Australia now one of the world’s most risky housing markets, according to new analysis

Concerning new analysis has revealed an “obvious vulnerability” for Australia as we head into a time of great financial uncertainty.

Australia is one of the world’s most at-risk nations of a housing bubble burst as we head into a time of great financial uncertainty — with the situation looking worse now than it was before the disastrous GFC hit.

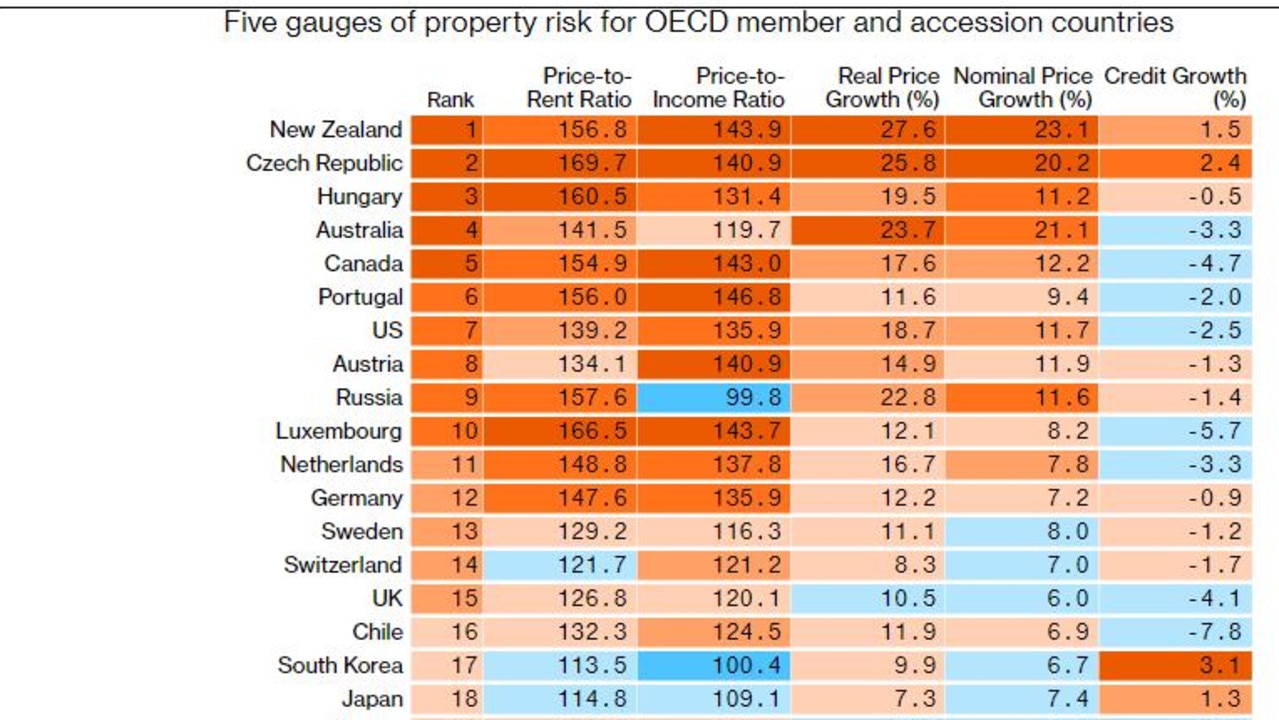

New analysis by Bloomberg Economics shows that 19 OECD countries have combined price-to-rent and home price-to-income ratios that are higher today than they were ahead of the 2008 financial crisis — an indication that prices have moved out of line with fundamentals.

Among them Australia is facing some of the biggest challenges, sitting as the fourth most risky property market in the developed world.

Only New Zealand, the Czech Republic and Hungary were found to have housing markets that were at a higher risk of imploding.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

The analysis found Australia performed very poorly when it came to key factors like price-to-rent ratio, price-to income ratio and real price growth. It means that Australia’s housing market is one of the world’s bubbliest and is particularly vulnerable to falling prices.

Bloomberg stressed that while a bad ranking doesn’t doesn’t make a housing crisis a certainty, it said it is an “obvious vulnerability” as central banks raise interest rates and mortgage repayments move higher.

“That’s another burden for a global economy already slowing down and in danger of falling into a recession,” it said. “Falling home prices erode household wealth, dent consumer confidence and potentially curb future development.”

Affordability to worsen

As interest rates began to rise this year, we have already seen property prices begin to fall.

Property prices nationally fell by 0.1 per cent in May, the first monthly drop since September 2020. Now experts are warning they could fall by a whopping 20 per cent across Australia in the next 18 months.

However, this does not mean housing will become more affordable.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

In a bombshell report this week, analysts at Moody’s Investors Service said that even if house prices tumbled by more than 20 per cent it would not solve the country’s housing affordability crisis.

In fact, they say it would make it even worse as higher interest rates will make it harder for new buyers to meet mortgage repayments, even on much cheaper homes.

They said that in January, the average Aussie household with two incomes needed 25.7 per cent of their monthly income to meet the repayments on a new mortgage loan. In May, that had risen to 26.8 per cent, and they expect it to keep rising.

If we’re talking about the two major cities, Sydney and Melbourne, that figure becomes even more concerning. Average Sydney households needed 37 per cent of their income to make their loan repayments. In Melbourne they needed 29.8 per cent, according to the research.

According to Moody’s analysts, affordability will continue to decline despite falling property prices because increasing interest rates will drive up mortgage repayments.

“We expect housing prices to decline over the rest of this year and into 2023 as rising interest rates weigh on property market sentiment,” they said.

“Based on our assessment of different housing price and interest rate scenarios, we expect that prices will not decline to the extent that housing affordability improves while interest rates are rising this year.”