Deposit sizes soar as $100,000 top-ups from ‘bank of mum and dad’ become the norm

New data has revealed an unfortunate truth about the housing crisis which many didn’t see coming.

Australians without well-off parents able to stump up nearly $100,000 are increasingly being locked out of the housing market, with new data revealing average deposit sizes soaring as the divide between the haves and have nots reaches crisis levels.

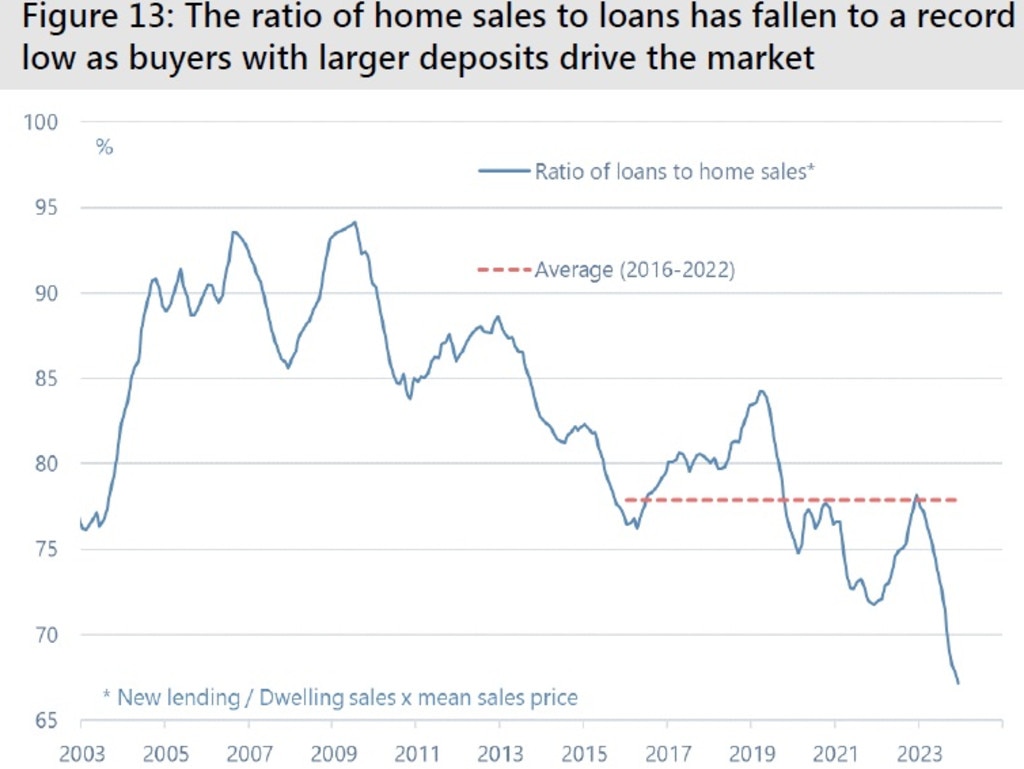

The average deposit reached a record high of more than 32 per cent in March as the ratio of home sales to loans fell to 67.6 per cent, according to analysis by investment bank Jarden, which says the market is now being driven by “high income, high deposit” households.

That is backed up by data from the prudential regulator showing the share of higher loan-to-value ratio mortgages – buyers with deposits of 20 per cent or less – falling from about 40 per cent in 2021 to less than 30 per cent in 2024.

A large driver of soaring deposit sizes is the increasing reliance on six-figure family assistance, both to keep up with rising house prices and cope with reduced borrowing capacity due to interest rate hikes.

Startling research by Jarden late last year suggested that the majority of first homebuyers were using the ‘bank of mum and dad’ to get into the market.

“We estimate a figure in NSW and Victoria not far off $100,000 when people are receiving gifts or loans,” said Jarden chief economist Carlos Cacho.

“Anecdotally I’ve heard figures much higher in some cases. There’s regular stories of parents who are just buying their kids homes outright. The bottom line is whether it’s direct financial support or giving a guarantee or just being able to live rent-free while saving for a deposit, we’re seeing it becoming increasingly difficult [without family assistance].”

Jarden’s survey last year of 282 mortgage brokers found about 15 per cent of borrowers used family assistance, with one third receiving a guarantee and two thirds receiving a cash loan or gift.

“Given FHBs represent around 20 per cent of new lending flows, we think this implies the majority of FHB are likely utilising some form of family assistance,” the bank said in November.

“This is consistent with other research which estimates the share of FHBs receiving family support has increased from 12 per cent in 2010 to 60 per cent in 2017. Given the worst housing affordability on record, with it taking around seven years to save a deposit even with a 20 per cent savings rate, this high rate of family assistance is not surprising.”

The estimated average value of deposit contributions by the bank of mum and dad was $70,000 nationally, but as high as $92,000 in NSW.

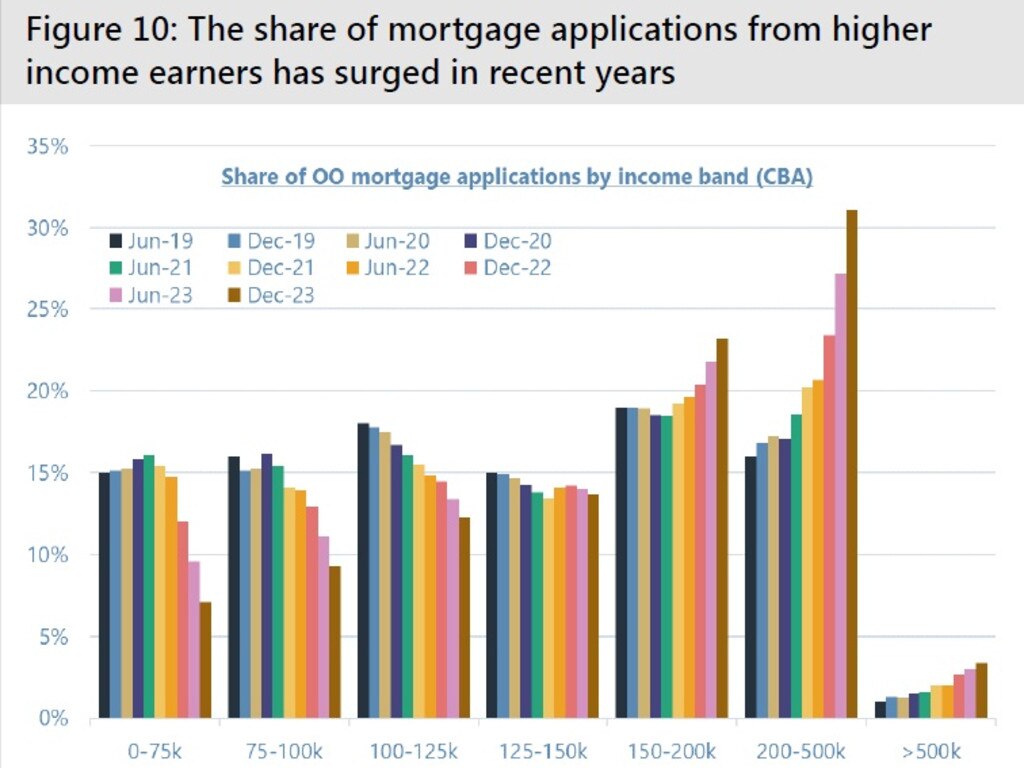

Mortgage data from the CommBank in February confirmed the increasing shift towards high-income buyers, with the average owner-occupier income rising from $160,000 in 2019 to $220,000 in December 2023.

At the same time, however, borrowing capacity is down about 30 per cent from its recent peak in 2021.

The Reserve Bank has raised the official cash rate 12 times since May 2022, from a record low of 0.1 per cent to 4.35 per cent.

For a person in roughly the same financial situation now as 2019, that means “all else equal you’re buying a much more modest home”.

“That’s the feedback we hear from brokers and agents, buyers are reassessing,” Mr Cacho said.

“Maybe they wanted a four-bedroom 10 kilometres from the city, instead it’s a three-bedroom within 15 kilometres. Or it might be having to look at a unit instead of a townhouse. I think what you’re seeing is buyers compromising because they still want to get into the market.”

Mr Cacho said housing affordability in Australia was “as bad as it’s been”.

“We can see that through time to save for a deposit which has never been higher, house price to income ratios remain very high, mortgage repayments to income remain high, any way you look at it housing affordability is at extreme levels,” he said.

“For buyers but also renters – rents are high relative to incomes, which means if you’re renting before buying [it takes longer to save]. That’s why family assistance is becoming so important, even if it’s just allowing you to live rent free, compared with just a few years ago.”

It comes after Australian house prices hit a fresh record in April, rising 6.6 per cent annually to a national median of $774,000 and capital city median of $840,000, according to PropTrack.

Sydney remains the least affordable city in Australia with just 3.8 per cent of home sales affordable for median-income households, PropTrack’s Affordability Report found last month.

The research firm defines affordable as the price at which the household would be spending 25 per cent of its gross income on typical mortgage repayments, assuming a 20 per cent deposit.

“Very few regions remain affordable to households earning median incomes (or lower),” wrote PropTrack senior economist Paul Ryan.

“This highlights the role existing wealth plays in entering home ownership given the high level of prices across the country.”

Housing accessibility – how long it would take on an average income to save 20 per cent deposit for a median home – is also at a record of around eight years in Sydney.

“If you go back to 2019 it was about five-and-a-half years nationally and about seven in Sydney,” Mr Cacho said.

Another chart from CommBank highlights the striking collapse of the middle-income homebuyer.

It shows how the share mortgage applications from people earning less than $125,000 – who made up roughly half of the total in 2019 – has fallen off a cliff.

At the same time, the share of applications from higher income earners has skyrocketed, particularly among those earning between $200,000 and $500,000, which was up from about 16 per cent to over 30 per cent.

Mr Cacho warned that home ownership was rapidly becoming out of reach for a growing segment of the population.

“Sydney has always been expensive, it used to be the case that on a median income you’d have struggled to find a median home, but in most of the capital cities that would have been achievable,” he said.

“But now we’re seeing increasingly you need 50 per cent above the median income to buy a median home. Generally you need to be in the top 40 per cent of income earners. The risk is if we continue to see house prices grow ahead of incomes that’s only going to move further.”

In a February note, Jarden warned housing affordability was likely to remain a key political issue for the next decade.

“Given the outlook for house prices (we expect them to rise 5 per cent year-on-year in 2024), it is hard for us to see these metrics improve without interest rate cuts and, even then, lower rates are only likely to drive home prices higher, further exacerbating housing unaffordability and inequality,” Mr Cacho wrote.

“In our view, this is likely to see policies and regulations increasingly shift in favour of renters and increase pressure for redistributive policies.”