Big Aus bank slashes rates as RBA decision looms

One of Australia’s big four banks just declared war on its competitors by slashing interest rates two weeks before the RBA even meets. It means 19 banks have now made the move since the last RBA meeting.

One of Australia’s big four banks just declared war on its competitors by slashing interest rates two weeks before the RBA even meets.

This bring to 19 the number of lenders that have cut mortgage interest rates since the Reserve Bank board’s last meeting, with wide expectations of a cash rate cut of as much as 50 basis points looming for May 20 – which is set to spark even more falls.

RELATED: Shock: Big Aus bank’s major rate cut call

MORE: Shock: Brisbane prices to smash Sydney

Australia’s biggest political property moguls revealed

Australia’s largest home loan lender, the Commonwealth Bank on Wednesday dropped its digital variable interest rate down to 5.84 per cent – running neck and neck now with Westpac and ANZ with only NAB on the outer with its 6.19 per cent lowest level.

Canstar.com.au data insights director, Sally Tindall said “CBA has dialled up the heat in the mortgage turf wars by matching two of its biggest competitors with a rate of 5.84 per cent.”

“This move is fantastic for competition because when Australia’s biggest bank cuts its home loan rates it forces other lenders to sit up and take stock of their own.”

A CBA spokesperson said “we continually review our interest rates”, adding “as the nation’s largest lender, we are always looking to deliver value to our home loan customers”.

“Our Digi Home Loan allows tech-savvy homebuyers to self-serve online and take advantage of a fully digital application process, ensuring a seamless, efficient, and valuable lending experience.”

MORE: See the Aussies who put their pets first when buying a house

Un-beer-liveable: SEQ costlier than Melbourne for housing, food, grog

The revving up of competition means there are more falls to come, especially with Ms Tindall flagging the big four banks still lagged the hottest segment of the market.

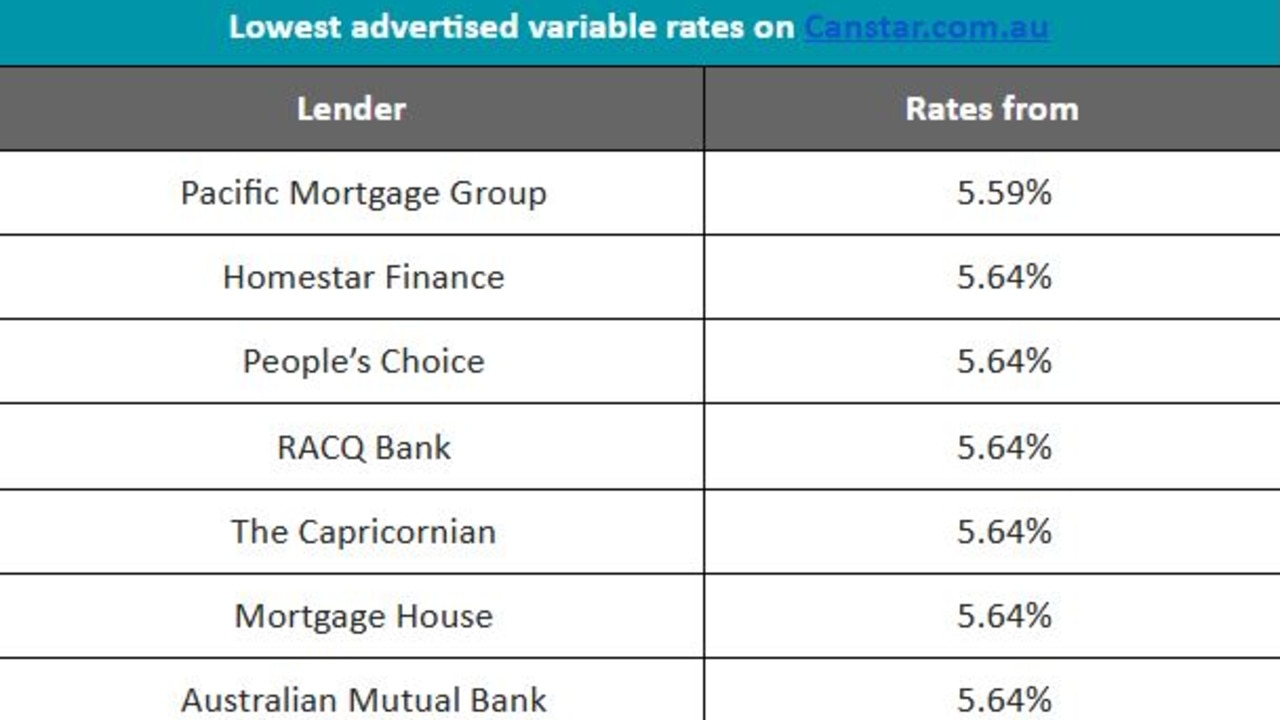

“While CBA, Westpac and ANZ now offer a variable rate of 5.84 per cent, borrowers can do better than this if they’re willing to venture beyond the big banks,” she said.

“As it stands, there are more than 35 lenders on the Canstar database offering at least one variable home loan rate under 5.75 per cent.”

She said “with the prospect of further cash rate cuts still firmly on the cards, potentially as soon as 20 May, variable rates could go well under 5.50 per cent in a matter of weeks.”

While the new lowest CBA rate was only for new customers with a 40 per cent deposit, it should not stop existing customers from using it as a bargaining chip to have their rate dropped as well.

“If you are an owner-occupier with a variable mortgage with CBA, and your rate doesn’t start with a ‘5’, it’s time to ask the bank why?”

“With no advertised variable rate under 6 per cent, NAB is trailing behind the big bank pack, although its subsidiary, uBank, does offer variable rates as low as 5.84 per cent.”

Originally published as Big Aus bank slashes rates as RBA decision looms