Big money mistake Aussies risk making as they rush to buy a home before Christmas

It’s now just five weeks until Christmas and experts warn a large number of Australians are putting themselves in financial danger with one big decision.

With just five weeks until Christmas, experts are warning a large number of Australians risk making significant financial missteps by trying to rush a major purchase.

Right now, a number of people are rushing to buy a home or an investment property so they can settle before Christmas or the New Year, according to Real Estate Buyers Agents Association of Australia president Melinda Jennison.

Ms Jennison said a common conversation between buyer’s agents and those in the market is the desire to act urgently, but it could result in long-term negative consequences.

“It makes sense that people want to be settled into a new home in time for Christmas – or even have a property settled at the same time for investors – but the looming holidays should not be the defining reason to purchase a particular property,” she said.

“Unfortunately, being too rushed with your asset selection can cause serious financial ramifications for many Christmases to come if you have unknowingly bought a dud or a property that is not fit for purpose.”

A range of factors make rushing a particularly risky choice this year, from higher interest rates to rising property prices and intense competition among buyers in the market.

“Over-paying for a property can result in underwhelming capital growth that can have consequences for your future financial position as well as your ability to upgrade to a new home,” Ms Jennison said.

“Likewise, buying an inferior dwelling because of a desperate desire for it be settled by Christmas makes little financial sense when you will likely own that property for years to come, and no doubt rue your hurried decision before long, too.”

Alarmingly, Ms Jennison said some buyers are getting deals done at the expense of due diligence by opting not to perform crucial checks, such as building and pest inspection reports.

“Other risky decisions include buying sight unseen or relying on friends and family to help with property-buying decisions, when their emotional connection and relationship with the buyer can influence their recommendations.”

Financial comparison website finder.com.au has seen an increase in visits to its home loan section, with a five per cent jump over the past month indicating a rise in buyer intent.

Investment home loans prove particularly popular among visitors, with a 14 per cent lift in sessions.

Meanwhile, those in the market for a mortgage are cost conscious, with a staggering 68 per cent surge in visits to finder.com.au’s page detailing the cheapest home loan deals going.

The latest data from the Australian Bureau of Statistics also shows a lift in activity, with $25 billion worth of mortgages taken out in the month of September.

It represented a modest 0.6 per cent lift on the previous month, but investor lending was particularly strong, up two per cent to $8.9 billion.

Despite the latest in a long line of interest rate hikes by the Reserve Bank last week, as well as the persisting cost-of-living crisis and uncertainty about the economy, the housing market is still firing.

Auction clearance rates – that is, the proportion of homes sold under the hammer each weekend – remain strong in the lead-up to the festive season.

Research firm CoreLogic reports a clearance rate of 69 per cent across the combined capital cities last Saturday, with buyer activity particularly frenzied in Brisbane and Adelaide.

The Queensland capital saw over 71 per cent of properties scheduled for auction sell, while the South Australian capital recorded a clearance rate of almost 79 per cent.

Every major city saw sharp double-digit increases in successful sales compared to the same period last year.

Another sign of strength in the market is the extent to which sellers are willing to lower their price expectations.

CoreLogic reports the median vendor discount at a national level in October was 3.6 per cent, down from 4.3 per cent at the end of 2022.

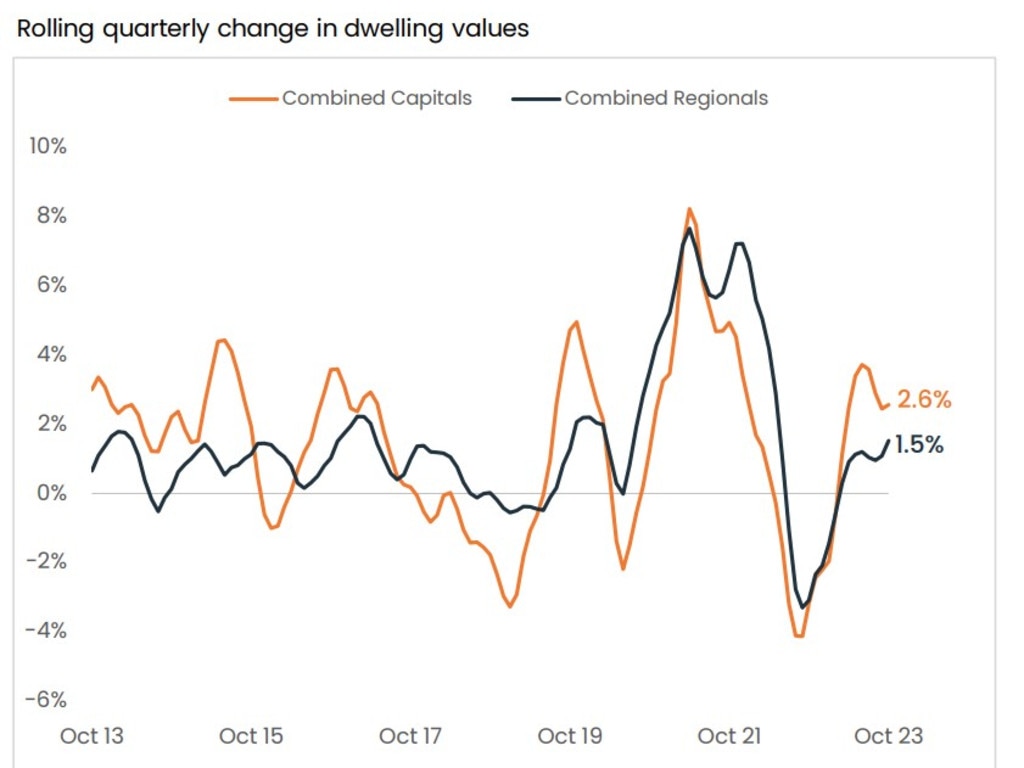

Property prices also continue to rise, with CoreLogic’s Home Value Index showing a 0.9 per cent lift nationally last month, contributing to a total 7.6 per cent surge over the course of the year.

“At this rate of growth, we will see the national Home Value Index reach a new record high midway [this month], recovering from the 7.5 per cent drop in values recorded over the recent downturn between May 2022 and January 2023,” the firm’s research director Tim Lawless said.

Higher prices, higher rates and higher prices for just about everything are putting intense pressure on household budgets, making any missteps – like rushing a home purchase – especially dangerous.

Graham Cooke, head of consumer research at finder.com.au, said the cost crunch is hitting Australians with a mortgage particularly hard at the moment.

“The threat to those with a mortgage is particularly acute – nearly two-in-five are struggling to pay [repayments] – so if you aren’t on a top deal, it might be time to shop around,” Mr Cooke said.

Those looking to buy should ensure they build an emergency fund to help weather financial storms, he said.

“Also try to find ways to give yourself some financial breathing room such as refinancing or downsizing and help your cash flow situation by taking up a side gig,” he said.