Experts divided over ‘risky’ new mortgage that doesn’t pay anything off a home loan – just the interest

A major Australian financial institution has just unveiled a new mortgage product with a significant twist, but some experts say it’s a serious case of “borrower beware”.

A major financial institution has unveiled a “bold” new mortgage product with a significant difference – borrowers won’t actually pay anything off their home.

Instead, AMP’s new offering is a 10-year, interest-only loan, which it said provides customers with “more choice, long-term financial flexibility and greater control over their cashflow”.

The big quirk with the loan is that there’s no midterm assessment point, where a lender might ordinarily check to see the property’s value and the borrower’s financial standing.

And where interest-only loans are usually the domain of investors, AMP is marketing to owner-occupiers.

“First and foremost, I strongly disagree with the offering for homebuyers, especially first home buyers,” Andrew Mirams, managing director of brokerage Intuitive Finance, said.

“If they can’t afford a 30-year mortgage, then the servicing for this loan is over 20 years and would reduce, not boost, borrowing power for these applications.”

MORE: Home loan trap taking years to escape

Economist and former Treasury adviser Leith van Onselen, chief economist at MB Fund and MB Super and co-founder of MacroBusiness, isn’t a fan at all.

“This type of mortgage product will increase borrowing capacity, household debt and ultimately home prices,” Mr van Onselen said.

“It will pour more mortgage fuel on the housing bonfire and is ultimately retrograde.”

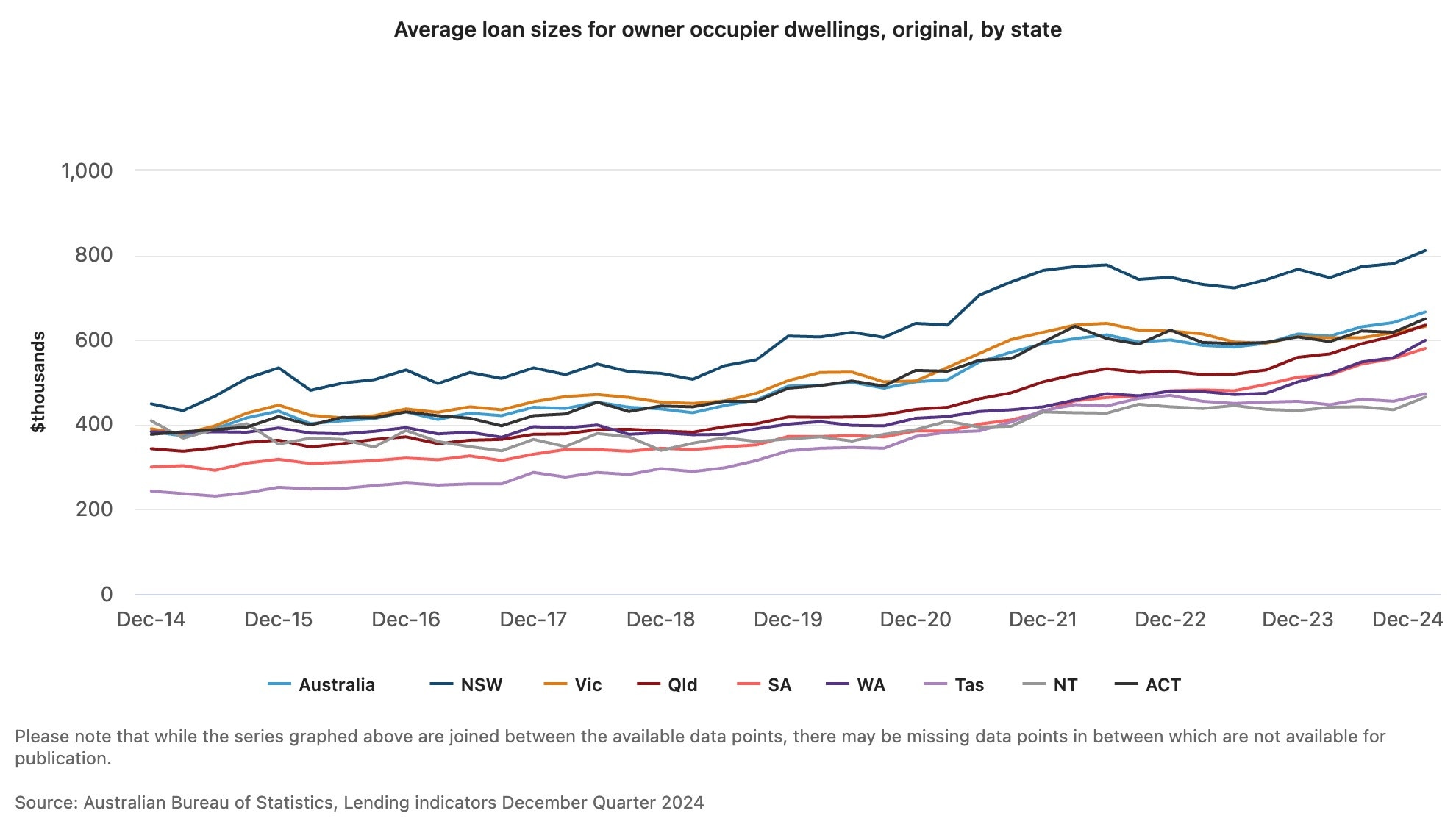

Australia already has one of the most expensive housing markets in the world in terms of prices relatively to household incomes and the broader economy, he said.

“Demand-side mortgage measures like these will merely drive more financial capital into housing, inflating home values further.”

Across the country, home prices are already on the rise once again after the Reserve Bank’s first interest rate cut in years dramatically boosted would-be buyers’ confidence.

MORE: Huge prediction for Aussie house prices

Social media users were more scathing, with AMP’s post on X announcing the product flooded with criticism.

“I am waiting for ‘no income, no job’ loans,” one wrote.

“Ahem, let me give you a hand and say the quiet part out loud,” another said. “If you’re paying an interest-only loan, you don’t build any equity through your regular loan payments, since you’re only covering the interest and not reducing the principal.”

In reference to the Global Financial Crisis, sparked by the collapse of subprime mortgages, one said: “How does this not end up like ’08?”

And echoing countless pointing out the same, another quipped: “Well done, gents. Why don’t you just buy the house for them and charge them rent?”

Most experts news.com.au spoke to welcomed innovation in the mortgage market, but many warned AMP’s product should be carefully considered.

Graham Cooke, head of consumer research at financial comparison website finder.com.au, said the product is a “bold” offering but warned it’s not for everyone.

“Because no principal is repaid for 10 years, customers should expect higher total interest charges and factor this into their long-term budget,” Mr Cooke said.

“If you have this type of loan, you never actually pay off any of the money you borrowed – you are betting on property prices continuing to rise in one of the highest price-to-income markets in the world.”

Michelle Cull, an associate professor of accounting and financial planning at Western Sydney University’s School of Business, said it would allow young borrowers just starting their property journey and cash poor older Australians to free up cashflow.

“On the plus side, the interest rate on offer is very competitive,” Dr Cull said.

“AMP also has strict loan-to-value ratio requirements in place for owner-occupiers in order to manage the risk of market fluctuation.”

But the product does come with some unavoidable risks, she cautioned.

“For example, if no principal is repaid during the 10-year, interest-only period, then there will be a significantly higher amount of interest paid over the life of the loan.

“Further, at the end of the 10-year interest only loan period, borrowers will have to reassess their situation, which may be drastically different and may require substantially higher repayments, which could cause financial stress.”

Youngers borrowers could be given a false sense of security by shelling out for repayments each month without actually paying down their mortgage, she added.

“They will still hold significant debt at the end of the interest-only period. While it may be helpful in managing cashflow in the short-term for these borrowers, it may place them in a worse position in the longer-term.”

A decade is a long time to not pay down a single cent of your home loan balance, Compare the Market’s economic director David Koch pointed out.

“And when you only tackle the interest, you’ll end up paying more in the long run,” Mr Koch said.

The product represents good business for AMP, given the average loan term in Australia has dropped significantly over the past few years.

According to the last Census, 66 per cent of Australians are homeowners and 45 per cent of those have a mortgage.

That’s millions of potential customers for banks to compete for via attractive home loan product offerings.

Research indicates the typical life of a loan is about three years, which means a huge number of homeowners refinance regularly, shifting banks to find a better deal.

Attracting those borrowers is only part of the deal, given interest-only products with a pre-committed term carry heavy penalties for early exits.

Richard Holden, a professor of economics at UNSW’s Business School, expects the product offering to be attractive to borrowers.

“AMP will need to be very careful about their underwriting standards given the risks involved, but that’s their core competency,” Professor Holden said.

“I would be concerned if other copies it and it became a significant share of lending, but I think that’s unlikely.”

An interest-only loan typically stretches for five years at a maximum, before reverting back to principal and interest, Property and real estate expert Adrian Lee, an associate professor at Deakin University, said.

“It may then be rolled over for another five years with a reassessment [by the bank],” Dr Lee said. “This AMP product seems to assess initially and grant it for 10 years instead of five years.”

It won’t suit all borrowers and its worth depends on one’s financial discipline as well as investment needs.

“For example, principal and interest is much easier financially as it forces disciplined savings, because some principal must be paid off each time. Interest only is up to the borrower how much principal is repaid or offset after interest is paid.”

Finance expert Andrew Grant, an associate professor at the University of Sydney Business School, welcomed the sign of “innovation in the mortgage market.

“And no doubt borrowers value certainty over their repayments, which this helps with,” Dr Grant said.

“Now, if it is the case that we’re on a downward rate cycle, then locking the rates for the longer term might be a little costly. If variable rates head downwards, people might regret fixing for a longer-term.

“But some borrowers will have learned that the shock of a rate hike can be quite painful, like the end of low fixed rates, then jumping three per cent or more. So, the timing of the offering seems interesting.”

In the past, interest-only loans have tended to be the domain of investors who can claim that component of their repayments as a tax deduction.

Sometimes, people experiencing periods of financial distress might opt to switch to interest-only for a period of time to boost their cashflow, Mr Koch pointed out.

“Usually those borrowers will try to get back onto a principal and interest loan as soon as they can afford to do so,” he said.

“Investors are likely to be the big winners here. They often like interest-only loans because it helps them maximise the tax-deductible interest while reducing repayments.

“It’s a popular strategy for investors who plan to sell after the interest-only period ends, assuming that the asset has grown in value.”

But even for investors, Mr Cooke warned the risks are important to keep in mind.

“Investors and rent-vestors gain extra cashflow to support further property acquisitions or reinvestment strategies, however they open themselves up to the risk of sinking quickly into negative equity if the property market crashes,” he said.

“This risk is exacerbated for investors with multiple properties, who were the first casualties in many EU countries during the GFC.”

AMP has also spruiked the benefits for retirees, with the company’s director of lending and everyday banking Michael Christofides saying many underspend in the early years post-work for fear of outliving their savings.

“For some retirees, the reality is that increasing equity in their property offers no felt benefit,” Mr Christofides said. “Instead, they could use additional cashflow to enhance their quality of life.

“Our new interest-only loan is a simple solution designed to provide this optionality and financial flexibility for retirees.”

Mr Koch said anyone in that position should seek advice from a financial adviser to decide if it’s a good strategy.

Regardless of the loan product, all borrowers have difference financial circumstances and should weigh up the pros and cons for themselves, Dr Cull said.

“Borrowers should consider all options available to them and seek independent financial advice to ensure they are making decisions that are in their best interests.”