‘No magic trick’: Brutal reality of buying a house now

A leading Australian finance guru has offered some matter-of-fact advice for Aussies looking to buy a house.

A top finance guru has offered some matter-of-fact advice for Aussies looking to buy a house, sharing first home buyers may need to lower their expectations if they want to get their foot in the property market.

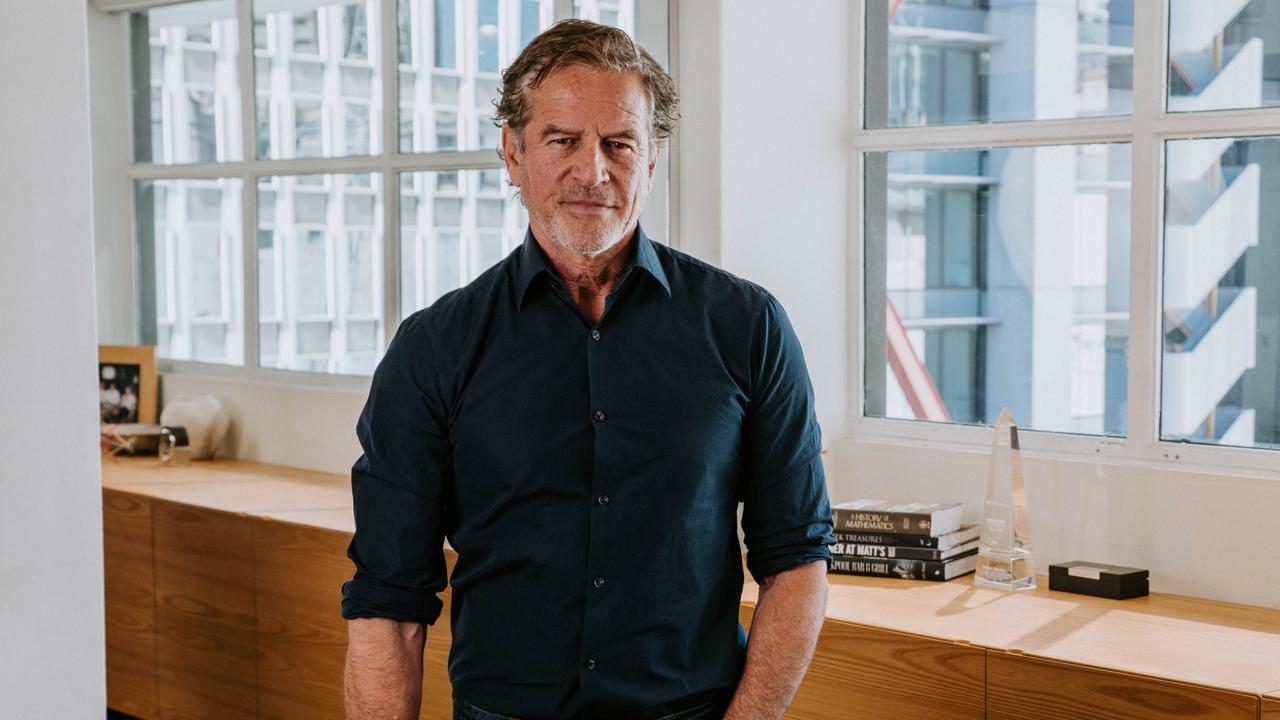

Mark Bouris, entrepreneur and executive chairman of Yellow Brick Road, said there is “no magic trick” to getting into property, and instead encouraged Aussies to temper expectations about where they plan to buy a property.

“[Younger Australians] in particular, think there is a magic trick. There’s no secret,” Mr Bouris told news.com.au.

“It’s pretty simple, increase the top line – the revenue – and reduce the bottom line – the cost. That’s the only thing you can do. There is no magic trick. And maybe one thing you could do is change your expectations.”

The business man said while a lot of Aussies are “probably thinking I would like to buy in the area I grew up in Sydney”, prospective home buyers should be casting a wider net and looking to buy in areas such as Orange or Ballina in regional New South Wales.

“Instead of trying to sort of have a 10 per cent or 15 per cent deposit to live in wherever you grew up in Sydney or Melbourne or Brisbane, that might be sort of a big expectation. Maybe lower expectations and have less disappointments, and get in on the market wherever you can, as long as it’s an area that has amenities like a good hospital and is close to an airport.”

Mr Bouris recognised the rising cost of living is by far the biggest barrier to the Australian dream of owning a house.

“The two biggest cost of livings – interest rates and rents – are the biggest problems that currently exists in this economy, or in this nation today, because everyone’s either a renter or a borrower.”

He warned if interest rates continue to rise or hold, young people will continue to be kept out of the market.

“Every year that you get kept out of the marketplace, house prices get away from you, another 10 per cent and another 10 per cent, and that means you save a much bigger deposit, and you’re always chasing the tail”.

The RBA will on Tuesday announce whether it intends to raise the official cash rate, having held off doing so since raising it 4.35 per cent in November, 2023.

It comes as the United States Federal Reserve defied expectations by revealing this week that it would be slashing the cash rate to roughly 4.8 per cent.

To help support Aussies on their property journey, Mr Bouris and Yellow Brick Road launched the ‘Help a Mate’ giveaway, where they offered Aussies the chance to win a share in $40,000.

New customers who were referred by their friend for the competition were invited to attend an appointment and receive expert guidance to support them on their property journey.

“Our research has shown us that within four months of borrowing money, nine out of 10 borrowers do not know what their interest rate is. So when someone advertises another interest rate, it’s very difficult for borrowers to be able to sort of pitch their position, so they can’t work it out. If you go see a broker … a broker will quickly work that out, because brokers only get paid if they can successfully get you a better deal.”

“So the whole thing was for me to put 10 grand on the table to get my current borrowers to encourage their mates to go and see somebody about getting a better deal. And we gave four lots of $10,000 to winners around the country. It was great, we had a lot of really positive feedback from it.”

More Coverage

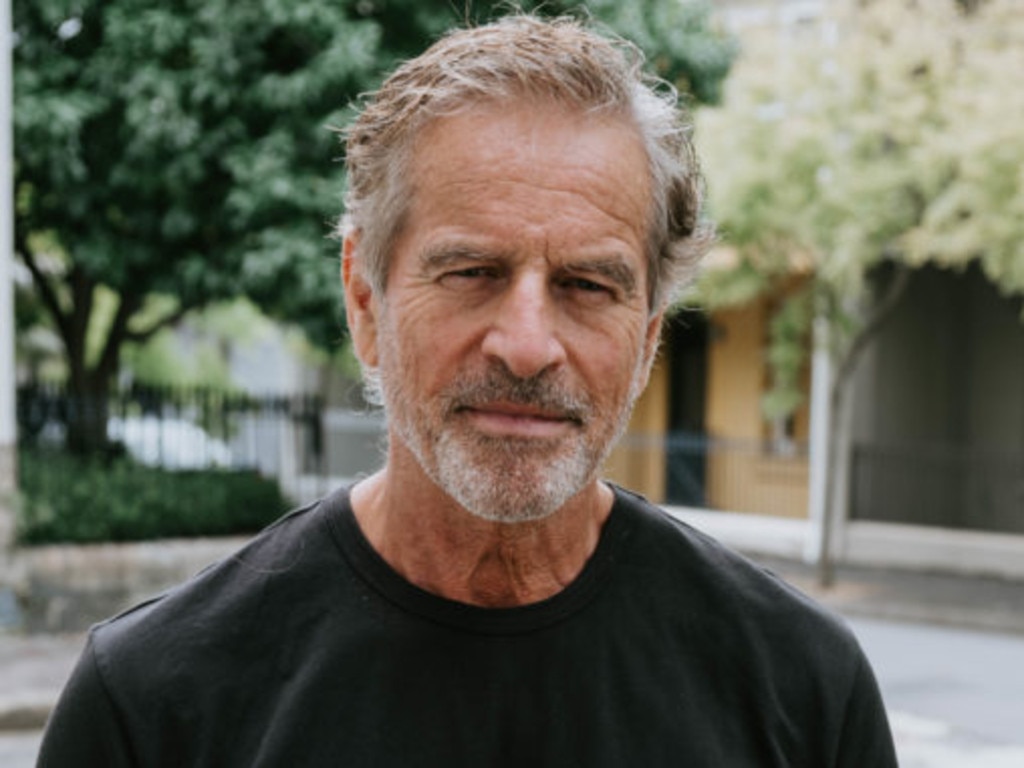

Melbourne tradie Riley Virgona was one of the lucky winners to walk away with $10,000 earlier this month, after he was referred by Yellow Brick Road customer and family friend.

The 22-year-old, who has spent seven years saving $80,000 for a property, said the money felt like a “weight off my shoulders”.

“I was a bit shocked, I’ve been saving for so long and trying to get into the market so I was just thrilled.”