Aussies with a mortgage should be bracing for major change, economists warn

The Federal Budget might have put some quick cash in the pockets of millions of Australians, but it’s seriously damaged some people’s ability to pay off their home loans.

Tuesday night’s cash splash might be lining the pockets of regular Aussies now, but economists have warned it could cause financial pain later down the track, especially for homeowners.

Although the budget represented an enormous amount of money changing hands, which was about one per cent of Australia’s overall GDP, it could force anyone with a mortgage to fork out more money in the long run.

The cash injection hasn’t postponed the inevitable in terms of the Reserve Bank of Australia hiking up interest rates by June, economists.

In fact, if anything, it has increased the amount that the RBA will have to lift the cash rate by.

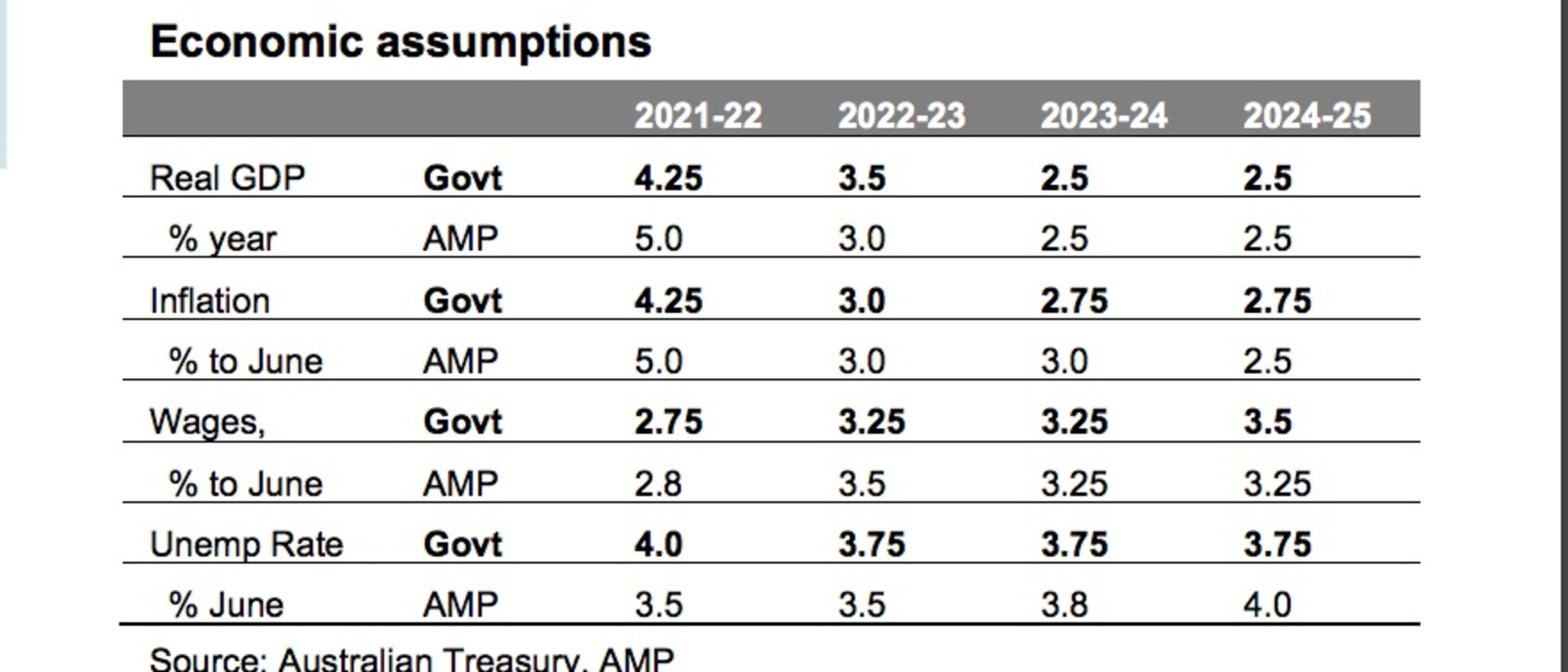

That’s according to the chief economist at AMP, Shane Oliver, who said in a note the budget “risks overstimulating the economy at a time when it is already strong, further adding to inflationary pressures and adding to the amount by which the RBA will have to hike interest rates.”

Based on the budget as well as the state of the economy, Mr Oliver expects the cash rate to increase in June, putting pressure on hundreds of thousands of mortgage holders.

That’s only two months away.

And the percentage rise is set to be a lot higher than it would have been, if the budget had addressed issues with a more holistic approach.

“We expect the first rate hike in June and the cash rate to reach 0.75% by year end and 1.5% next year,” he wrote.

“The extra stimulus in the Budget increases the chance that the first rate hike is 0.4% rather than 0.15% (taking the cash rate to 0.5%), with the cash rate reaching 1% by year-end.”

Interest rates in Australia reached an all time high of 17.5 per cent in January 1990. Since then, they have averaged 3.93 per cent.

The last time the RBA hiked up rates was in 2010. It has only been going down ever since.

As a result, more than one million home borrowers have never experienced an increase in mortgage rates, because they bought a home after 2010.

The official cash rate has been at a record low of 0.1 per cent since November 2020 in response to the Covid-19 pandemic but it won’t last for much longer.

Although a one per cent rise sounds like a tiny amount, it could add hundreds or even thousands of dollars extra every month for the average Australian mortgage.

RBA does U-turn on when rates will lift

Back in February, the RBA assured Australians that it would be at least another six months before they lifted rates, saying they would need to see two more quarterly inflation reports.

But earlier this month, RBA governor Philip Lowe conceded that inflationary issues sparked by the Ukraine-Russia crisis could force him to bring up Australia’s interest rate much earlier than planned.

In February, the Commonwealth Bank warned that the interest rate could rise by as early as June this year – and that was before Russia began its invasion of Ukraine.

At the time, the RBA assured Australians that it would be at least another six months before they lifted rates, saying they would need to see two more quarterly inflation reports.

However, Dr Lowe is no longer making such a promise.

“We don’t have a plan that’s locked in,” he said on March 9.