Banks quash interest rate frenzy

The country’s biggest bank has flagged a shock rise in home loan arrears as rate cut expectations build to a frenzy.

A shock jump in home loan arrears has failed to stop several banks from quashing expectation of mega rate cuts as frenzy builds ahead of Tuesday’s Reserve Bank meeting.

The head of the country’s biggest bank Commonwealth Bank CEO Matt Comyn is among those moving to temper rate cut expectations, after releasing his third quarter 2025 trading update for the period to March 31 which saw profit of $2.6 billion.

RELATED: Big Aus bank slashes rates as RBA decision looms

May interest rate decision already made for Reserve Bank

MORE: Inside new Liberal leader’s property portfolio

Sad finding amid wild Aussie bank rate cut call

Mr Comyn expects a 25 bps cut to the cash rate target by the Reserve Bank board on Tuesday - a view reinforced by CBA senior economist Belinda Allen who on Thursday stuck with their call due to the unemployment rate and wages growth coming in within RBA expectations.

CBA has also flagged two more cuts over the year for a total 75bp ahead to close 2025 at 3.35pc – almost half the projections of rival National Australia Bank which has pegged a 150bp fall by February next year.

The market is virtually 50-50 at this stage on whether RBA will go 50bps, with the ASX rate tracker currently at a 51pc expectation (down from 56pc on May 1) of an interest rate decrease to 3.6pc come Tuesday. That would make it a 50bp cut, similar to the NAB view of the equivalent of a double rate cut on Tuesday.

This as CBA, the country’s biggest bank, on Wednesday highlighted a rise in its problem loans forcing an impairment expense of $223m during the quarter, with Mr Comyn flagging “increases in consumer arrears and corporate troublesome and non-performing exposures”.

Mr Comyn said in a statement to the stock exchange that “home loan arrears have increased over the quarter to 0.71pc” – up 5 basis points to sit above its historic average (0.65pc).

CBA home loan arrears are back up to the level they were at in March 2019, a year before the pandemic hit, and at a time when cash rate had languished at a low 1.5pc for more than three years.

“We know it has been another challenging period for many Australian households and businesses dealing with cost of living pressures,” Mr Comyn said. “We have remained focused on proactively engaging with our customers on a range of support options to help those who need it most.”

MORE: Shock: Brisbane prices to smash Sydney

Australia’s biggest political property moguls revealed

Global investment banker TD Securities has also flagged that the RBA would be “slow and steady and in no rush” to slash rates this year.

An update to clients overnight by Prashant Newnaha, senior Asia-Pacific rates strategist, said “our current forecast is for the RBA to deliver two further 25 bps cuts, in May and in August”.

That would bring the cash rate target down to 3.85pc on May 20 and then 3.6pc in August.

“We continue to believe it’s highly unlikely the Bank delivers cuts in between (Statement of Monetary Policy) meetings given the outlook for tariffs is nowhere as dire as it was a few weeks back.”

The SoMP is released four times a year alongside the February, May, August and November monetary policy decisions of the RBA’s monetary policy board.

The only other rate cut that TD Securities flagged was a further 25 bps reduction in November, which would bring the cash rate target down to 3.35pc.

“The risk to our call is for the RBA to deliver another 25 bps cut in Nov, but the market is priced for this outcome.”

TD Securities believes “CPI and labour market outcomes have landed close to the Bank’s Feb’25 Statement on Monetary Policy forecasts and should support the Bank easing at next week’s meeting”.

It said inflation had continued to decline steadily.

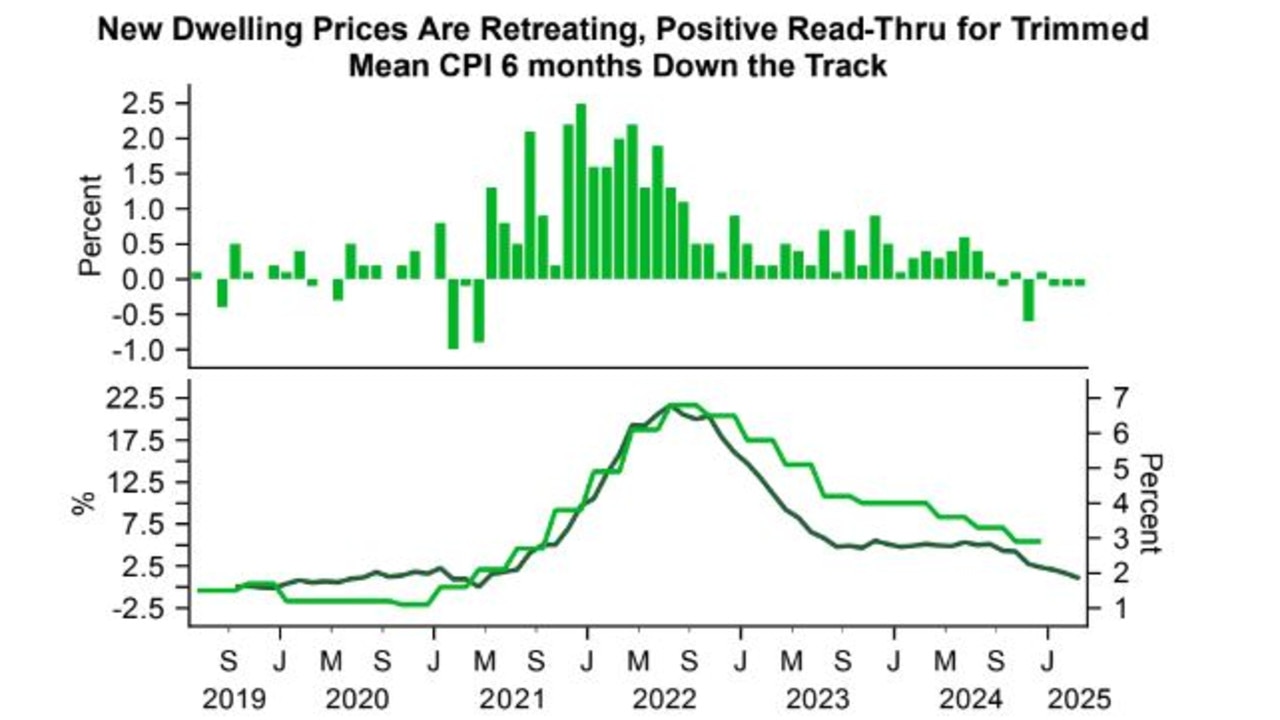

“With respect to CPI, the Bank has paid more attention to housing inflation and in that respect the outcomes are moving in the right direction for the RBA. The decline in the cost of building a new dwelling has dropped for three straight months now and the annual series has provided a good lead for where trimmed mean CPI is heading. The trend suggests the Bank is on course to hit its 2.5pc target.”

It said actual annual rental growth was also slowing.

Analysts were keen to see how the RBA board approached the question of risks around tariffs.

“Of particular focus will be the RBA’s assessment of the risks around tariffs. There are downside risks to growth, but we see no compelling case for trimmed mean CPI forecasts to deviate from 2.7pc. They could be lowered a smidge, but unlikely as low as 2.5pc.”

Originally published as Banks quash interest rate frenzy