Home buyers should be careful when it comes to using super

A proposed policy to put $50,000 in the pockets of homebuyers has proved wildly popular, but it could massively backfire.

ANALYSIS

With the release of the federal budget in recent weeks, the issue of housing is once again at the forefront in the nation’s halls of power.

The Albanese government’s housing policy rests on the promise to build 1.2 million new homes in the next five years and the $11 billion injection into social and affordable housing.

Meanwhile, the foundation of the Coalition’s housing policy is a change to superannuation, which would allow prospective first home buyers to withdraw 40 per cent of their super balance up to a maximum of $50,000 each in order to use these funds to purchase a home.

While this proposal has received a varied reception in the past, in some of the most recent polling a significant majority has thrown their support behind the proposal. According to pollster Essential, in April, 57 per cent of respondents supported the proposal to allow superannuation to be used to buy a home.

In a rather less scientific poll conducted on the 9 News Facebook page, 78.6 per cent of those who reacted supported the proposed changes.

In a lot of ways this is a rather understandable shift from the public. There is a great deal of desperation out there, as renters and prospective renters attempt to secure a roof over their heads amid what is arguably the worst rental crisis in generations.

What limited data we do have suggests that whatever relief and opportunity would be on offer for first home buyers who took the plunge and withdrew a large proportion of their super would be short lived, and relatively swiftly priced into the market, as other interventions such as first-homebuyer grants have been on multiple occasions for decades.

The other side of the coin

But there is a major difference between this proposal and the first-homebuyer grants of previous government’s going back over 60 years, the amount on offer for each recipient is different. For example, instead of receiving the $7000 the Hawke government provided with its version of first homebuyer grants in 1983 to all eligible applicants, in 2024, some couples may only qualify for $20,000 combined, where as more affluent couples may be able to easily afford the $100,000 withdrawal option.

In order to explore this in greater detail, we’ll be looking at two hypothetical couples, both of which are in the prime first homebuyer age bracket of ages 30 to 39.

• Couple 1: Matt and Amanda – Have a median amount of super for their age range, with a total balance of $104,000.

• Couple 2: Chris and Jessica – Have 150 per cent more than the median, with a total super balance of $261,000.

If Matt and Amanda choose to withdraw the maximum amount possible given their circumstances, they will be able to withdraw $41,600 to be used toward their first home. Meanwhile, if Chris and Jessica were to do the same, they are able to withdraw the maximum $100,000 per couple.

There are also other issues to consider. Contractors and small business owners may have significantly smaller super balances to call upon due to a lack of compulsory superannuation for many in the field. Parents, in particular primary carers who spent time out of the workforce, are also more likely to have significantly lower superannuation balances to call upon.

A lasting impact

While the Coalition’s policy is that the superannuation withdrawal should be repaid if and when the home is sold, the reality is that on average a home is held for roughly 20 years, with the median about a decade.

So it could be quite a long time before the money was paid back into the super account, provided there were no policy changes in the intervening time period.

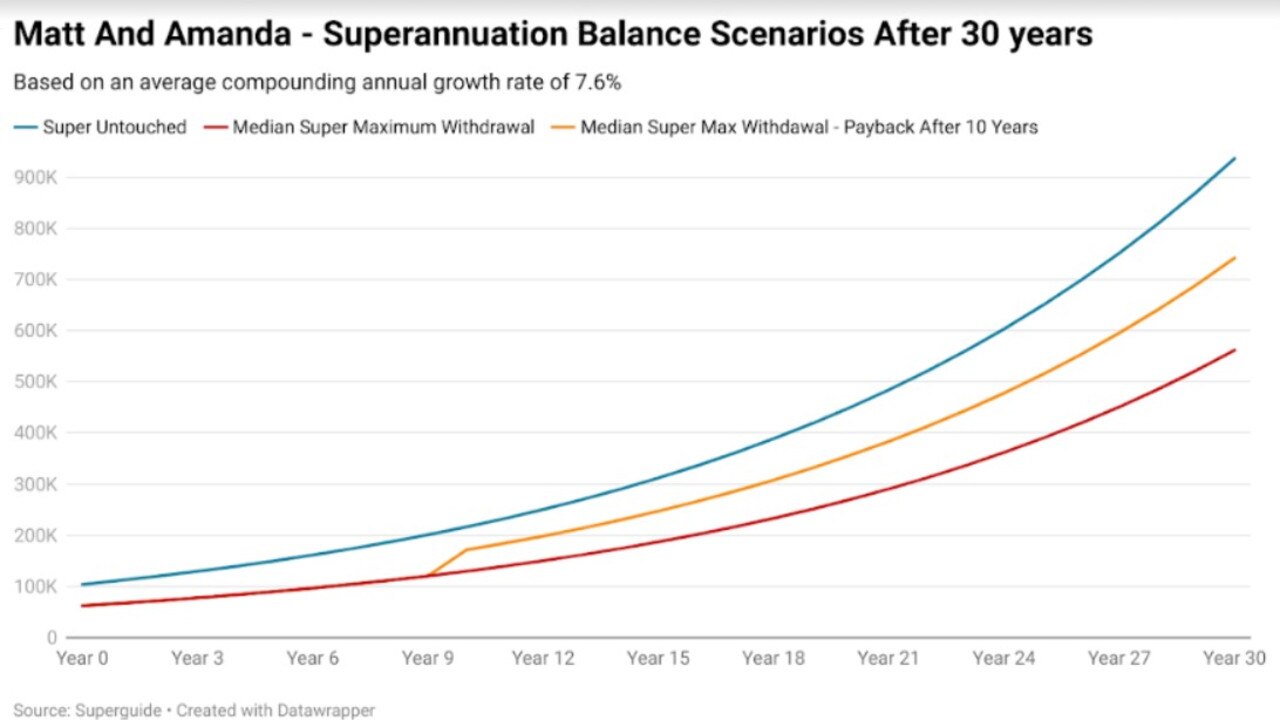

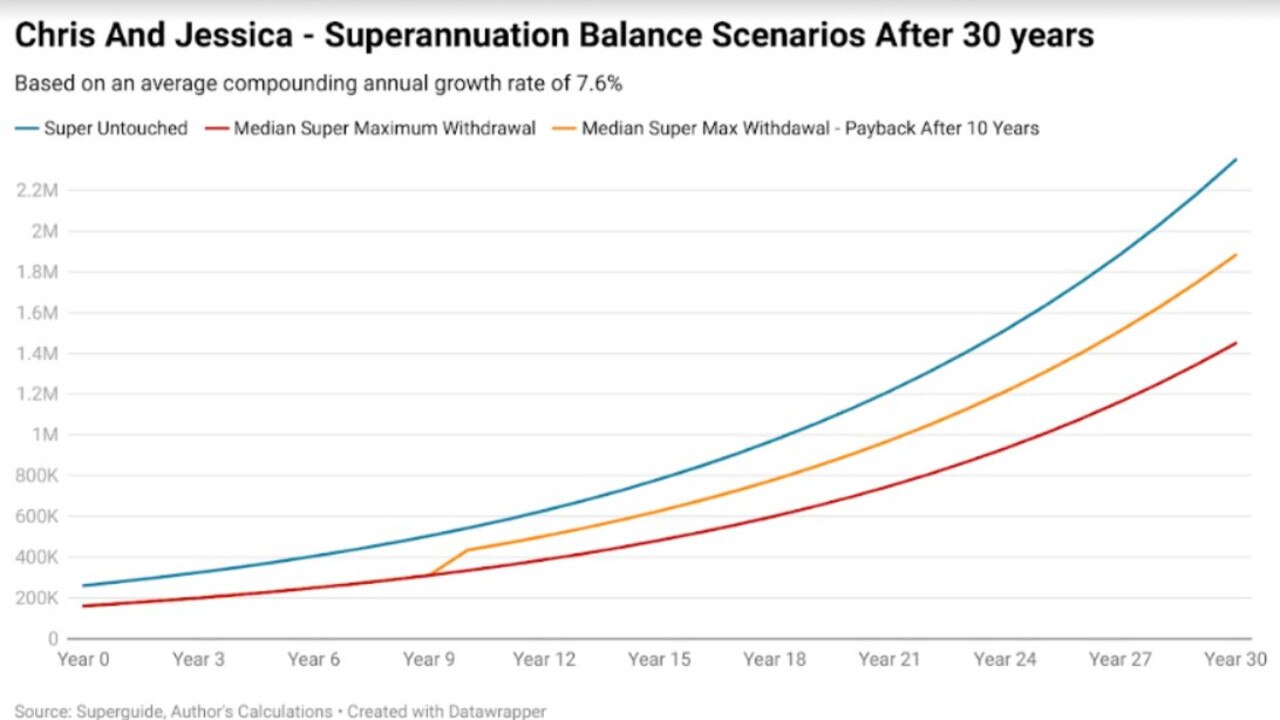

Given the multitude of possibilities we’ll look at three different scenarios for each of the previously mentioned couples which stretch over a 30-year time horizon. In all scenarios the super balance continues to grow at 7.6 per cent, which is the compound average growth rate over the last 31 years of available data after investment fees and tax.

1. The superannuation remains untouched and continues to grow.

2. The maximum amount is withdrawn by each couple based on their circumstances and not repaid, as they do not move homes.

3. The maximum amount is withdrawn and then after moving 10 years down the road, the initial capital is repaid into the couples super accounts.

For Matt and Amanda, our median super balance holding couple, withdrawing the super and not repaying it costs them $374,500 in retirement. If they were to repay the funds after a decade, it would cost them $194,500.

For Chris and Jessica, our more affluent couple, withdrawing the super and not repaying it costs them $900,300 in retirement. If they were to repay the funds after a decade, it would cost them $467,500.

Hope where there was none

While its understandable why so many Australians would want to crack open the superannuation piggy bank in an attempt to get into the housing market, the proposed scheme would be a deeply unequal one.

More Coverage

At one end of the spectrum are those who would have an extra $100,000 in their pocket and there are others, particularly in their 20s, who might end up bringing only a small fraction of that to the table.

Data on various first homebuyer grants and support mechanisms over decades also paints a rather clear picture of the likely consequence of this policy being enacted - being capitalised into higher housing prices.

Ultimately, this is may be a case where its best to be careful what one wishes for. Because if you’re in the market for a first-homebuyer friendly property, this policy may see your competition pull an even bigger trump card than yours or help support a bidding war that sees the property go for a significantly higher price than it would have beforehand.