‘Costs more’: big real estate lie exposed

Home buyers will be stung with extra charges next month in a surprise trend that disproves a frequent housing market claim.

It’s a line often wielded out by real estate agents or parents trying to encourage their adult children: buy a home in spring and you’ll have more choice and maybe even get a bargain.

But it turns out it’s not true and may even be the opposite.

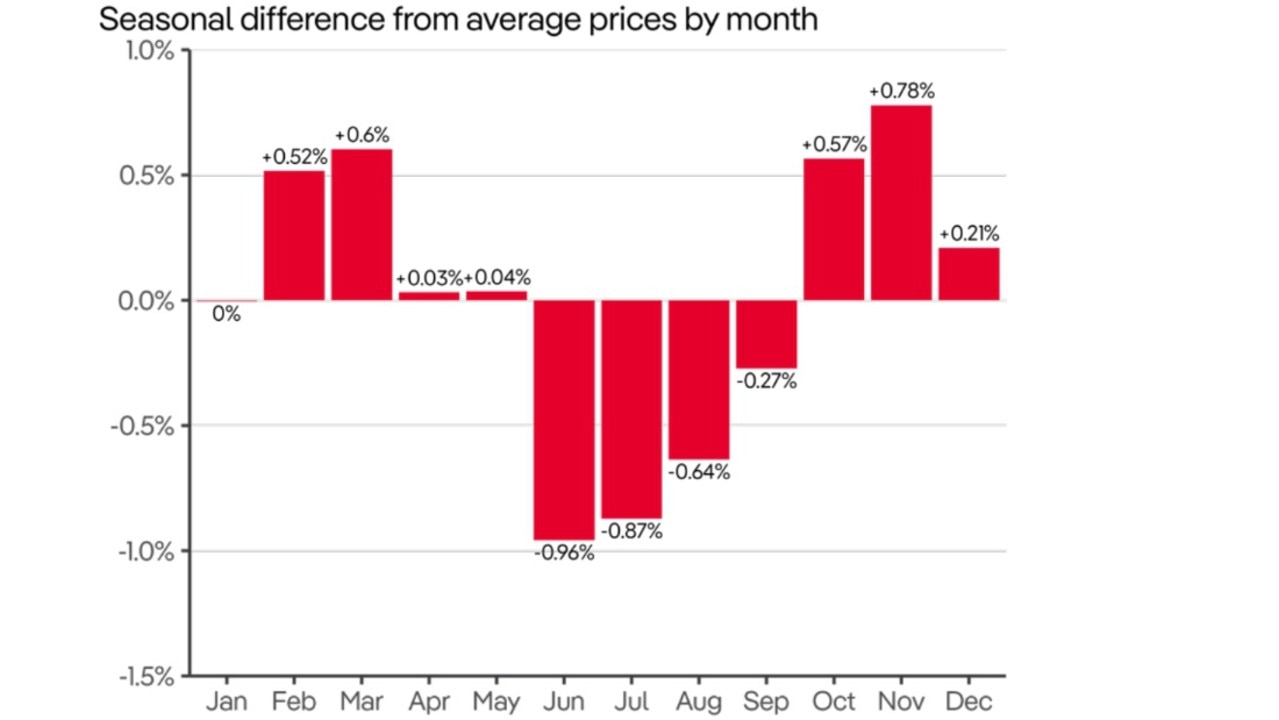

A new PropTrack study of the past 10 years of price growth trends revealed November ranks as the worst time of the year to buy a home nationally.

The study noted that buyers in November typically paid a premium for homes compared to the rest of the year.

MORE: Aussie suburbs set to boom in 2025

But PropTrack noted that climate, school and public holidays and other local forces meant the best and worst times of the year did vary somewhat across capitals:

> Time of year when NSW prices go up $12k

> Month when VIC sellers get extra $10k

> QLD’s best months to buy and sell

> SA’s best months to sell and buy

November was considered the best time of the year to sell property nationally, with the typical seller pocketing about 0.78 per cent extra for homes traded over the month.

That may sound like a minuscule amount, but given that median home prices are approaching $900,000 in most of our capitals, the premium equates to nearly $7000 extra.

In the 700-odd suburbs nationally where prices above $1.5m are the norm, the premium could total over $12,000.

MORE: Homes of our PMs: how new Albo mansion compares

MORE: Home trick nets dad extra $426k a year

PropTrack economist Paul Ryan said November prices typically spiked because it marked the high point of the spring selling season.

The supply of homes available for sale was usually higher than at other times of the year but so was the pool of prospective buyers, Mr Ryan said.

Many of those buyers were also recent sellers and were highly motivated to purchase their next house quickly – before the end of the settlement period on their existing homes.

This motivation often translated into emotionally driven purchasing decisions and FOMO, or fear of missing out, at auctions.

“Spring brings more listings but the weight of buyer demand offsets that additional supply,” Mr Ryan said.

MORE: Bold moves that got Albo $8.8m property empire

MORE: ‘Dead giveaway’ you’ve bought a dud home

Mr Ryan added that energy was already coming back into the housing markets in much of the country due to expectations of an interest-rate cut.

Some economists are expecting a move from the RBA as early as next month.

“A drop in rates will boost the market,” Mr Ryan said. “Over time, with more cuts, the impact could end up being significant.”

Nationally, the best time of the year to purchase a home was June, when properties typically sold for about 1 per cent cheaper than the average for the rest of the year.

Buyers got a similar saving of about 0.87 per cent in July.

September and October generally saw higher prices, along with March – although the premium was not as high as in November.

MORE: How Aus tech worker got $850m payout

MORE: $130m mystery over ‘Elton John’s Aussie home’

Buyer’s agent Michelle May said buying a home in November “costs more” bit anyone hunting around for a home may get a good deal if they purchase just after.

“There comes a point in the year when there are a lot of buyers who have been looking since the start of the year and they start to get disillusioned,” she said.

“There’s also a lot of other things outside of property that come up for people. There’s end of school year performances, holidays, time with family so often a lot of buyers will take a break.

“That’s when there’s often a great opportunity to get a bargain because the agents won’t have too many others buyers in front of them ready to move on one of their properties.”