‘Millionaire buyers’: Foreigners flood back into Australian property

Foreign buyers with deep pockets are flooding back into Australian housing, new figures show, with one state emerging as a new hotspot.

Foreign cash flooding into Australian homes has surged by an additional $400 million, new figures show, as Queensland solidifies as the new hot spot for overseas investors.

Data released by the Foreign Investment Review Board (FIRB) on Friday show 1580 residential real estate investment proposals worth $1.9 billion were approved in the October to December 2023 quarter, overwhelmingly from China at $800 million, with an additional $100 million from Hong Kong.

India, Vietnam and Taiwan each saw $100 million worth of home purchases.

The total was up from $1.5 billion in the previous three months, $700 million of which came from China.

Chinese investors purchased 2601 homes worth $3.4 billion in full 2022-23 financial year, up from 2317 homes worth $2.4 billion in 2021-22, according to the FIRB.

Separately, a report published by the Australian Taxation Office (ATO) on Friday analysed foreign purchases of residential real estate for the full 2022-23 financial year.

“Across Australia, purchase transactions increased by 26.8 per cent,” the report said.

Foreigners from all countries purchased 5360 homes worth $4.9 billion, according to the analysis of the ATO’s Register of Foreign Ownership of Australian Assets.

That was up from 4228 purchases totalling $3.9 billion in 2021-22, and 5310 purchases totalling $4.2 billion in 2020-21.

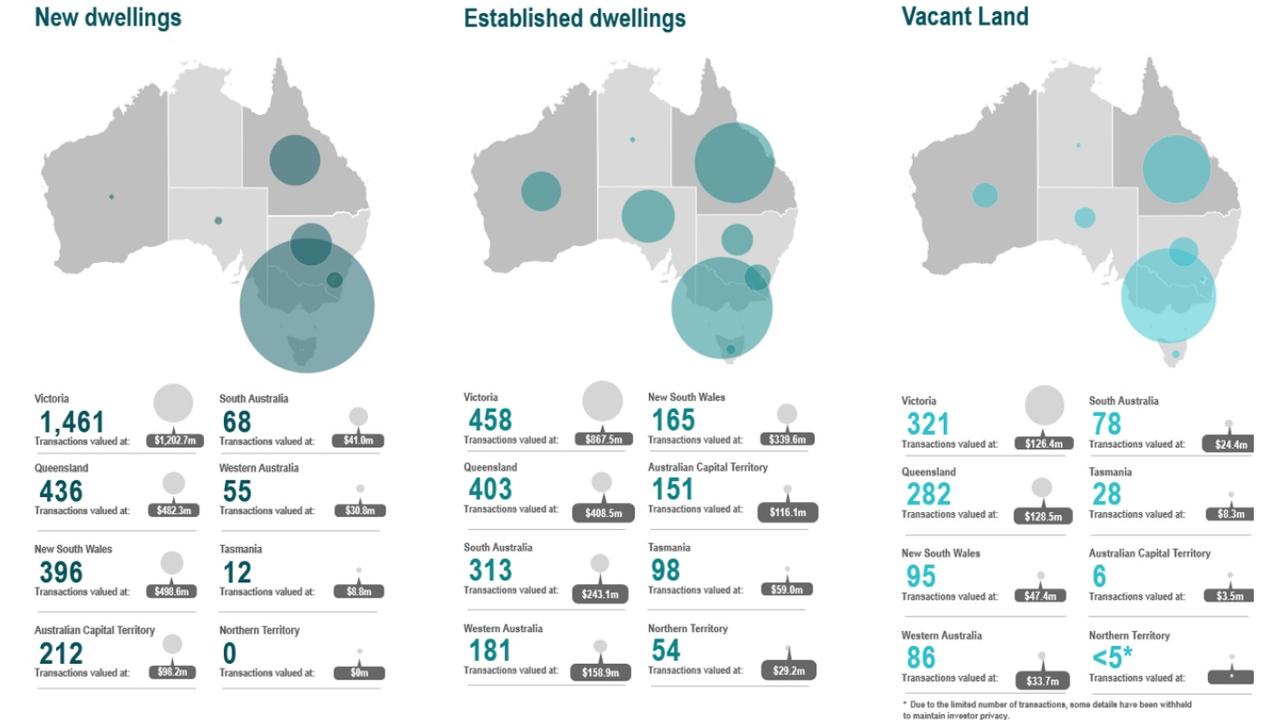

The latest figures showed a greater proportion of purchases in 2022-23 were for established dwellings at 34 per cent, compared with 49.3 per cent for new dwellings and 16.7 per cent for vacant land.

In the previous year, new dwellings represented 52.1 per cent of transactions, 31.7 per cent were established dwellings and 16.2 per cent were vacant land.

In 2022-23, foreigners offloaded 1119 properties worth $1 billion.

Asian property portal Juwai IQI’s co-founder and group managing director Daniel Ho said the 27 per cent increase showed “overseas buyers were bouncing back after the travel slowdown during the pandemic”.

“The number of offshore buyers in NSW was flat, and actually decreased by 1 per cent, from 664 to 656,” Mr Ho said in a statement.

“Meanwhile, the number of buyers in Queensland and Victoria jumped. The number of buyers in Queensland climbed 17 per cent, while the number of buyers in Victoria jumped 32 per cent, by about a third. This is the second consecutive year that more foreign buyers purchased in Queensland than in NSW.”

Mr Ho said one fifth, or 1169 of all foreign purchasers were “millionaire buyers purchasing property worth at least $1 million”.

“Foreign buyers paid an average price of $914,000, which is just below the overall average price across the country of $959,300 in the March quarter, according to the Australian Bureau of Statistics,” he said.

He noted that while Queensland attracted more buyers overall, NSW attracted more millionaire buyers. Foreign buyers purchased 284 homes in NSW worth at least $1 million, compared to only 200 in Queensland.

“Victoria got by far the most millionaire buyers, with 569 foreign buyer transactions worth over $1 million each,” he said.

“Why do foreign buyers like Australia? They appreciate Australia’s strong economy, good education system, and attractive lifestyle.”

He added that in many cases, these buyers paid 7-8 per cent of the purchase price on stamp duty and “tens of thousands of dollars, or more, on foreign buyer application fees”.

“And once they own their property, at least until they become permanent residents or citizens, they will pay an additional land tax every year,” he said.

“People have been moving to Australia in record numbers, and that shows up in the foreign buyer reports. It’s not just Australia, because we see the same thing happening in the US, Canada, Europe, and the UK. There is a significant wave of post-Covid migration as people act on plans they had to put on hold during the pandemic. We also see it in Southeast Asian countries like Thailand, which have seen rapid intake of their golden visa programs since the pandemic.”

He warned that if the Australian government “succeeds in reducing the number of foreign students and other migrants coming to the country, we can expect foreign buying to be affected”.

It comes after a survey this month found Australians overwhelmingly support a crackdown on Chinese investors buying real estate, amid growing concerns over housing affordability.

Eighty-three per cent of respondents believe the government “should restrict the amount of investment in residential real estate that is permitted from Chinese investors”, according to the poll by the University of Technology Sydney’s Australia-China Relations Institute (ACRI).

That was the highest number in the four years the UTS:ACRI survey has been running.

The poll asked a representative sample of 2015 Australian adults a range of questions on issues ranging from national security — including foreign interference and the conflict over Taiwan — to tourism, trade and investment.

Only 28 per cent of respondents agreed that “Chinese investment in Australian residential real estate brings a lot of benefits for Australians” such as housing construction, new dwellings and jobs.

A “clear majority” of 80 per cent agreed with the statement that “foreign buyers from China drive up Australian housing prices”, a seven-point increase from 73 per cent in 2023, and almost back to the 82 per cent high recorded in 2021.

Just under three quarters, or 74 per cent, said Chinese investors “have negatively affected the rental market for residential real estate in Australia”, also a four-year high and a six-point increase from 68 per cent in 2023.

More broadly, just under three quarters of respondents said Australia was “too economically reliant on China”, while just over half said foreign investment from China was “more detrimental than beneficial”.

ACRI director Professor James Laurenceson issued a fact sheet to rebut the perceptions reflected in the poll findings.

“Recently, the Australian government and opposition have arguably fuelled such perceptions by explicitly tying migration to domestic housing affordability and availability,” he said.

“The facts, however, are more equivocal.”

Foreigners without Australian citizenship or permanent residency can only purchase new homes unless approved by Treasury, but even foreigners purchasing new homes must pay hefty fees to the FIRB.

The current application fee is $14,100 for new dwellings and $42,300 for established dwellings valued up to $1 million, while higher-priced dwellings attract higher fees.

Foreign owners who leave their properties vacant must also pay an annual vacancy tax, equivalent to double the original application fee.

“Foreign buyers not residing in Australia are generally only permitted to purchase new housing,” Prof Laurenceson said.

“This reflects an Australian government assessment that foreign investment in new housing increases domestic supply — improving affordability, creating construction sector jobs and bolstering government revenues.”

He noted a recent peer-reviewed article in Housing Studies, which tested the “sensitivity of Australian residential real estate prices to Chinese investment”.

The paper, focusing on Sydney, found that “only a limited number of suburbs with large concentrations of Chinese residents, such as Chatswood, revealed any significant impact”.