Coronavirus Australia: Virus could see house prices fall 20 per cent

As coronavirus takes hold across Australia, house prices have started to plunge, with experts expecting a 20 per cent drop in the next few weeks.

Last Saturday, I went along to watch an auction for a very nice house in my suburb. I saw two men both bid over $2.3 million for that house and as they did so, I began to wonder if they had seen the news about coronavirus and the economy.

One man pulled out of the bidding at $2.34 million, and I would not be surprised if now, just a few days later, he thinks that was the best decision of his life. Now we know a lot more about how devastating the coronavirus is for the economy.

We are talking about millions of people out of work in a devastating recession of a kind we haven’t seen in many decades. We have seen the pictures of Centrelink lines stretching around the block.

Even with the enormous interest rate cuts from the Reserve Bank of Australia, plus quantitative easing, there is little chance house will prices remain at their current levels.

Last weekend, auction clearance rates began to fall, with more homes remaining unsold than the previous week. Experts see that as a sign prices will fall, with estimates of the size of the fall swirling around 20 per cent.

Prelim Domain auction clearances

— Shane Oliver (@ShaneOliverAMP) March 21, 2020

Syd 65% =final ~58%, yr ago 52%.

Melb 62% =final ~57%, yr ago 50%.

Sales momentum is slowing significantly.

Coronavirus driven social distancing & rising uncertainty around the econ outlook looks to be impacting.Expect price falls ahead #ausecon

THE HOUSING MARKET

Two main trends will hit the housing market.

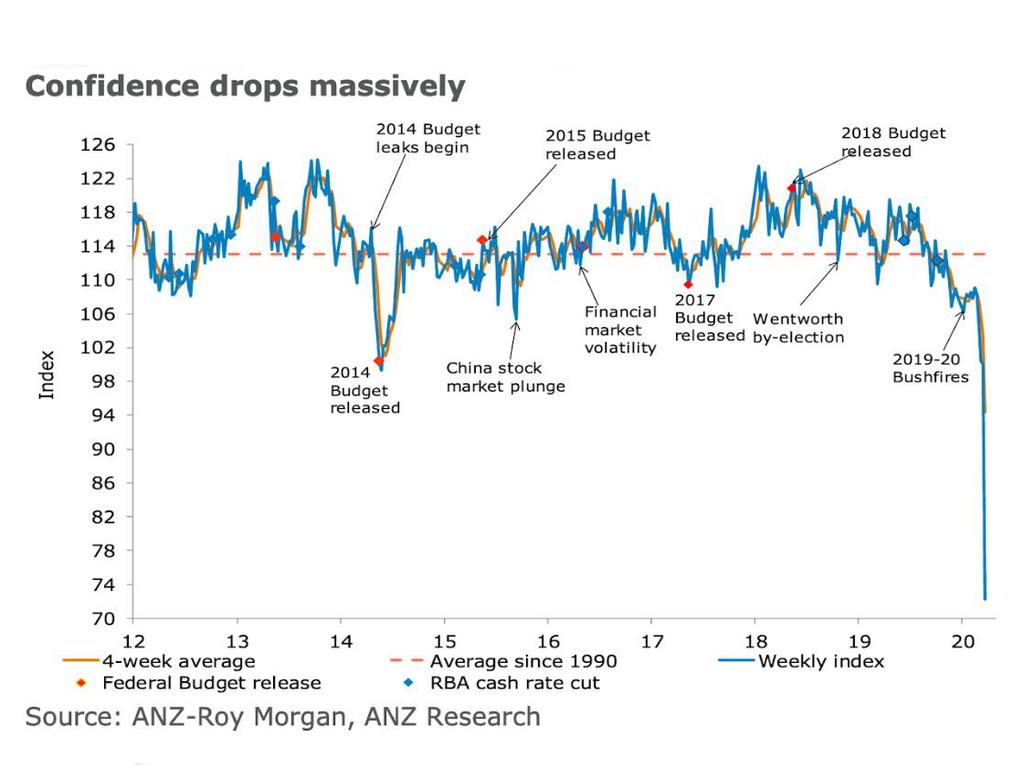

One: uncertainty will kill demand. Anyone taking out a mortgage wants to be certain they can repay it. But certainty has never been in such short supply, as the next graph shows.

RELATED: Follow the latest coronavirus updates

RELATED: Extraordinary virus restrictions imposed

Unless you’re an intensive care nurse, you’re probably wondering if your job is safe. For most people, buying a house is something that can wait until the crisis is over and we know more about whether we will be able to repay those loans.

In history, not every economic slip has led to a house price crash. As Corelogic’s Tim Lawless points out, house prices sometimes fall when there’s no recession and sometimes you can have an economic shock where house prices rise.

How have housing values traversed previous economic shocks? Generally well insulated. Larger downturns in housing values have been associated with periods of credit tightening & rising interest rates. More detail in this report from from @corelogicau https://t.co/ZjOQEVpfRo pic.twitter.com/47UPsQqxji

— Tim Lawless (@timlawless) March 20, 2020

In this picture, the shaded areas represent economic shocks. They’re not all equal in importance though. The most relevant one is the 1990s recession, where house price growth was negative for an extended period.

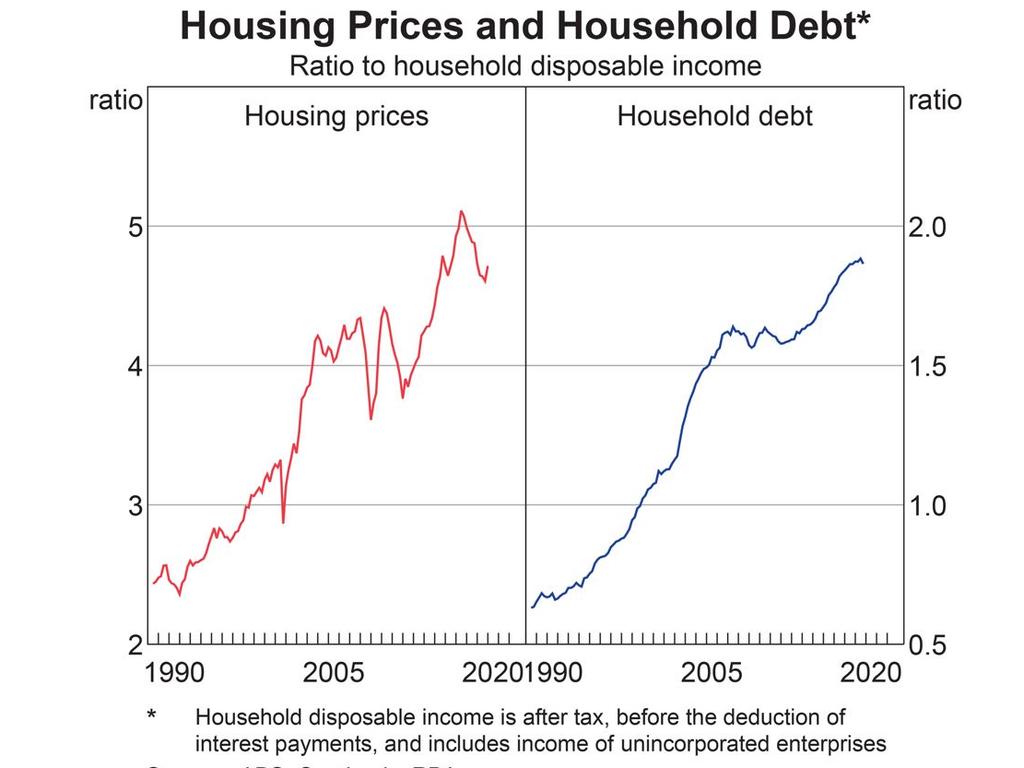

The current recession is likely to be at least as deep as that one, and it begins from an altogether more fragile state, with house prices far more elevated and debt much higher.

RELATED: What panic buying says about Australians

RELATED: How to self-isolate due to coronavirus

NO CROWDS

The second main hit to the housing market is very practical – you can’t easily sell a house when people are self-isolating. Of course, the real estate industry is not one of the industries that has been shut down by state governments.

Unlike pubs, clubs, restaurants and cafes, it is permitted to continue. But it will be very difficult to run an open-for-inspection when people are not leaving their home.

Gil King, chief executive officer of the Real Estate Industry of Victoria, says that estate agents will scramble to find ways to sell homes.

“Being able to see a home in person is an exciting and vital process in purchasing a property, you need to be able to look through all the cupboards freely, go through all the rooms, and be doubly sure that a property is the right one for you,” Mr King said.

“Each agency is running under their own set of guidelines, with some having elected to enforce a no-handshake policy while others are limiting inspections to one family at a time.”

There is also a burgeoning group of apps that permit people to bid at house auctions online. One such app is Gavl, and it saw a 200 per cent increase in online traffic last weekend.

“We expect even greater take up this weekend in Australia with Gavl giving some confidence and reassurance to the industry,” Gavl CEO Joel Smith said.

Such emergency measures might help at the edges, but they will not be enough to keep the market ticking over. Facing the prospect of weak prices, many vendors will likely remove their homes from sale. It will be a similar pattern to what we saw during the house price dip of 2018-19, where the numbers of properties for sale slumps dramatically.

WHAT’S NEXT

The stock of rental properties in Australia is the sector most at risk. A large share of housing in Australia’s capital cities is leased to the hundreds of thousands of foreign students in the country. With fewer foreign students around, some of those homes are empty. Some landlords may be forced to sell.

Other landlords may find their tenants are suddenly out of work and unable to pay rents. Big banks are giving distressed mortgage holders the option to not pay for six months, which will provide some stability for a while. But those deferred payments get added to the loan balance, so mortgage holders end up paying one way or another. Some investors could end up owing the bank more than their house is worth.

During the 2018-19 house price dip, the nation’s economists came to a surprising revelation – the real estate industry is a bigger part of our economy than we realised. A collapse in house prices and a fall in the number of houses changing hands is actually bad for our economy. Retail and construction, lawyers and financiers, all of these industries go well when the housing market is hot.

The RBA was quite willing to let house prices bounce back quickly and enjoy the rebound in economic growth. But now prices are set to fall for reasons beyond any central bank’s control. That will only add to the vicious cycle affecting Australia’s economy.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.