‘Weird’ detail let sellers keep Victorian family’s $320k house deposit

A family with three young kids under the age of 12 thought they’d secured their $3.2m dream home - until one clause in the contract left them ruined.

A Victorian family who lost their entire $320,000 home deposit are now warning other aspiring property owners to look out for the legal “loophole” that left them penniless.

Sam Gayed, 42, and his wife Nardine, 37, thought they had found the perfect place for themselves and their three kids, who are all under the age of 12, back in 2019.

Based in Bendigo, the family were looking to move to Melbourne for their kids’ schooling and found their “dream home” in Balwyn.

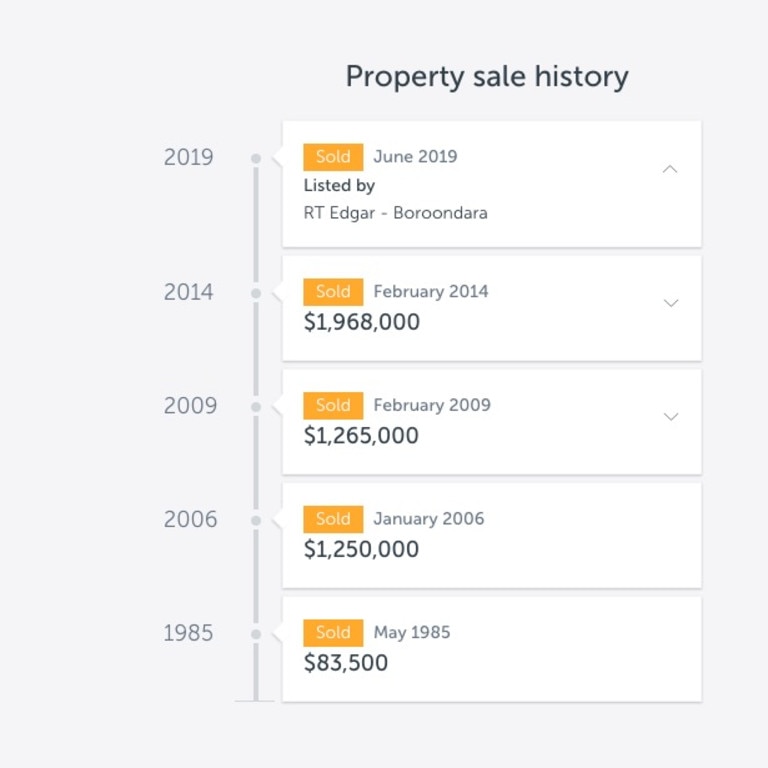

They scored the four-bedroom, four-bathroom 756-square-metre mansion for $3.2 million in June 2019 and were meant to settle on the property in December that year.

But now, exactly two years later, the Gayeds have no savings to their names, live in a “very tiny house”, and have had to lie to their children about their sudden change in fortune.

“It was a tough time, it was like minus in our bank account, we used all our credit cards, we were in overdraft,” he told news.com.au.

It all started when Mr Gayed noticed something “weird” in the contract.

Mr and Mrs Gayed are originally from Egypt and moved to Australia 10 years ago as citizens.

“That’s when we started to save money and try to buy our dream. Both of us were saving, we were planning to buy a house,” he recalled.

They eventually nabbed a home in Bendigo in regional Victoria.

Once Mr Gayed got his health business accredited and his wife finished her medical exams to become a qualified psychiatrist, they were able to refinance their home.

They used their life savings and equity from this house to get together the $320,000 down payment for the new purchase.

But when it came to signing the contract, the couple noticed the “subject to finance” clause had been removed.

It’s an important clause in a standard home contract which gives the buyer the legal right to dip out if their bank won’t approve the loan.

“It was a bit weird when they removed the subject to finance clause,” Mr Gayed recalled.

“We wanted the house of course, we had got emotionally attached to the house, we liked it.”

Mr Gayed also felt pressured into signing the contract with the revised conditions because the real estate agent told him there were other potential buyers waiting in the wings.

“I was worried they would sell the house [to someone else],” he said.

“The agents have great sales techniques, they sell 10 houses a month, I buy one house every 10 years.”

So the couple signed the contract.

“Everything was in order, if they insisted on removing the clause, we thought we could manage, we were not planning to withdraw,” Mr Gayed continued.

“It would be far from our thinking that there could be a loophole [in the Australian legal system].”

Mr Gayed had put his household income into a loan calculator and assumed he would be eligible for the same type of loan he had used to purchase his first home, a 90 per cent doctor’s scheme loan, which allows medical professionals to borrow up to 90 per cent of the value of a home without having to pay lender’s mortgage insurance (LMI).

But after the contract was signed, he got some bad news - the bank had a $2 million threshold for its doctor’s scheme, which he had never heard of before.

Instead of being able to receive 90 per cent of the home loan from the bank, the Gayeds could only get 85 per cent.

“At this moment, we became very stressed and sought every avenue to arrange the additional five per cent,” he said.

Mr Gayed frantically tried to get together cash for the last five per cent of the property, which amounted to $160,000, as well as a further $160,000 due on stamp duty for settlement day.

He tried selling part of his stake in the company he owned and then tried to sell his family’s Bendigo home. However, both sales couldn’t be done in time.

“I asked the real estate agent to discuss with the vendor if we could pay the 90 per cent and pay back the five per cent, they declined,” he added.

But the vendor declined, the deal lapsed and the vendor then took Mr Gayed’s $320,000 deposit, as they were entitled to by law.

“We had great aspirations and dreams,” Mr Gayed said. “Now we’re moving in a different direction where we’re trying to save our livelihoods.

“We lost all our savings before lockdowns and the pandemic, during that pandemic of course the business slowed down significantly.

“We saved nothing still, during those lockdowns, we couldn’t save anything.

“If you want to punish me for wasting the vendor’s time, at least make it proportionate, don’t take all my savings,” he pointed out.

To date, the vendors haven’t resold after Mr Gayed’s deal fell through.

Annabelle Feng, the RT Edgar real estate agent who made the sale told news.com.au she received a commission for the aborted sale.

She said it was the vendor’s idea to remove the “subject to finance” clause.

“We can’t suggest, we just tell them [the purchaser] what the options are,” she told news.com.au.

“Normally we let every purchaser know what their rights and their obligations are. They are free to make their decisions.”

She also said the seller had decided to rent the house out instead which is why it never resold.

News.com.au reached out to the vendor through their solicitors for comment but received no reply.

The Gayed family are currently renting a small house in Melbourne. They have no idea if they will ever manage to own a home in Melbourne after the setback.

Have a similar story? Continue the conversation | alex.turner-cohen@news.com.au