Borrowers warned of multiple interest rate hikes once RBA opens up floodgates

Once interest rates go up, they will continue to go up very quickly, and mortgage holders will bear the brunt of the pain.

Mortgage holders have been dreading the day the Reserve Bank of Australia hikes up interest rates but they are underestimating how quickly it will rise – once the floodgate opens, an expert has warned.

Back in February, the RBA assured Australians that it would be at least another six months before they lifted rates, saying they would need to see two more quarterly inflation reports.

But last week, RBA governor Philip Lowe conceded that inflationary issues sparked by the Ukraine-Russia crisis could force him to bring up Australia’s interest rate much earlier than planned.

The Commonwealth Bank thinks it is likely to happen in June this year.

And now financial services group executive of comparison site Canstar, Steve Mickenbecker, believes that the main issue won’t be that interest rates have risen – it’s that once they do rise, they will continue to rise in quick succession.

“An increase of 0.15 or 0.25 per cent doesn’t add much [to a mortgage],” Mr Mickenbecker told news.com.au on Monday.

“What people have to remember though is when the Reserve Bank moves [the cash rate] from the bottom, history shows there are usually six or eight increases within 18 months or two years.

“That puts a serious increase on your home loan repayment.”

But there’s a way homeowners can save as much as $16,000, if they act now.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Interest rates in Australia reached an all time high of 17.50 per cent in January 1990. Since then, they have averaged 3.93 per cent.

The last time the RBA hiked up rates was in 2010. It has only been going down ever since.

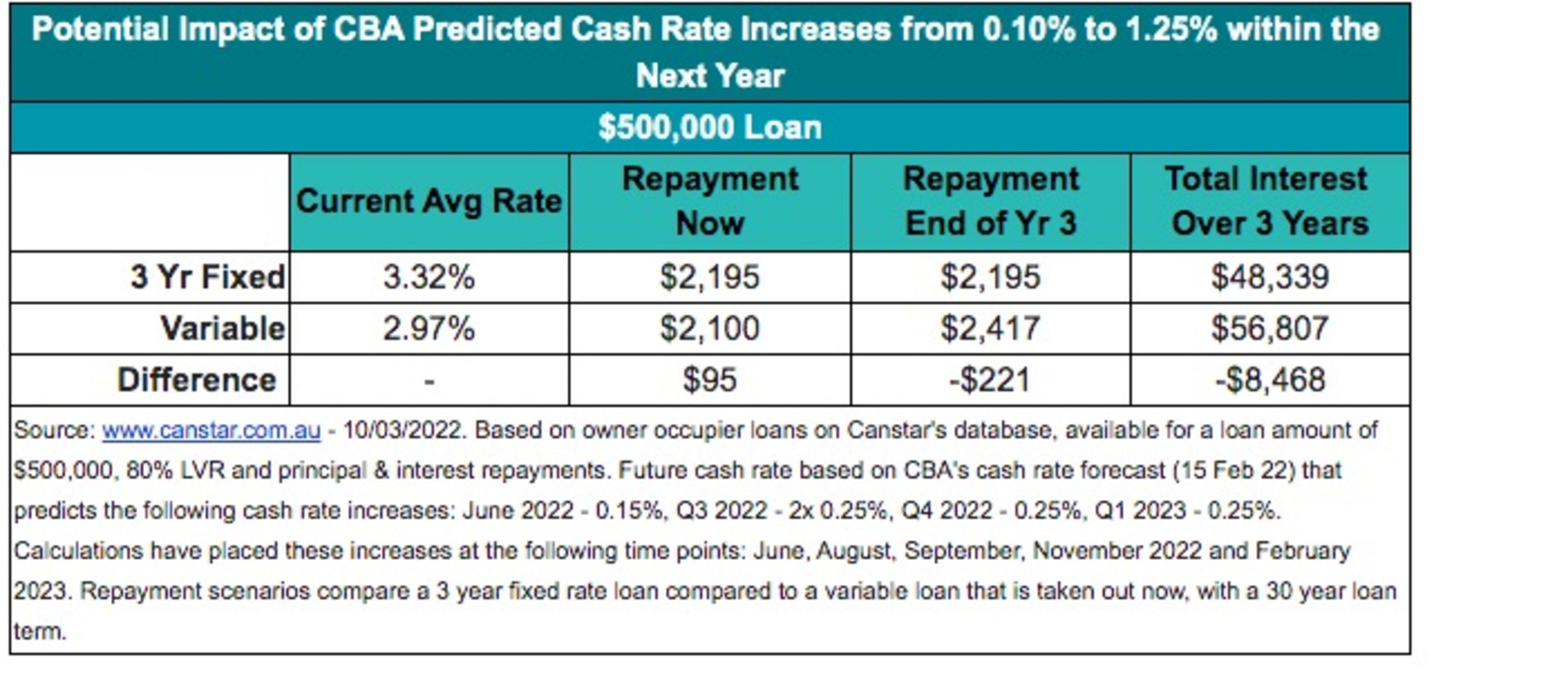

The official cash rate has been at a record low of 0.1 per cent since November 2020 in response to the Covid-19 pandemic but it is expected to jump by 1 per cent by the end of this year and hit 1.25 per cent next year.

Although a 1 per cent rise sounds like a tiny amount, it could add hundreds or even thousands of dollars extra every month for the average Australian mortgage.

Mr Mickenbecker estimates that in the last half of 2023, the cash rate will hit 1.75 per cent, meaning the current average home loan rate of 2.95 per cent will jump accordingly to 4.72 per cent by then.

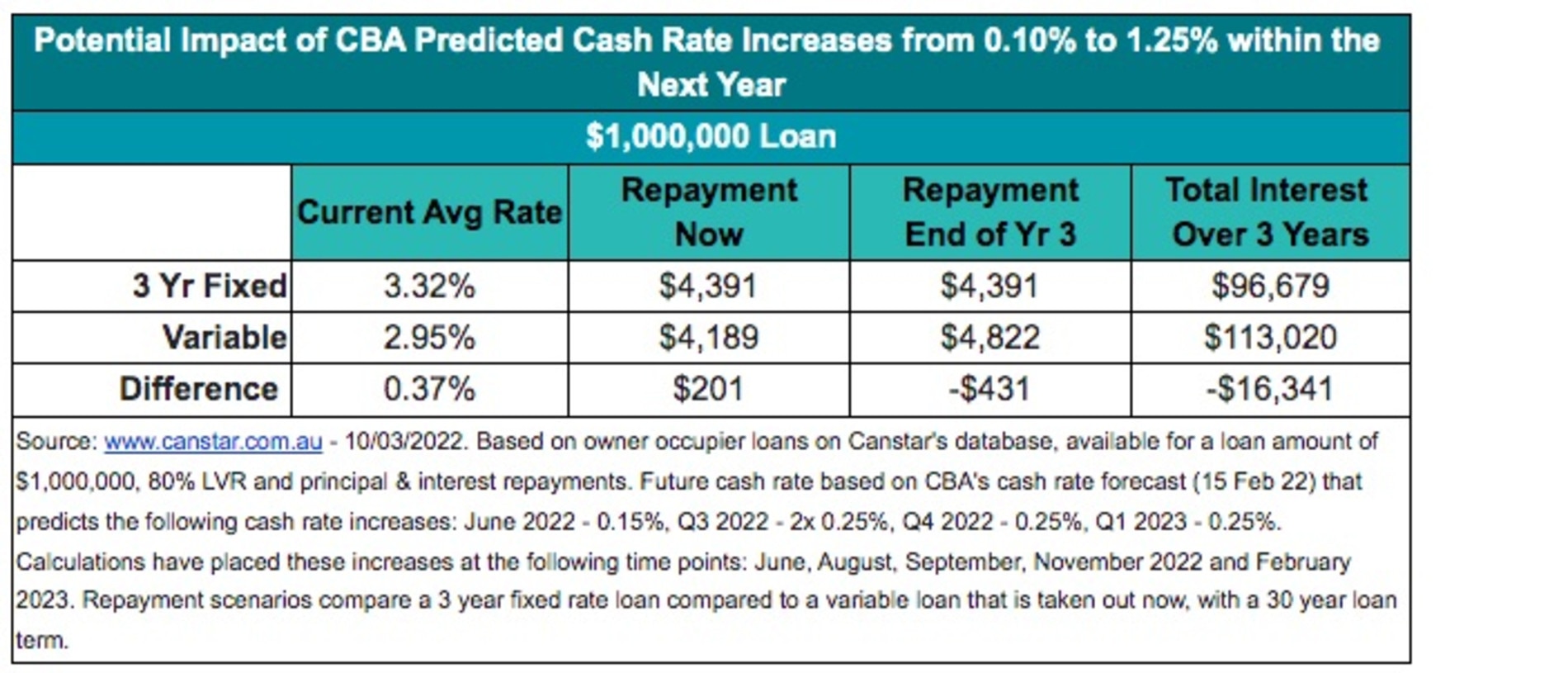

Canstar analysis shows that for the past year and a bit, a borrower with a $1 million home loan has been paying $4189 every month, or $50,268 per year.

If the cash rate rose in line with the Commonwealth Bank’s forecast and the average variable rate increased accordingly, their repayments could reach as high as $4822 in the next several years.

In a 12 month span, a mortgage holder would have to fork out $57,864 – a difference of $7600.

That could spell disaster for an estimated one million Australian property owners who have never lived through a rate hike before as they have only recently entered the market during the turbocharged real estate year of 2022.

No need to worry though – Canstar analysis has found a way for Australians with a mortgage to save themselves as much as $16,000.

Mr Mickenbecker is championing fixed home loans to spare property owners from the immediate pain once the interest rate starts to pick up.

“Fixed rates were a lot lower than they are now, people think they’ve missed the boat,” he explained.

“But it’s not too late. Take a bit of pain now and you’ll be ahead in the next 12 months.”

For instance, if a mortgage with a $1 million principal and interest loan locked in the average three year fixed rate of 3.32 per cent, their monthly repayments would be $4391.

The total interest over the three year period would come to $96,679.

Meanwhile, if they were paying the $4822 monthly variable loan instalment by the third year of the cash rate rise, as mentioned above, this would take their total interest paid to $113,020.

That is $16,341 higher than if they had opted to fix their loan for three years.