First home buyer error that may have changed history

THE Bureau of Statistics is having a very bad year. The bungled census was embarrassing - but this might just be worse.

THE Australian Bureau of Statistics is having a no good, very bad year.

The latest admission is that it has been publishing incorrect first home buyer statistics.

It comes after a huge controversy over the bungled census, and a furore over rubbery unemployment statistics. This latest disaster could be the most serious one yet.

On Monday, the bureau announced it was revising its first home buyer statistics. Not too many people seemed to notice. After all, this was the third time recently they’ve revised them.

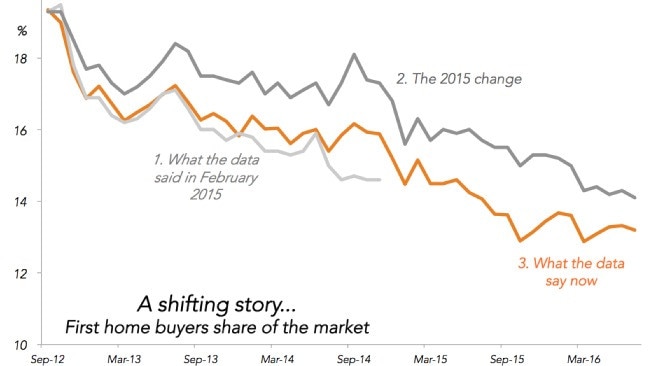

The first adjustments were in 2014 and 2015. The stats were showing the share of first home buyers falling to very low levels, so when the ABS announced that banks had not been giving them all the data, it made sense.

The ABS twice rejigged the series so the share of first home buyers rose. That was plausible enough and nobody objected.

Until this week. the bureau now admits the first adjustment was actually closer and the latest adjustment made the numbers too high.

This small and seemingly technical change could have been very important.

THE ELECTION MALCOLM TURNBULL ONLY JUST WON

In the six months leading up to the election, the ABS reported first home buyers had 14.4 per cent of the market on average. It now admits the true numbers were at 13.2 per cent.

Housing affordability was a big issue in the election. Labor’s flagship policies were to remove negative gearing and cut capital gains tax concessions. Both of these were controversial, but they would have probably caused house prices to be lower.

During the election campaign, it appeared first home buyers were getting more of the houses on the market than they really were.

The record low share of first home buyers, in the history of data collection, is 12.8 per cent back in 2004.

In March 2016, the numbers were 12.9 per cent — just 0.1 per cent off the record. But, we didn’t know that at the time.

Instead, the data was showing the share of first home buyers at 14.3 per cent in March. In that same month, Malcolm Turnbull set his party on course for a double dissolution election, which he eventually won by the narrowest of margins.

If the data on first home buyers had been more eye-catching, would Labor’s election platform have seemed more urgent, more important? Could the dodgy data have affected the election outcome?

We will never know.

I am by no means suggesting the ABS is trying to affect election outcomes. Collecting data is hard, especially when your agency has been stretched desperately by years of Budget cuts.

It is harder still when you rely on an intermediary to collect data for you, as the ABS do with the housing finance data. It is collected by the bank regulator, the Australian Prudential Regulation Authority, and passed on. Mistakes will always happen and the ABS deserves kudos for finding and correcting them.

ABS General Manager, Industry Statistics Division Jacky Hodges said lenders had been under-reporting the number of first home buyers to APRA. Lenders were reporting only loans extended to first home buyers who had also received a First Home Owner Grant instead of all first home buyers.

“In 2015, the ABS introduced modelling to adjust for this lender under-reporting,” she said.

“The ABS and APRA have been working with the lenders to improve their reporting of lending to first home buyers. As a result, improved reporting from financial institutions has now enabled the ABS to update the first home buyer series, replacing modelled figures with actual figures.

“This revision sees a fall in the number and proportion of first home buyers. Nationally, the proportion of first home buyers for July 2016 has been revised from 14.1% to 13.2% of total lending (including re-financing).”

But first home buyers locked out of the market might wonder if finding that mistake even a few months earlier would have saved them from many more years stuck in rental properties.

Statistics matter to people’s lives — governments of all political stripes should make sure they provide the resources necessary for the ABS to do its job properly.

This article originally omitted reference to a 2014 revision by the ABS of First Home Buyers share and has been edited to reflect that previous revision and the data from earlier.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy