swallowing more than half the monthly income of about one in five Aussie homeowners, who now face tough financial decisions to keep their homes.

About three quarters of mortgage holders surveyed in the Finder.com.au research were spending over a third of their household income on repayments – defined as “mortgage stress”.

This was despite the February cut to interest rates and a recent frenzy of refinancing activity as homeowners sought to cash in on cheaper loans.

Mortgage stress levels were now at a “crisis point”, according to Finder, which pointed to additional research that showed about one in 10 homeowners had missed a repayment in the last six months.

MORE: John Howard’s hidden homes shame

Finder home loans expert Richard Whitten said many households would need a lot more support than just another interest rate cut to stay afloat.

“The loan to income ratio has blown way out with millions teetering on the edge due to mortgage stress,” Mr Whitten said.

“Unexpected costs could spell serious financial trouble for many homeowners.”

Mr Whitten said recent rate cuts and the prospect of another cut in May would offer much-needed reprieve for millions of Australians, but most households needed more cuts to make a real difference.

“Many families will still face tough financial choices to keep their homes,” he said.

Nerida Conisbee, the chief economist at Ray White Economics, said the Albanese government’s re-election could deliver mixed outcomes for the housing market.

MORE: Inside the private homes of Aussie prime ministers

She pointed out that much of the housing policy announced in the lead up to the election was about supporting first-home buyers getting into the market.

This included the government’s flagship shared equity scheme, which will allow first-home buyers to snap up homes with deposits as low as 5 per cent.

This policy, while aimed at improving accessibility for first-home buyers, was “likely to drive prices higher in the near term before supply-side measures can take effect,” Ms Conisbee said.

Much of the rise in prices would come at the most affordable end of the market, she added. “(That’s) not great for affordability. But it will be a positive for people that already own property in those areas.”

More interest rate cuts would help, Ms Conisbee said. “Albo can’t control those obviously. But they will be coming through now because of the global slowdown and inflation under control.

“A global slowdown, however, may come with rising unemployment so that is a risk factor … The real challenges come if people lose their jobs so it’s really crucial they remain employed.”

A possible financial lever the Albanese government could pull would be allowing a freeze on mortgage repayments, like those ushered in during the Morrison government’s tenure during Covid.

This step wouldn’t be necessary unless unemployment went up markedly from current levels, Ms Conisbee explained.

Finder money expert Rebecca Pike said some promised Labor policies may help if the government can deliver on them.

“The election of the Labor government means that Australians get the budget promises of tax cuts, energy rebates, student loan discounts and childcare subsidies, to name a few,” she said.

“This will be a huge help for so many struggling Aussies who have been battling rising costs.

“There may be some concern around what impact the budget measures might have on inflation, but for now people can breathe a little easier. And for the everyday Aussie, that’s all they really need right now.”

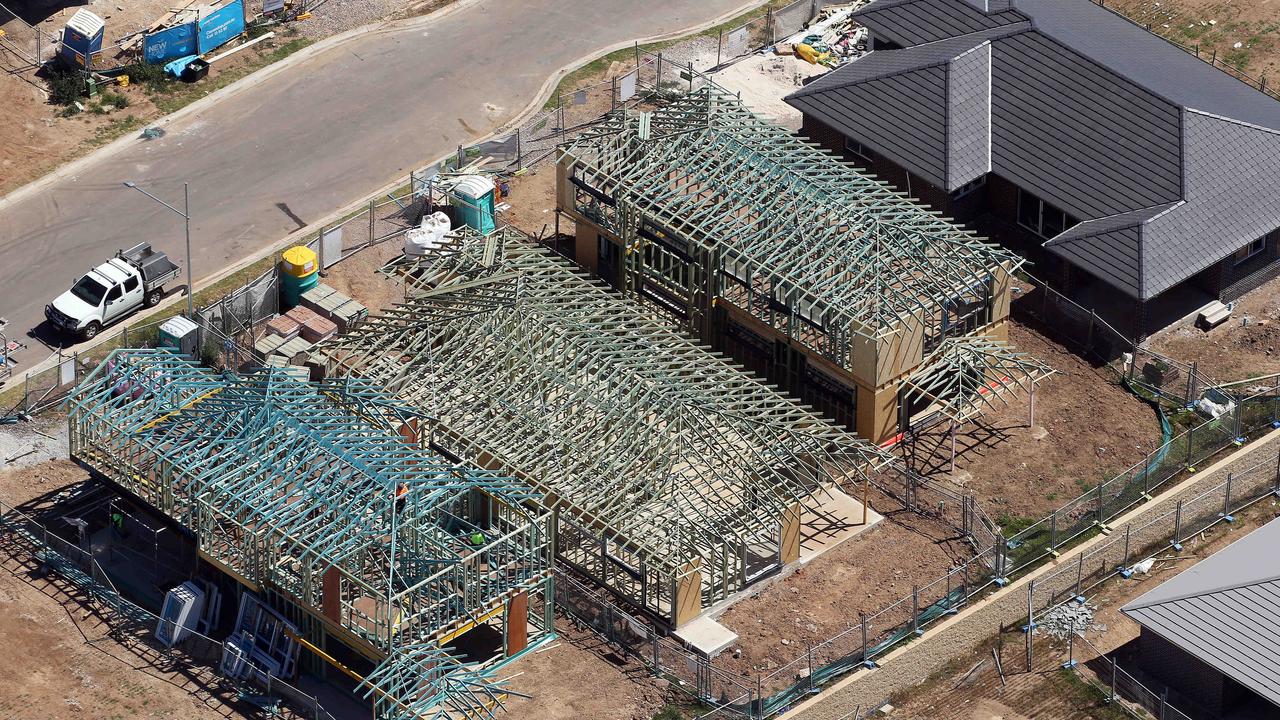

Housing Industry Association managing director Jocelyn Martin said the Albanese government should also prioritise home building.

She also pushed back against any suggestion that the housing crisis lies outside the Federal Government’s remit.

“We’ve heard it too often — that housing and planning is a state issue, or that the Commonwealth has limited levers to pull. That excuse simply doesn’t stack up anymore.

“The Federal Government has the influence, the resources and the leadership role to bring all levels of government together. It can drive the co-ordinated policy, funding and reform needed to move the dial on supply and affordability — not just tinker at the edges.

“This was reinforced in yesterday’s election results and with voters outlining housing as a key issue to be addressed as a matter of priority. We urge the new Government and the entire parliament to work together to implement the solutions already on the table.

“Housing Australians must not become a casualty of politics-as-usual. We can’t afford more years of delay and stalling of key policies being implemented – we need action within weeks not years.”