House prices to fall in Sydney, Commonwealth Bank predicts

House prices have risen sharply in the past 12 months, but it coud be “the beginning of the end” for Australia’s property boom.

The Commonwealth Bank is predicting overheated house prices will plunge in Sydney — and across Australia.

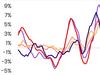

Median house prices in the Harbour City have spiked 23 per cent in the past year, but could drop nearly $200,000 by the end of 2023, analysis by the Commonwealth Bank shows.

The bank’s dwelling price projections predict the median house price across Australia will drop by eight per cent in 2023.

This includes a three per cent drop this year and a nine per cent fall next year in both Melbourne and Sydney.

That means Sydney’s median house price could plunge from $1,410,128 to $1,213,686 — a drop of $196,442.

In Melbourne, prices could also fall from $998,356 to $880,871.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Last week Sydney recorded its first fall in dwelling prices in 17 months.

RateCity.com.au research director Sally Tindall said prices in Australia’s two biggest cities were beginning to falter amid buyer fears of purchasing at the peak, higher fixed rates and stricter serviceability tests.

“This could be the beginning of the end for the current property price peak in Australia’s two biggest cities,” she said.

Ms Tindall acknowledged that falling property prices “can be stressful” for any buyers who have bought at the peak, but it would be an exciting opportunity for aspiring homeowners.

“Property price drops will provide a reprieve for people hoping to get into one of Australia’s many overheated property markets, however, would-be first home buyers should crunch the numbers before they pop the champagne,” she said.

“If property prices fall on the back of rising rates, buyers might not need to stump up as much for a deposit. They will, however, need to make higher monthly repayments, which means they won’t be able to borrow as much from the bank.

“First home buyers should think carefully about overextending themselves in a market where rates are set to rise and prices are forecast to fall. Make sure you have a buffer to ride out any bumps.”

CoreLogic’s home value index released last Tuesday found that Sydney property prices had dropped by 0.1 per cent.

While minor, it was a meaningful development in a city where house prices jumped by 23 per cent in the last 12 months.

CoreLogic has attributed the drop to the huge price gains that happened last year.

“Housing affordability has been eroded by the high rate of growth in dwelling values alongside low income growth,” the research group reported.

“Not only does worsening affordability restrict access to the housing market, especially first homebuyers, it also erodes housing sentiment.”

Last month, the Commonwealth of Australia drastically changed its property outlook over concerns that interest rates could rise as early as June this year.

CBA chief executive Matt Mr Comyn said his bank expected slower property growth of four to seven per cent this year. Most of the decline would begin in the later half of 2022.