‘No go zone’: Prediction from 2007 highlights grim Australian housing issue

A “dire” prediction about Australia made back in 2007 has come true, with parts of the country now marked as “no go zones” for millions.

A “dire” housing prediction made 17 years ago has highlighted the brutal reality facing millions of hard working Australians who are struggling to break into the housing market.

A new report from the Property Council of Australia has found that housing affordability in Queensland has gone from bad to worse, particularly in the south eastern parts of the state.

The Beyond Reach report is an update to research first published in 2007, which predicted that, without long term pragmatic solutions, “a housing crisis of dire proportions was in our future”.

The latest report found that, for many Aussies, particularly our essential and frontline workers, the dream of owning a home is now “beyond hope” and the day that was predicted 17 years ago “has come”.

House prices have outgrown household incomes at a rapid rate in the past few years. This, combined with skyrocketing population growth and insufficient housing supply has resulted in unattainable house prices for the average worker.

Jess Caire, Property Council of Australia Queensland Executive Director, blamed Queensland’s prevailing policy settings for “exacerbating” the housing crisis.

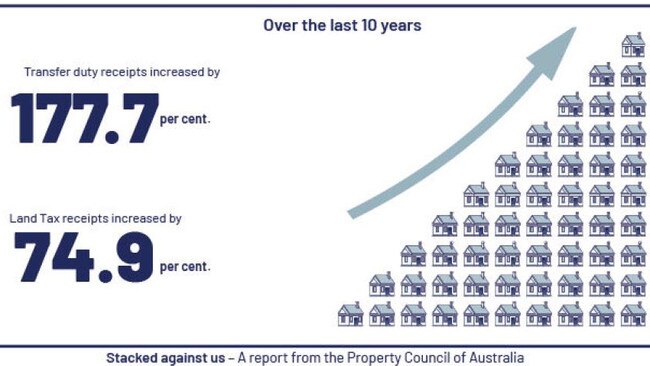

“Every new tax on property, regardless of the intended recipient, inflates the cost of housing and is ultimately paid for by Queenslanders,” she said.

“The initial Beyond Reach report from 2007 predicted this housing crisis and its policy recommendations fell on deaf ears.

“Queenslanders are paying an extraordinary price for this, with property-related fees and charges generating 38 per cent of the taxation revenue that funded this year’s State Budget.”

The report dug into housing affordability in the region for different hypothetical single and dual income households, drawing data from Queensland Government Statistician’s Office, REIQ and CoreLogic.

It highlighted the average salaries of critical workers, such as a police officer earning $85,000 a year or a child care worker on $62,407, and showed they are being completely priced out of housing.

Even for those on dual incomes, such as a full-time primary school teacher and an admin assistant bringing in a combined $153,000, the Great Aussie Dream is getting further out of reach.

While some of the hypothetical households can afford a house in regional cities, even renting is an affordability challenge for some.

Ms Caire said the report’s findings paint a grim picture for home buyers and renters.

“The research shows no essential worker can afford to buy or rent a home, or unit, on their own in South East Queensland,” she said.

“For dual income families with an average gross income of $150,000, buying an established home is ranked ‘beyond reach’. It’s a similar story for house and land packages, which are deemed ‘unaffordable’.”

It is particularly grim for Aussies in critical roles, with Ms Caire saying most of South East Queensland is now a “no go zone” for frontline workers hoping to enter the housing market.

“These are the same people we rely on to save lives, fight crime and teach our children, and it will be Queensland’s loss when they are forced to choose a new career or a new state to live in because they can’t afford to live here,” she said.

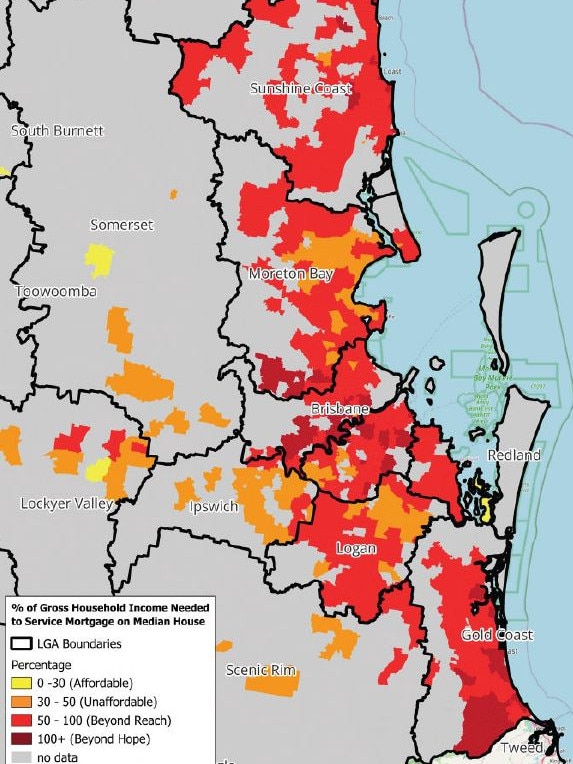

The report stated that, for a family with a household income of $100,000, it would be nearly impossible to purchase an affordable house in South East Queensland.

For the purpose of the report, “affordable” housing is defined by where costs are 30 per cent or less of the household income.

That is something experts claim had now almost “ceased to exist” in the region — particularly for younger households or essential workers wanting to buy a detached house.

According to the research, the only place in South East Queensland where a family with a $100,000 income can find affordable median priced housing are the southern Moreton Bay Islands or isolated pockets in the Lockyer and Somerset regions.

There are now multiple suburbs in the inner and western suburbs of Brisbane, northern Sunshine Coast, and southern Gold Coast, where buying the median priced house would, in theory, consume more than 100 per cent of this family’s income.

Further north in areas like Cairns and Townsville, median priced houses are generally not affordable for a household with a $100,000 income.

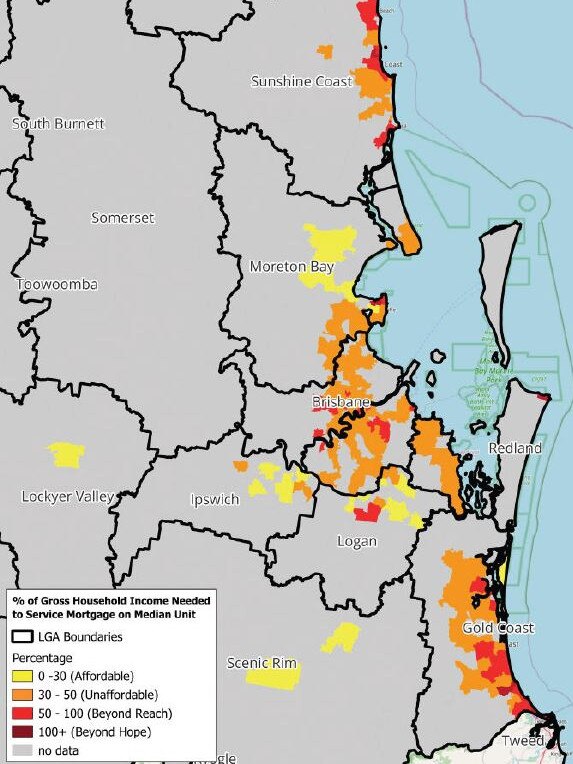

Even if this family was to opt for a unit instead of a house, affordability is still largely non-existent within Brisbane, the Gold Coast and Sunshine Coast.

Ms Caire said that, after the October election, the Property Council of Australia will be calling on the newly formed Queensland government to commit to a “thorough evidence-based review of the impact taxation has on the delivery of new homes” across the state.

“It’s time for political bravery and real industry consultation. We need decisive action to change the policies and tax settings that punish growth and punish home buyers,” she said.

It isn’t just those in Queensland who are seeing the Great Aussie Dream becoming increasingly impossible to achieve.

Finder’s Consumer Sentiment Tracker found that just 29 per cent of Australians believe now is a good time to buy property, a massive drop from 59 per cent in 2020.

The research also found that one in three people surveyed don’t think they will ever be able to afford a home, while 34 per cent of homeowners said they struggled to pay their home loan in June.

Graham Cooke, head of consumer research at Finder, said housing affordability has become a “significant challenge”, noting it can take single income earners more than 20 years to save for a deposit.

More Coverage

“The rising cost of living is putting a chokehold on people’s ability to save for a home,” he said.

“Everyday essentials are eating up a larger chunk of income, leaving less for that critical down payment.

“The situation creates a vicious cycle. People struggling to pay their rent can’t save for a home, pushing them into an already competitive market with rising rents.”