Young Aussie on six-figure salary reveals intense money rules in order to save for a house

A young Aussie earning a comfortable six-figure salary has revealed her intense spending habits and strict $400 act she does every week.

A young Aussie earning a six-figure salary has revealed that she only spends $250-a-week on expenses in order to save for a house.

Natalie Hale, 23, lives in Queensland and is currently paying $125 to live with her boyfriend’s dad.

She’s taken a pretty hard-line approach to budgeting.

“I typically spend around $250 per week on expenses and I’m trying to limit my non-essential spending to under $150 per week,” she told news.com.au.

$150 might seem like a victory, but Ms Hale still thinks she could do better.

“This is definitely still a lot higher than it needs to be,” she said.

Ms Hale works as an independent disability support worker and, right now, she’s logging as many hours as she can to save up for a deposit.

“I’m working as much as I can while I’m young. In my free time, I complete paid surveys or make money off live streaming on TikTok,” she said.

Her salary often fluctuates because she works for herself, but she recently shared how much she had earned in a week.

The young worker took home $900 after tax from her support work, $77 from her online ventures and $200 from completing surveys.

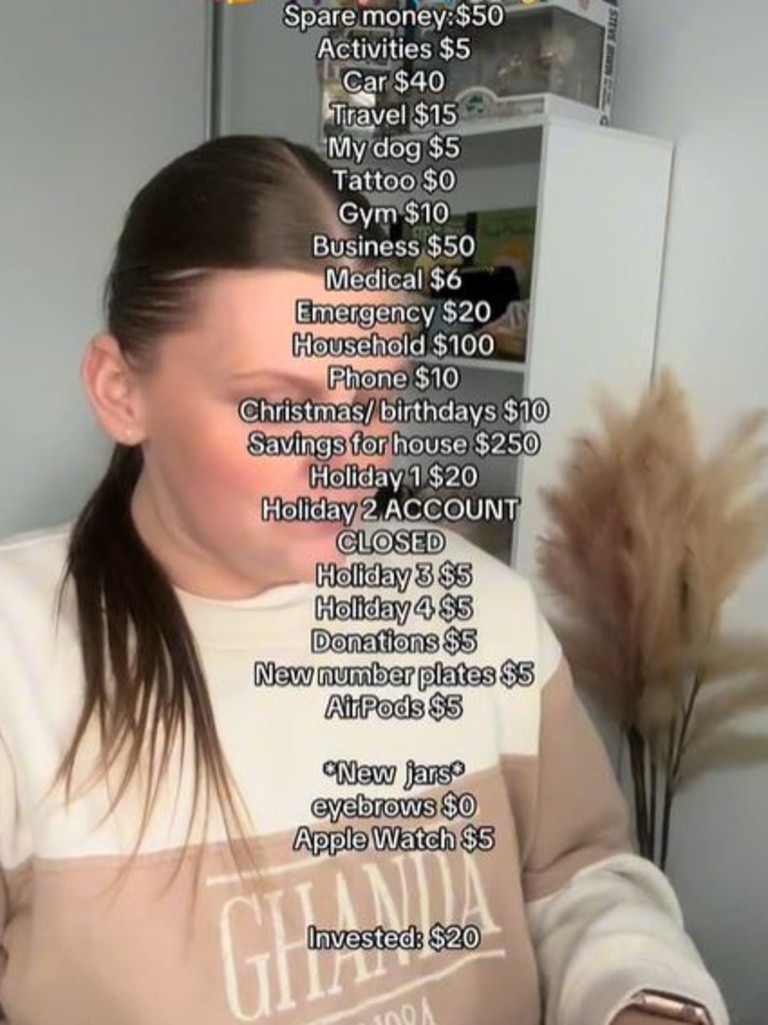

Ms Hale then comprehensively shared exactly where all her money goes. She likes to assign small amounts of money to various accounts that fund various things.

For instance, she transferred $5 into her activities account, $40 into her car account and $10 into her gym account.

She put $250 into her house savings account but only $6 into her medical account. This is all part of a complicated system she’s created to keep track of her spending.

Her income, though, can look radically different from week to week.

In March, she posted another breakdown of her spending, revealing she had earned $6000 after tax, but had used the bulk of the money to reduce her car loan by $3000.

While her income fluctuates, Ms Hale said her yearly salary for this financial year was is in the six-figure range.

Ms Hale said she is motivated by her desire to be “financially free” and, even though she’s only 23, she’s already planning for a “stress-free retirement when the time comes”.

She has to be vigilant though.

“I do not pay for subscriptions like Netflix, Disney, and Stan. I don’t go out on weekends drinking or partying, which are two major expenses for young people, and I try to shop when there’s a good sale,” she explained.

Currently, she’s focused on saving for a house deposit, a goal she thinks she can achieve by next July.

“Right now, my goal is to have a house deposit saved by July next year, but depending on the housing market, I am prepared to wait a while to be able to afford a home,” she said.

She has full faith she’ll get there though.

“By setting realistic savings goals and believing in myself, I will definitely achieve this goal, but it is scary to think about the housing market and sometimes there are doubts about this goal,” she explained.

More Coverage

While Ms Hale has a solid plan now, she hasn’t always been perfect with money and said a she had to go through a big learning curve.

“My biggest financial mistake was downloading buy now pay later apps. This allowed me to spend so much unnecessary money because I could pay it off in four easy payments,” she said.

“I didn’t have time to think about the overall cost or if I really needed it because it was so convenient.”