Skyrocketing stamp duty costs push young Aussie homebuyers to breaking point

Young Australians wanting to enter the property market are being slugged the equivalent of six months wages to cover one “inefficient” upfront cost.

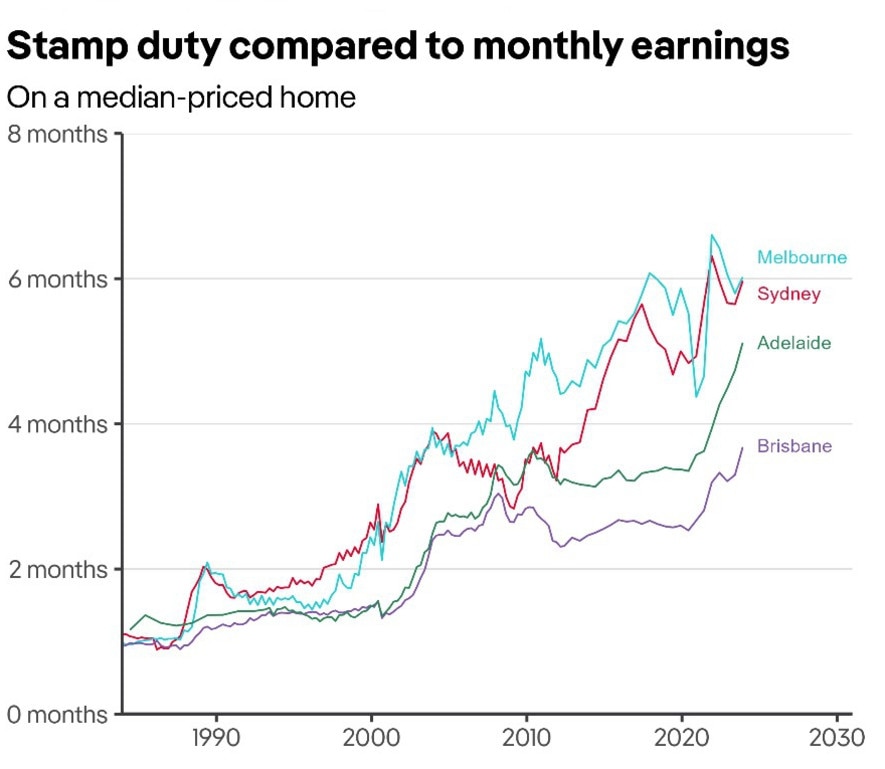

A troubling report has revealed a massive surge in stamp duty costs for homebuyers across Australia over the past generation.

The report paints a grim picture of the escalating financial burden placed on prospective homeowners, particularly in major cities like Sydney and Melbourne.

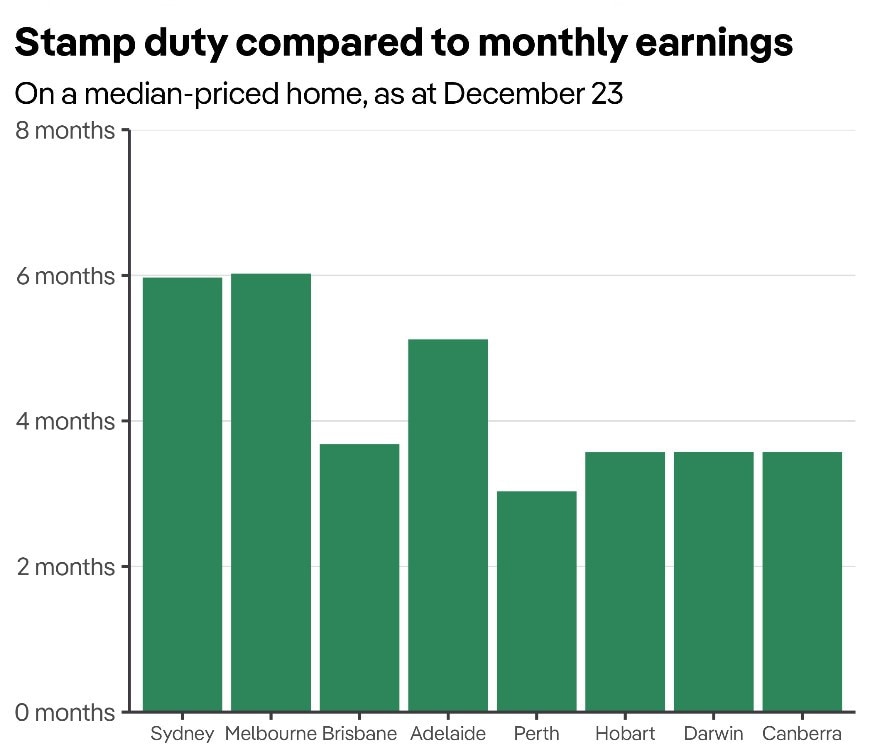

According to the findings in joint research study by the e61 Institute and PropTrack, stamp duty on a median-priced home in Sydney now stands at an eye-watering $44,500 – equivalent to a daunting six months of average full-time post-tax income.

This figure represents a 5.4-fold increase from the levels seen in the early-to-mid 1980s, leaving aspiring homeowners grappling with unprecedented financial hurdles.

Melbourne, too, is reeling under the weight of exorbitant stamp duty costs, with buyers needing to amass a whopping $42,500 – equivalent to six months of full-time income – just to cover this upfront expense.

Shockingly, this marks a considerable 6.1-fold surge from four decades ago, marking the sharpest increase among all cities analysed in the study.

Stamp duty, a tax that governments charge for transactions, is a high upfront cost for home buyers that must be saved on top of a deposit.

The report underscores the broader national trend, revealing that stamp duty burdens have also skyrocketed in other major urban centres like Brisbane, Adelaide, Perth, and Hobart.

In Brisbane, although buyers face a relatively lower burden, stamp duty still amounts to around $25,900 or 3.7 months of income for investors and $18,700 or 2.7 months of income for owner-occupiers – a stark contrast to the figures witnessed four decades ago.

The report emphasises how these exorbitant costs have significantly impeded Australians from pursuing the key life milestones of becoming homeowners.

“This burden has increased enormously compared to a generation ago. Home prices have grown faster than incomes, and stamp duty brackets have not kept up with growing prices,” the report stated.

The study also draws attention to the impact of stamp duty on Australians’ life choices, citing a McKinnon poll that reveals how housing costs – of which stamp duty plays a pivotal role – have led one-quarter of Australians under 40 to delay changing jobs, caused one-in-five in their 30s to postpone having children, and hindered people of all ages from relocating.

The report underscores the “inefficiency” of stamp duty as a tax, according to PropTrack Senior Economist Angus Moore.

“Stamp duty is an inefficient tax because it discourages people from moving to homes that suit them,” he said.

“While the rise has largely been incidental, rather than an intentional increase in tax rates, stamp duty reform is critically needed to allow the property market to operate more efficiently.”

Dr Nick Garvin, Research Manager at the e61 Institute, said the ramifications extended beyond prospective homeowners’ personal finances.

“Our research also highlights the indirect impacts of stamp duty on other parts of people’s lives, including whether or not they change jobs and when they decide to have children,” He said.

“Previous e61 research highlighted that preventing job switching can weaken productivity, which has flow-on effects on wage growth and inflation.

“Overhauling the current stamp duty system has the potential to alleviate these pressures on individuals and the economy more broadly.

Governments and policymakers must consider the unpopularity of stamp duty, and the indirect impacts stamp duty has on various other parts of the economy and people’s lives.”

The report analysed the growing burden of stamp duty for home buyers by comparing the cost of stamp duty for a median-priced home in capital cities with average full-time incomes.

It also investigated survey data on how housing costs affect people’s major life decisions.