Shock sum parents are willing to give their kids to purchase first house

An Australian study has revealed the eye-watering financial assistance many parents are prepared to give their children later in life.

More and more young Aussies are relying on the ‘bank of mum and dad’ to purchase their first home as the property market becomes increasingly out of reach for first time buyers.

But how much parents are handing out to their kids may surprise you — as an Australian study has revealed what many parents are prepared to give their children later in life.

Finder’s Parenting Report 2023, which surveyed just over 1000 parents with children 12 years and under, indicated many parents are planning to gift an eye-watering $33,278 on average to put towards a first home deposit.

That figure is about a third of the average first-home buyer deposit ($96,274) based on the average first-home buyer loan of $481,368 in March.

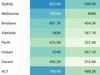

Parents in Victoria were by far the most generous, offering an average of $52,716, followed closely by parents in South Australia ($44,656) and New South Wales ($40,191).

However, not everyone parent was ready to splash out.

More than one in two (51 per cent) say they would give $1,000 or less.

Finder money expert Sarah Megginson said without the help of their parents, plenty of young Australians will be priced out of the market.

“Recent property price hikes combined with interest rate rises have made it extremely tough for young buyers to save a sufficient deposit let alone qualify for a home loan,” she said.

“Buying a home also comes with new responsibilities such as managing hefty council rates and strata fees, paying for ongoing repairs and managing your money.

“If parents are in a position to step in to stump up a deposit, it’s important for that gift to come with the support of financial literacy too.”

Ms Megginson urged older Aussies to think carefully before gifting the money.

“The risk is that the parents who contribute to their children’s property purchase could do so to their own detriment, hurting their retirement fund and potentially running out of money later in life,” she said.

“It’s important to consider whether you are financially secure before helping family members and look for ways to work towards a mutually beneficial outcome.”

Interest rate conundrum

Most young people have little confidence they will ever be able to buy their own home.

According to a Resolve Strategic poll taken in February this year 72 per cent of respondents between the age of 18 and 34 say they will never be able to buy a house.

This is despite prices falling by around 12 per cent in Sydney and eight per cent in Melbourne last year, according to data firm CoreLogic.

And while interest rates predicted to fall later this year, experts warn falling interest rates won’t necessarily help young people trying to attain the great Australian dream.

Falling interest rates may seem appealing to first homebuyers, but in real terms, it only increases competition and pushes prices higher, sometimes out of reach for those trying to get into the market for the first time,” said Professor Rachel Ong ViforJ from Curtin University’s School of Accounting, Economics and Finance.

From 1994 to 2017, almost a third of the increase in house prices has been driven by falling interest rates.

Foreign buyers snapping up Aussie homes

An additional headache for young people is that they are increasingly having to compete with foreign investors in the property market.

The nation’s housing market has experienced a 2.7 per cent jump in the number of new properties being purchased by international buyers in the first quarter of this year.

Consequently, the market share for this category now sits at 7.9 per cent despite a two-year low of 4 per cent in Victoria, the first NAB residential Property Survey for 2023 highlights. Of this number, real estate experts believe about half are Chinese buyers, with a small portion from the southeast Asian countries of Malaysia, Indonesia and Vietnam.

with Sarah Sharples and Rebecca Borg

carla.mascarenhas@news.com.au