‘Salaries can no longer pay for houses’: Chilling warning

An expert has pointed to a chilling problem with the property market after spotting an eye-watering new listing.

A property researcher and buyers agent has suggested that first homebuyers struggling to get a foot in the market as house prices soar into the millions simply have the wrong “attitude”.

Simon Pressley, founder and managing director Propertyology, has weighed into the debate over the rapidly worsening housing crisis with a pointed rebuke to a common complaint, which he has dubbed “bulls**t”.

“I get the s**ts every time there’s a story, once a year, ‘We’ve done the numbers and now it takes 10 years for someone to save for a deposit,’” Mr Pressley said.

“That’s a bulls**t statement. It’s calculated based on how long it would take a median income to save a 20 per cent deposit for a median house price. Who’s a median anyway? Everyone’s income is different.

“It’s an easy thing to say average wages [are low] relative to average house prices, but that’s always been a nonsense ratio. What is average? Someone could be earning $15,000, $50,000 or $1 million. You can buy a one-bedroom unit or a mansion.”

Mr Pressley, naturally, is an advocate of rent-vesting — renting where you need or want to live, while investing somewhere you can afford to get a foot on the ladder.

“A standard house in one of Australia’s 40 largest cities today costs circa $650,000,” he said. “In 20 years’ time, that same standard house will have tripled in value to be worth $2 million.”

He argues if someone is in the workforce, they are capable of saving a deposit to buy something, somewhere in the country — and that despite the doom and gloom, the problem today is not uniquely severe in Australia’s history.

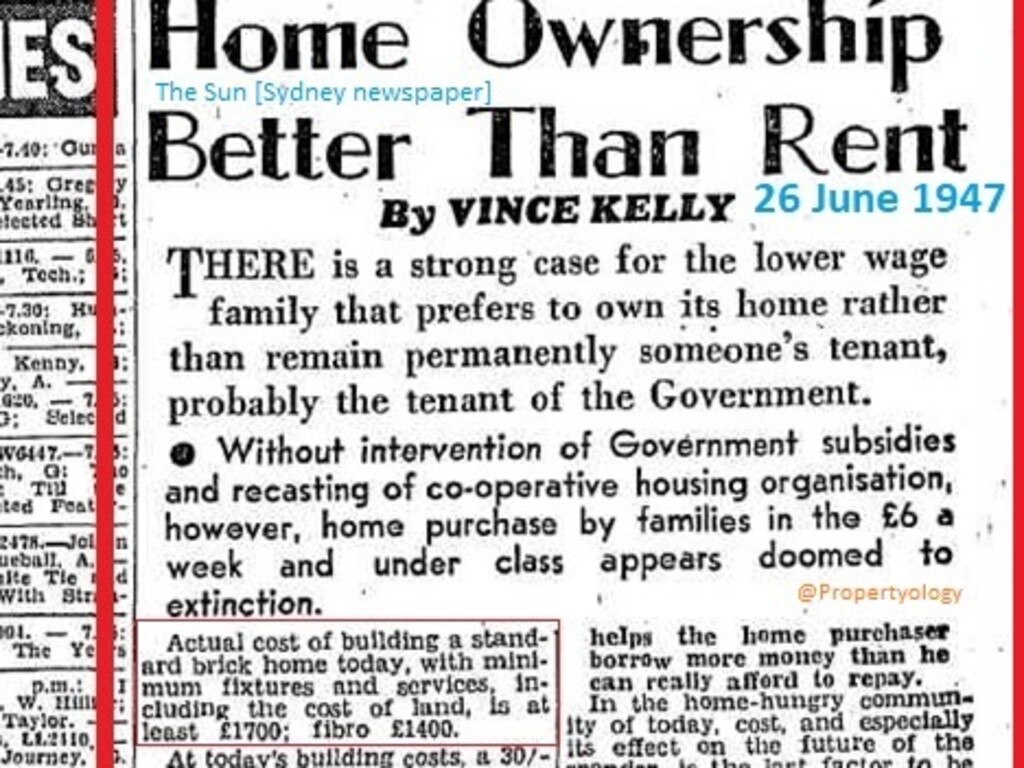

“As far back as 1880, every year housing affordability has been a hotly debated topic,” he said, highlighting newspaper clippings dating back more than a century.

“Without intervention of government subsidies … home purchases by families in the £6 a week and under class appears doomed to extinction,” reads one article in Sydney newspaper The Sun from 1947, at a time when a house cost £1700 — or around $140,000 today.

“It’s always been a challenge,” Mr Pressley said.

“For different generations the specific challenge has been different. In some eras it’s been interest rates at 19 per cent. Lots of generations had to have a 30 per cent deposit. What we do know is that for the last 50 or 60 years, seven out of 10 households own a home consistently. No matter the individual challenge, seven out of 10 managed to find a way.”

But Mr Pressley said he was “frustrated on a daily basis [by] people’s attitudes”.

“Whether it’s housing affordability, success in the workforce, in relationships, anything in life, people who have a positive attitude invariably get what they want,” he said.

“But we do know one thing — if we say something is too bloody hard, you’ll be right 100 per cent of the time.”

He stressed “none of that means it’s easy to buy a house, I’m not saying that”, agreeing there were “legitimate challenges”.

“But there are lots of solutions available to people if they really aspire to home ownership,” he said.

For example, he said, saving a 20 per cent deposit was often overkill.

Depending on eligibility for various federal, state and territory schemes, buyers may need just 5 per cent and sometimes as little as 2 per cent.

“Anyone who consciously decides I’m going to put off buying my first property until I’ve got a 20 per cent deposit, you’re only harming yourself,” he said, suggesting paying the one-off premium of lender’s mortgage insurance was usually the more “intelligent choice”.

“The longer you take to get a foot on that housing ladder the more expensive it’s going to be. If you put the deposit you do have into bricks and mortar somewhere, that will grow at a much faster rate than what most people are able to save.”

‘Salaries can’t pay for houses’

Stories of eye-watering sale prices for modest homes in once working-class capital city suburbs are now an almost daily occurrence.

Last weekend, a 100-year-old four-bedroom bungalow in Glebe sold for $4.7 million, after a neighbour already living on the same street beat out four other bidders, Domain reported.

The desirable inner-west suburb has a median household income of just over $91,000, according to 2021 Census data.

In other words, it would take a median-income household in Glebe, saving 20 per cent per year, nearly 52 years to save up a 20 per cent deposit of $940,000.

Clearly, that is not what’s happening — mortgages of that size are vanishingly rare. Wealthy, cashed-up buyers are driving the market in these suburbs.

“Salaries can no longer pay for houses in Sydney,” Freelancer chief executive Matt Barrie wrote on X.

“Average house price rapidly going to $5 million. $4.7 million for a 100-year-old bungalow in … Glebe. Blind Freddie can see the writing on the wall. Not a serious country.”

Last month, a newly built luxury home in Strathfield — once better known for its Korean BBQ — fetched a record-breaking $8.6 million, also raising eyebrows.

Mr Pressley said he was “not denying” there were areas where average earners were priced out.

“I don’t care if there’s a house someone paid $8 million for, good luck to that person,” he said.

“You can’t have that one — you can’t afford that one. But the reality is there’s 11.2 million properties in this country. If someone wants one they’ll find one.”

It comes after a September report by PropTrack warned housing affordability in Australia was at its worst level in “at least three decades”.

PropTrack’s 2023 Housing Affordability Index found a household earning the median income of $105,000 could afford just 13 per cent of homes sold in the year.

The report defined affordable as spending 25 per cent of pre-tax income on loan repayments.

PropTrack also found the time it takes an average household saving 20 per cent of its income to save a 20 per cent deposit for a median-priced home was nearly seven years in NSW, 6.2 years in Victoria, 5.4 years in Queensland, six years in South Australia, less than four years in Western Australia, and 6.2 years in Tasmania.

The differing relationship between wages growth and property prices has meant the time to save a deposit has either remained largely stable compared with five years ago, such as in NSW, fallen slightly, as in Victoria, or blown out significantly, as in Tasmania.

Cameron Kusher, director of economic research at PropTrack, said since the report last year “we’ve seen further interest rate increases and property prices have continued to climb, [so] the only real outlook here is that housing affordability has since deteriorated”.

Mr Kusher said the time to save a deposit similarly had “elongated”.

“The key thing at the moment basically is that the cost of renting is going up much more than wages, so it’s getting much more difficult to save for a deposit,” he said.

“It’s extremely hard, unless you’re able to get somewhere rent free.”

The growing divide between the haves and have-nots was underscored by new data earlier this month revealing average deposit sizes soaring, buoyed by generous top-ups from the “bank of mum and dad”.

The average deposit reached a record high of more than 32 per cent in March as the ratio of home sales to loans fell to 67.6 per cent, according to analysis of Australian Bureau of Statistics (ABS) lending data by investment bank Jarden, which said the market was now being driven by “high income, high deposit” households.

That was backed up by data from the prudential regulator showing the share of higher loan-to-value ratio mortgages — buyers with deposits of 20 per cent or less — falling from about 40 per cent in 2021 to less than 30 per cent in 2024.

A large driver of soaring deposit sizes is the increasing reliance on six-figure family assistance, both to keep up with rising house prices and cope with reduced borrowing capacity due to interest rate hikes.

Earlier this week, real estate guru and auctioneer Tom Panos broke the news that Sydney was now a city for the ultra-rich.

Speaking to Mark Bouris on Yellow Brick Road podcast, Mr Panos said a young person not blessed with rich parents — or willing to turn to OnlyFans — would need 20 years to save for a deposit to comfortably buy in Sydney, and that’s just for a unit.

“A house, if you’re age 20, it will take you until the age of 60 to get a deposit,” he said. “Back in the old days, that was the goal to have your home paid off by then, not to be saving for a deposit.”

Research by Jarden late last year suggested that the majority of first homebuyers were using the bank of mum and dad to get into the market.

“We estimate a figure in NSW and Victoria not far off $100,000 when people are receiving gifts or loans,” said Jarden chief economist Carlos Cacho.

“Anecdotally I’ve heard figures much higher in some cases. There’s regular stories of parents who are just buying their kids homes outright. The bottom line is whether it’s direct financial support or giving a guarantee or just being able to live rent-free while saving for a deposit, we’re seeing it becoming increasingly difficult [without family assistance].”

Jarden’s survey last year of 282 mortgage brokers found about 15 per cent of borrowers used family assistance, with one third receiving a guarantee and two thirds receiving a cash loan or gift.

“Given FHBs represent around 20 per cent of new lending flows, we think this implies the majority of FHB are likely utilising some form of family assistance,” the bank said in November.

“This is consistent with other research which estimates the share of FHBs receiving family support has increased from 12 per cent in 2010 to 60 per cent in 2017. Given the worst housing affordability on record, with it taking around seven years to save a deposit even with a 20 per cent savings rate, this high rate of family assistance is not surprising.”

Mr Kusher agreed the wealth divide was “becoming really pronounced, I think actually measuring it is the tricky part”.

But he noted the ABS housing finance data for March showed lending to first homebuyers was up nearly 18 per cent year-on-year.

“When you consider that property prices have continued to rise, and that interest rates have increased over the past year, it’s hard to imagine that many people are doing this without some form of help,” he said.