‘Reset’: Major bank flags big change ahead for homebuyers

One of Australia’s biggest banks has made a wild call signalling major change ahead for homebuyers.

One of Australia’s biggest banks has made a wild call signalling major change ahead for homebuyers.

The National Australia Bank residential property survey for the third quarter this year, released Wednesday, has flagged a “reset” in prices across the country.

NAB executive Claire Righetti said the numbers across the market were playing towards some relief ahead for buyers.

‘Extraordinary’: Inside rare home on urban island in the streets

Sydney Roosters chairman’s takeover bid for Queensland pubs

“The latest NAB data suggests a gentle reset in property prices – we’re expecting steady, but flatter growth over the coming year,” she said.

“Demand for homes in Australia is still going strong, although slower price growth gives those looking to buy their first home an opportunity to get into the market without the pressure of fast-rising prices.”

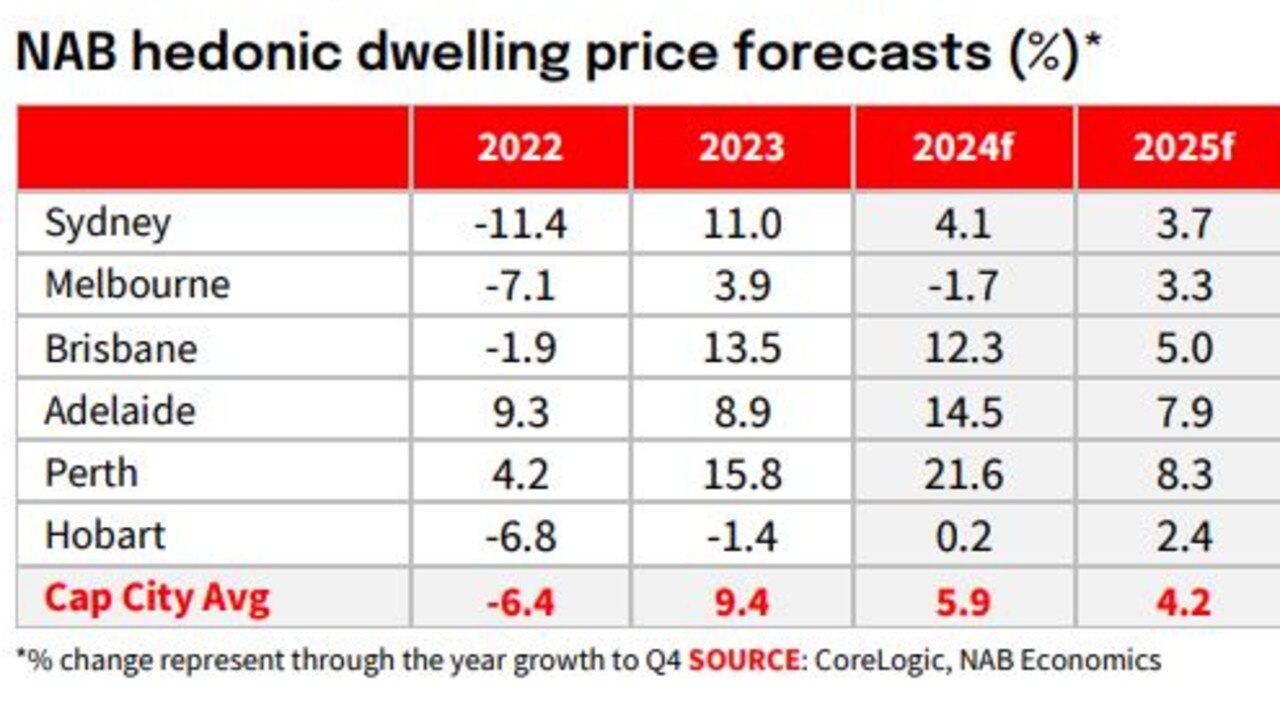

The NAB Economics hedonic dwelling price forecasts put Sydney at a 4.1 per cent rise for 2024 after an 11pc shift last year, with growth set to slow to 3.7pc in 2025.

Melbourne was expected to post a fall of -1.7pc to this year, followed by a rise of 3.3pc in 2025, with Brisbane predicted to post 12.5pc for 2024 and slow to 5pc in 2025.

The forecast for Adelaide was a 14.5pc rise in 2024 slowing to 7.9pc in 2025 with the highest growth out of Perth this year at 21.6pc and then 8.3pc next year.

Hobart was expected to just scrap by in positive territory this year at 0.2pc followed by a 2.4pc rise in 2025, with the capital city average forecast at 5.9pc in 2024 and 4.2pc in 2025.

‘Spoiled for choice’: New listings surge to stunning decade-high

Just evil’: Share house’s shock offer to renter

The bank said capital city house price and rent growth continued to slow in annual terms, with the NAB Residential Property Index falling for the second straight quarter to 34 index points from 46 in Q2 – and lower than the same time last year (40).

Confidence among property professionals for house price growth has been scaled back to 1.8 per cent for the next 12 months and 2.7 per cent in two years’ time.

“Expectations for the next 12 months were scaled back across most of the country except WA (5.8pc) where they are highest overall, and in TAS (1.6pc).”

“Property professionals on average expect house prices to grow across most of the country in the next 12 months except VIC (-0.5pc) and the NT (-0.4pc).”

But NAB group chief economist Alan Oster did not see any big crash ahead in the near term.

“Despite the rise in completions in Q2 and a stabilisation in new approvals it is unlikely we will see a significant rebalancing in the property market in the near term,” he said.

“More broadly, we continue to see a relatively soft landing for the economy. While growth has slowed, driven by softness in the private sector, we expect H2 2024 to be the low point, with growth returning to around trend over 2025.”

“The labour market has been resilient and while we expect the unemployment rate to rise gradually to around 4.5pc, it is expected to remain below pre-Covid levels. For the RBA, both the pace of the ongoing moderation in inflation and resilience in the labour market remain important.”

This as NAB found “the market share of FHBs in new housing markets fell to a well below average 29.9pc in Q3, with both FHB owner occupiers (21pc) and investors (8.9pc) less prominent in this market.”

“Sales to owner occupiers (net of FHBs) climbed to a 13-year high 44.3 per cent, with sales to owner occupiers higher than FHBs in all main states,” the report found.

“The market share of local investors edged down to a below average 17pc, with the share of sales to foreign buyers also dipping to a near 2-year low 6.8pc.”

Ms Righetti said “even with a slight dip in the market share for first home buyers, we’re still seeing strong demand with just over one in three buyers in established home markets being a first homebuyer”.

“It’s a good reminder that the right timing and options are out there for those looking to get on the property ladder.”

The biggest barrier to more housing projects kicking off in Q3 according to property professionals was construction costs – which were “most problematic in QLD (90pc), NSW (87pc) and VIC (83pc)” – with planning permit delays and labour availability the biggest hurdles.

NAB has “slightly revised down” its forecasts for property prices over 2024, given “slightly softer than expected” monthly figures coming through.

“We expect broadly similar growth over 2025 to what we forecast in the Q2 Residential Property Survey – namely, a softer but still positive rate of growth, following the strong growth in prices over recent years.”

But it said with the population expected to remain elevated in coming years, underlying demand for property would remain strong.

Originally published as ‘Reset’: Major bank flags big change ahead for homebuyers