How to buy a property as a single person

The Sydneysider had to make one huge sacrifice to save up her $100,000 deposit, but she was determined to go it alone.

Brigitte Rees sacrificed living with her parents until she was 27-year-old so she could buy a property on her own.

It meant she was able to save up $100,000 for a deposit over five years but she quickly discovered that wouldn’t stretch to buying in her dream area on Sydney’s Northern Beaches.

The properties she could afford she didn’t like and the ones that appealed were way above her budget.

She also had her heart set on a two-bedroom apartment so she could rent out the spare room, but she soon realised this would be too expensive.

Yet she was determined to buy a property as a single woman.

“It’s something I wanted to do on my own. I have friends buying with partners but I it’s something I wanted to achieve on my own,” she told news.com.au.

“I’m quite ambitious. I like working and I want to have a life for myself and not be dependant on someone else for that. I want to be self sufficient.”

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

The quality management professional realised she had been priced out of the Northern Beaches, as well as the lower North Shore but was stoked to stumble on an “affordable pocket” in Lane Cove.

She purchased a one-bedroom apartment off the plan for between $700,000 and $750,000, which includes a 20 sqm courtyard, with the building expected to be finished in October.

However, she said it was “daunting” and felt a “bit risky” to buy off the plan but said she had done her research and had a good lawyer look over the contract.

“Every now and then I do have a little bit of regret that I didn’t go for the beaches and I know I could have got something but it would have not been a nice property,” she said.

“But in Lane Cove I’m getting much better value for money in terms of the type and size of apartment and it’s going to be brand new so it’s a big attraction for me.”

Covid had also changed her priorities, she said.

“Being in lockdown I decided I did want quite a big balcony. I didn’t want a two metre pokey balcony,” she explained.

“I wanted somewhere I could sit outside and have a barbecue, so I ended up looking at one bedrooms with a garden and a bigger balcony.”

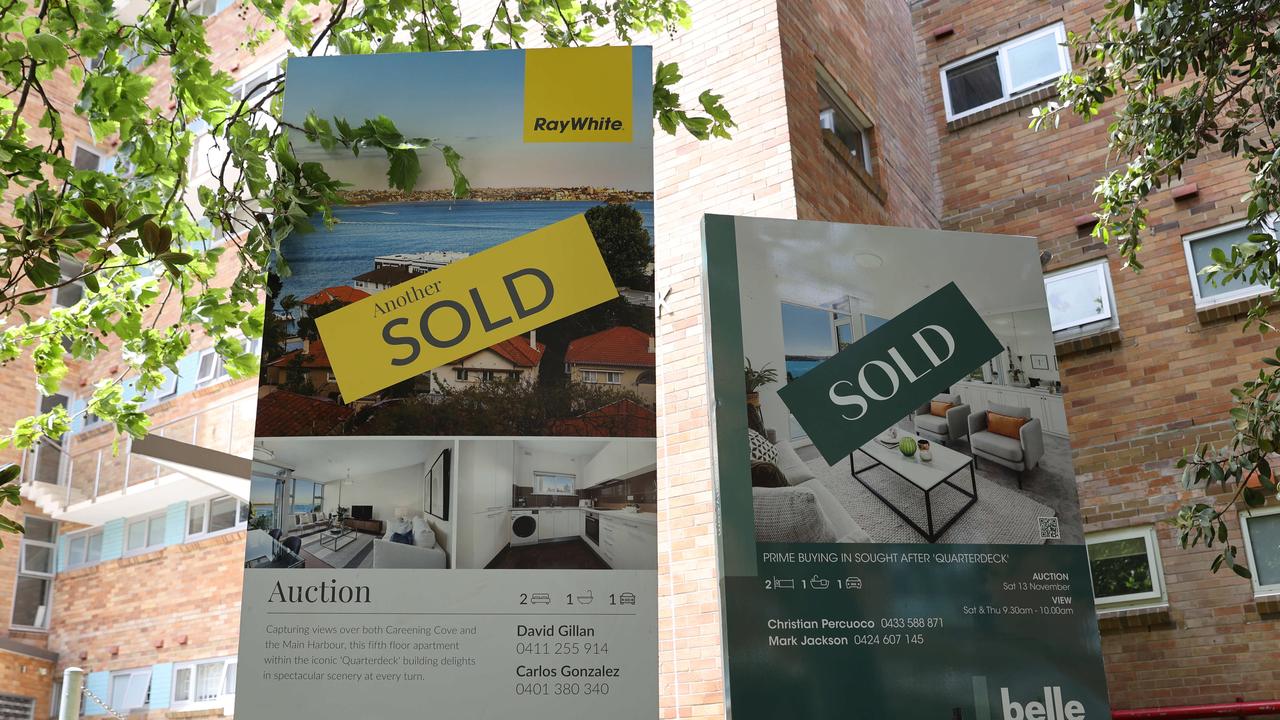

Ms Rees is one of many first home buyers having to weigh up their options, particularly amid fears of rising interest rates and worries they will be paying too much in a market that is slowing down.

For those looking to buy, Brad Cramb, CEO of distribution at Lendi Group which is the parent company of Aussie home loans, said it’s important to have a long-term strategy in place.

For those struggling to get into the market that may involve compromising on location or property features to get a foot on the ladder, he added.

“Owning a home is one of the biggest and most important purchases most people make in their lifetime and when Aussie entered the market some 30 years ago, the median dwelling value across the country was $114,034. Today it is more than $700,000 demonstrating the gains that can be made over a generation,” he said.

“With potential interest rate rises on the horizon and ongoing debate around where the housing market is headed, this can be a stressful time for aspiring homebuyers but what is clear from the analysis is that property is a long game.”

Trying to pick what the market will do in the short-term can be distracting for homebuyers he added, as the market has defied expectations so far since the beginning of the pandemic.

“The last thirty years have shown us that property prices will invariably go up over time, and so we encourage Australians not to get caught up in this short-term thinking,” he noted.

The Aussie Progress Report, commissioned by Aussie home loans and developed by CoreLogic, found Australian house values increased 414.6 per cent in the past 30 years to December 2021, compared to 293.1 per cent across units.