Coronavirus: RBA to buy government bonds to dodge recession

The Reserve Bank made two extraordinary moves today, firing its last bullets in an attempt to pull our economy back from the brink of recession.

With a word from the RBA, Australia is entering brand new territory, deploying the extraordinary monetary policy that is quantitative easing.

On Monday, RBA Governor Philip Lowe said the RBA was ready to start up quantitative easing. “[T]he Reserve Bank stands ready to purchase Australian government bonds in the secondary market,” he said.

Today, he pulled the trigger. “Purchases of Government bonds … will be conducted.”

Quantitative easing (QE) is the same kind of extraordinary monetary policy the US used to help it escape from the global financial crisis. It’s designed to get the economy back on track.

The US continued to use QE for years after the GFC. So did Europe, the UK, and Japan. But Australia never did. We never had to. Until now.

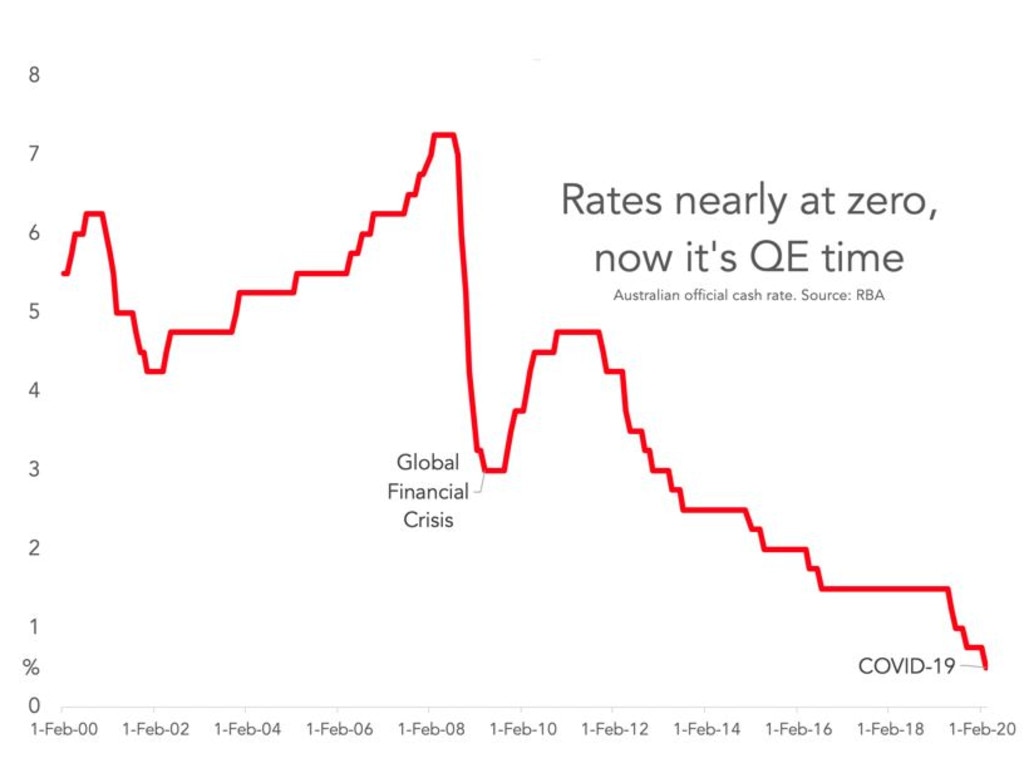

Now our interest rates are so low that there is almost no more room to move, and so in the face of a rampant coronavirus, QE is the RBA’s last option.

On Thursday the RBA also made its last rate cut, from 0.50 per cent down to 0.25 per cent. The fact it is rolling out QE at the same time as the rate cut is a sign it knows the last bullet in its gun is not nearly enough.

RELATED: Follow the latest coronavirus updates

RELATED: How ‘flattening the curve’ saves lives

WAIT, WHAT IS QE?

Under QE, the RBA buys government bonds. What are government bonds? Basically, an IOU for money the Government has borrowed.

The Government borrows by selling IOUs promising to pay people money. These IOUs are called bonds. They are traded on the bond market in much the same way stocks are traded, and how much people pay for them goes up and down.

In Australia, you can buy a government bond that will, for example, pay you back $100,000 next year. It is like putting money in the bank – you pay, say, $99,000 now to get back $100,000 in one year, and you basically earned interest of just over 1 per cent.

This interest rate is the most important thing about government bonds – it is known as the yield.

When people buy bonds, their price goes up (closer and closer to $100,000 in our example), and the yield (the implied interest rate) falls closer to zero (bond yields and bond prices go in opposite directions). When the RBA buys bonds, it is trying to reduce the yields.

Why would they want lower yields? The same reason they cut the cash rate when they do their usual monetary policy. They are trying to make borrowing money cheaper in the Australian economy. The yields on 10-year government bonds are an important indicator rate in the economy, and other interest rates depend on them.

As the RBA governor described it last year: “An important advantage in buying government bonds over other assets is that the risk-free interest rate affects all asset prices and interest rates in the economy. So it gets into all the corners of the financial system.”

RELATED: What are the coronavirus symptoms?

RELATED: What to do if you get sick

Cheaper interest rates are supposed to make us all spend more money – our debt costs less to repay, borrowing is cheaper, the economy is supposed to run faster. All of which is to say that by doing QE, the RBA is trying to boost the economy.

WILL IT WORK?

Of course, interest rates have already gone very low, and much of the impact is on asset prices not on actual economic activity. Low interest rates seem rather effective at creating high house prices but only moderately effective at creating high wages. Anyone expecting a huge sudden splash from QE is likely to be disappointed.

What is likely to be effective is fiscal stimulus: more handouts. For all the people losing work, money in the pocket will mean a lot more than a lower government bond yield. Treasurer Frydenberg has already announced one round of cash, but as the news on the coronavirus gets worse and worse, it is possible round two will have to come very soon.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology