Queensland couple ‘shocked’ by loss of dream home

A couple from Queensland said they waited for their brand new home for months. Then they were left “shocked” when the contract was ended.

A Queensland mum was left “crying every day” after the developer building her family’s dream home invoked a termination clause in the contract just a year after signing it.

Peggy and David Sitbon had signed a contract in February last year to buy a four-bedroom townhouse at an off-the-plan development in the Queensland suburb of Seven Hills.

They claim they were told the house would be ready for the family-of-four by August, but the Sitbons said they waited months for the land to be put in their name and it never happened.

Now the couple don’t know how they will buy a new place after being priced out of the area when the developer, Property Developments No. 1, activated the sunset clause to legally terminate the contract in February 2022.

Mrs Sitbon said they had originally agreed to purchase the townhouse for $700,000 but said the townhouses are now being sold for hundreds of thousands more.

The couple, who are originally from France and became Australian citizens last year, said they had requested the sunset date be reduced from two years to one because they believed the place would be finished by August and didn’t think it would be a problem.

“It was the worst decision we made – it was a very bitter test. It was a wake up call for us that it’s not because you are in a beautiful place with beautiful people that you should trust everyone,” Mr Sitbon told news.com.au.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

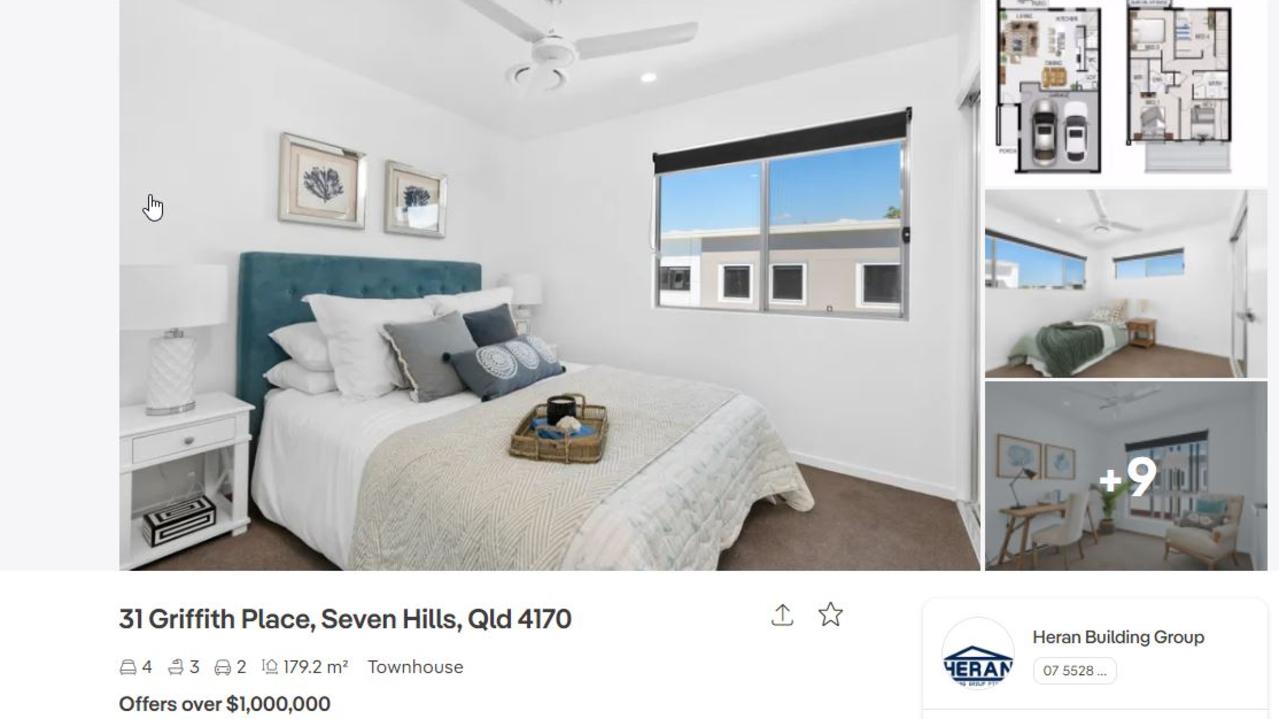

While their $34,000 deposit has been refunded, one townhouse from the development is now being advertised on realestate.com.au for offers over $1 million, although it has a balcony which the Sitbon’s did not opt for in their plan.

But the couple said they can no longer afford places in the area at all.

“Now with the market the way it is, even with the budget we had one year ago, we can’t find something else and now we don’t know what we are going to do,” Mrs Sitbon said.

The mum, who has two children aged 14 and 11, has been left frustrated and incredibly upset by the process.

“They kept us on the hook every month they said it would be ready the next month and then the next month, we had to extend our finance and everything they asked we did – we couldn’t control anything,” the 49-year-old said.

At the couple’s requests, lawyers for Property Developments No. 1’s provided reasons for the delay in completing the building after the sunset clause was activated.

They pointed to the effect of the Covid-19 pandemic on the property market resulting in a lack of trade contractors and materials, bad weather and council delays for the hold up.

But Mr Sitbon, 48, claimed the delays also meant they missed out on the $15,000 government HomeBuilder’s grant.

He added they had requested that the sunset clause be extended by two months from February this year and were “shocked” when it was denied.

He understood that the building had been completed by 15 February before the sunset clause was due to take affect or likely to be done four weeks later.

Mrs Sitbon, a French tutor, said they had dreamt about the future in the home.

“We had pictured our future in this house,” she said.

“Every time we were talking about the townhouse I was crying, I didn’t sleep and was waking up at night.”

Isabella Tester from David K Lawyers, who are acting for Property Developments No. 1, said the possibility that property registration may not occur by the sunset date is an inherent risk associated with off-the-plan contracts.

“In this instance, the buyers specifically requested a reduced sunset date when the contract was negotiated. The sunset clause also allowed the buyers to terminate the contract if registration did not occur by the sunset date. At the time of contract signing, our client was willing to bear this risk,” Ms Tester said.

“It was the buyers’ prerogative to assume the risk associated with bringing the sunset date forward. Likewise, our client was well within their rights to refuse an amendment to the contract after the fact.”

She added that settlement cannot occur without registration of titles, meaning the transfer of the property into the buyers’ name prior to registration was never legally a possibility.

“Our client has at all times acted in accordance with their rights under the terms of the contract,” she noted.

The family are not the only one that has been caught out by the sunset clause issue with another Queensland family left angry and distressed after the developer ended the contract for their dream home just nine months after signing it.

Sunset clauses are legal in Queensland and have been used on other developments in Brisbane and the Gold Coast.

Other states around Australia have moved to put more protections in place for buyers who are purchasing off the plan.

In New South Wales and Victoria, special laws were established requiring sellers to get consent from the purchaser or the Supreme Court before using the sunset clause to terminate an off the plan contract.

Mr Sitbon said the couple are now “lost” about what to do and may have to buy a two-bedroom place as an investment and continue to rent in the area as the kids are established in school.

They have already had to move and struggled to find a place, caught up in Queensland’s rental crisis where they were competing with more than 20 people at inspections, and where offers of $20 extra a week on the rent were being made to secure a property.

But the business development manager wants to warn others in Queensland in the hope they won’t be caught out like they were.

“We were caught in a very sophisticated trap. I can see NSW and Victoria put special specific laws in to make sure it doesn’t happen anymore to buyers and if developers have problems being on time or there are delays, they have to go to court,” he said.

“We know our case is over and everything we are doing now is not for us as we know it’s over. It’s just for future people buying – we think it’s very unfair for buyers but at the end of the day we have no more control, everything is done.”

Real Estate Institute of Queensland (REIQ) chief executive Antonia Mercorella previously said the organisation was aware of some allegations that vendors are exercising sunset clauses by terminating off the plan contracts to obtain higher prices for lots they are selling in a development.

“If evidence were to emerge that this is indeed the case, this may warrant the introduction of stronger buyer protections,” she said.

She added there is currently no REIQ standard contract for off-the-plan sales, and these contracts are usually drafted by the vendor’s solicitors.

The CEO strongly recommends that buyers get independent legal advice.

Do you know more or have a similar story? Continue the conversation | sarah.sharples@news.com.au