CoreLogic report finds first sign of housing market taking a dive

This tiny number could signal the beginning of the end when it comes to the winning streak property owners have been enjoying over the last year.

For most people, 0.1 might not sound like a very big number, but it could signal a change for Sydney property owners.

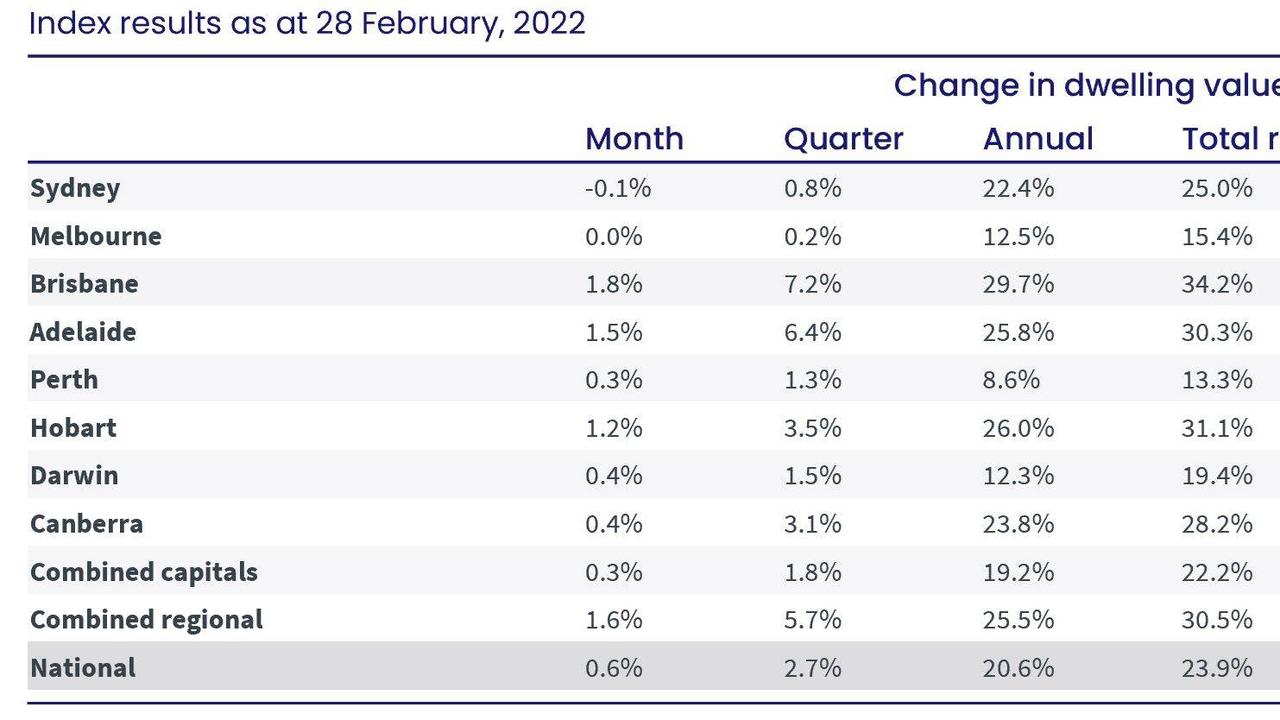

That’s because in the latest report released on Tuesday by property data firm CoreLogic, the NSW capital suffered a 0.1 per cent decline in housing values.

It’s the only time Sydney has endured any kind of loss in its housing sector since September 2020, 17 months ago.

Analysis found that nationally the property market is becoming sluggish and slowing down significantly in what could be an end to the windfalls enjoyed by property owners during the turbocharged year of 2021, when houses boomed 25 per cent in value.

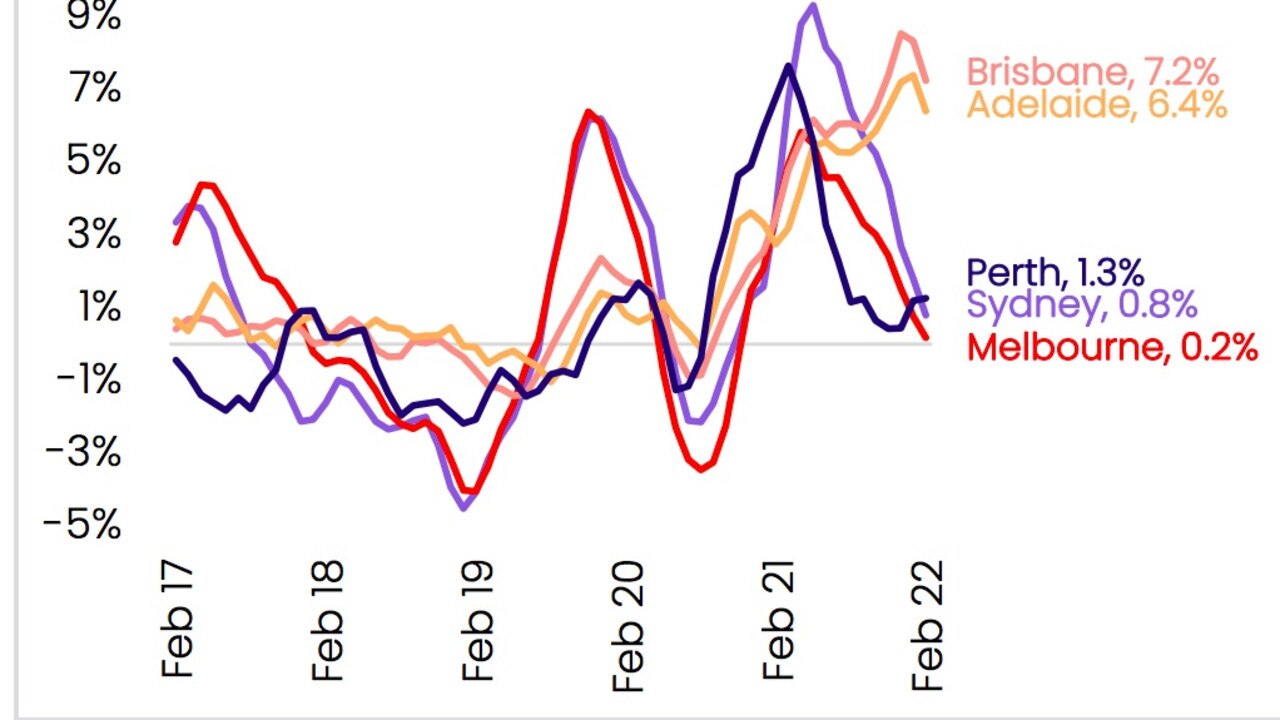

According to CoreLogic’s director of research, Tim Lawless, “Sydney and Melbourne have shown the sharpest slowdown.”

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

While Sydney was down 0.1 per cent, the Victorian capital city was sitting on 0.0 per cent growth. The month before Melbourne experienced a slight uplift, of 0.2 per cent. However, in December, it plunged 0.1 per cent, the same as Sydney this month.

Although not as extreme, other parts of the county are also beginning to see signs of a slowing real estate industry, the report found.

“The pace of growth in housing values started to ease in April last year, when fixed-term mortgage rates began to face upwards pressure, fiscal support was expiring and housing affordability was becoming more stretched,” Mr Lawless said.

“With rising global uncertainty and the potential for weaker consumer sentiment amidst tighter monetary policy settings, the downside risk for housing markets has become more pronounced in recent months.”

The dropping desire for home ownership hardly comes as a surprise at a time when interest rate hikes are looming over the heads of every mortgage holder in the nation.

Last month, the Commonwealth of Australia drastically changed its property outlook over concerns that interest rates could rise as early as June this year.

CBA chief executive Matt Mr Comyn said his bank expected slower property growth of 4 to 7 per cent this year. Most of the decline would begin in the later half of 2022.

By next year, in 2023, Commbank predicted a 10 per cent plunge across the nation.

Meanwhile, NAB had an even more dire outlook.

Australia’s property sector would grow by a snail’s pace in 2022, at just 2.7 per cent.

Sydney and Melbourne would only rise 1.9 and 1.2 per cent respectively for 2022.

Property prices will take a turn for the worse midway through this year and by 2023 house prices will plunge by a whopping 11 per cent, according to the bank.

Sydney and Melbourne would be hardest hit the following year, dropping by nearly 12 per cent each in 2023.

“We are seeing house prices ease in 2022 and already we have seen more supply come on to the market. NAB’s forecast is for house prices to remain flat at around three per cent in 2022 before a decline of around 10 per cent in 2023,” NAB executive Andy Kerr said after CoreLogic released its February findings.

“We expect Sydney and Melbourne to experience the largest declines, while Brisbane and Adelaide will likely see less significant drops in house prices.”

Not all cities suffering

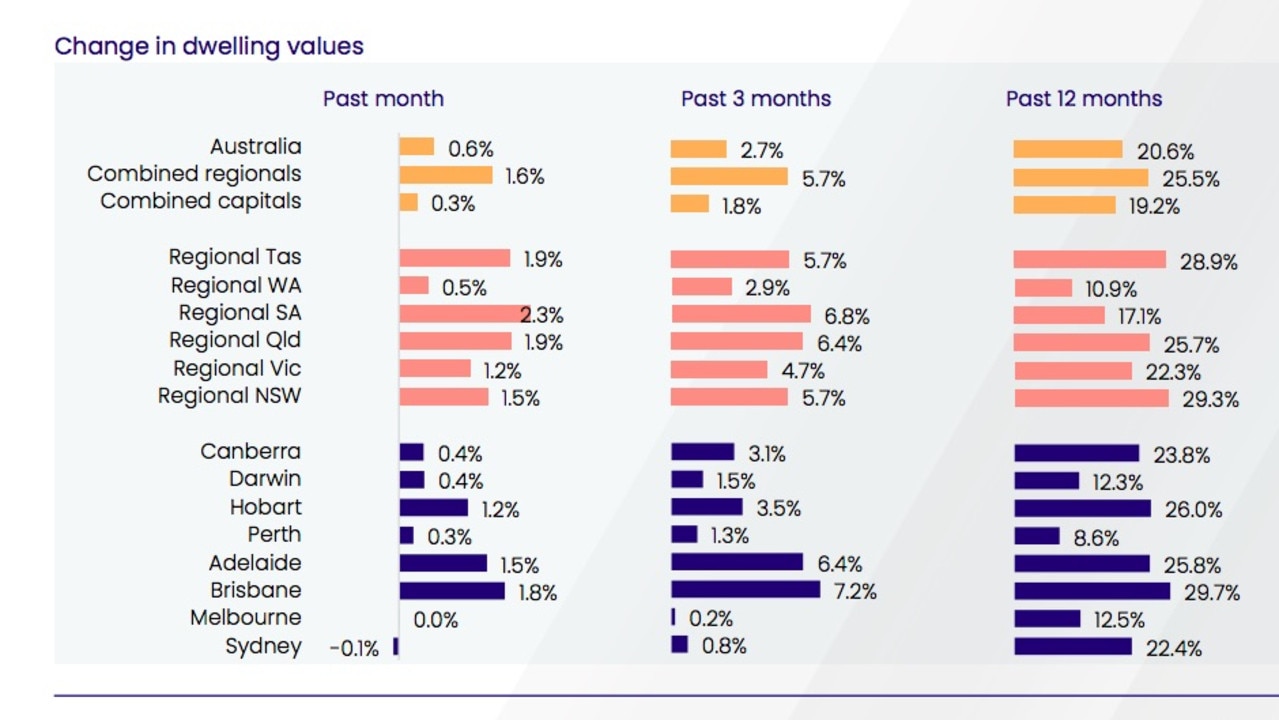

The CoreLogic report noted that Brisbane, Adelaide and Hobart were recording considerably “stronger” housing conditions than their state counterparts.

Brisbane’s housing values rose 7.2 per cent over the last quarter months to February, while South Australia’s capital was up 6.4 per cent over the same period.

Regional areas are still seeing a bit of an uptick in interest.

The report stated: “Regional Australia continues to record a substantially higher rate of growth than the capital cities.

“Over the past three months, housing values across the combined rest-of–state regions increased at more than three times the speed of housing values across the combined capital cities.”