‘I wasn’t entitled to anything’: 10 million Australians risk leaving their families in ‘miserable’ battle

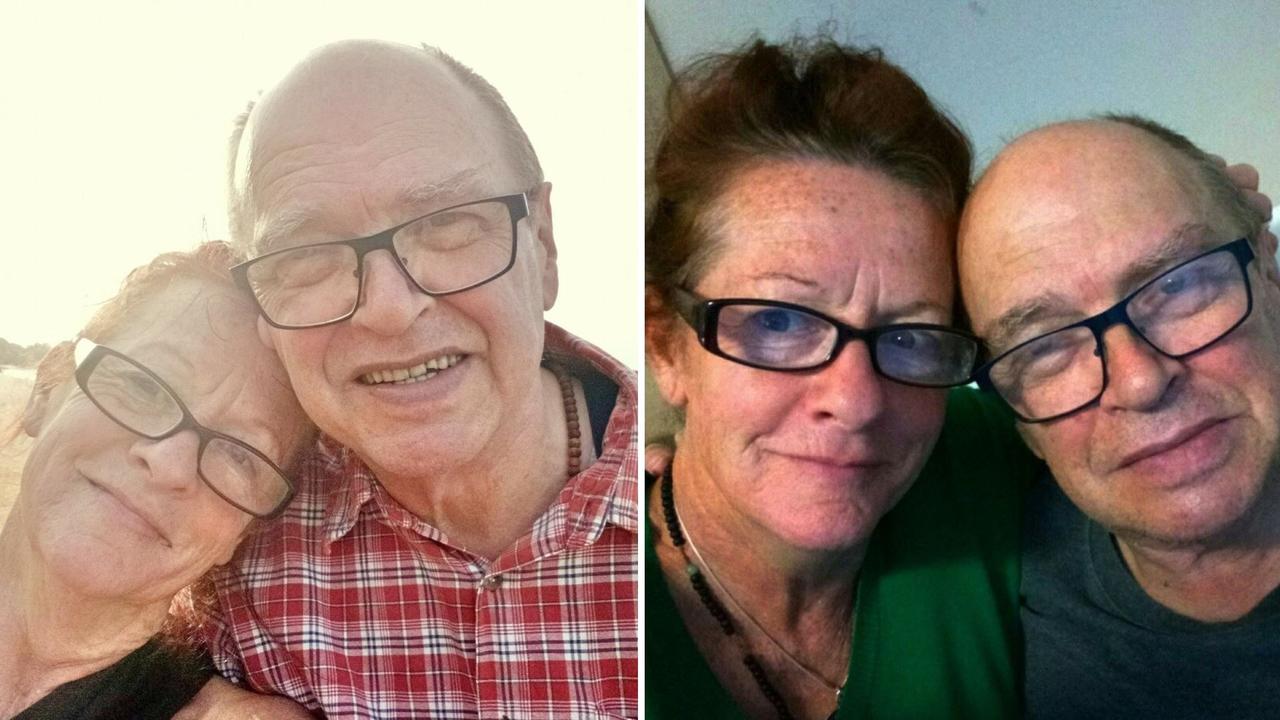

Ajanta Judd was grieving the loss of her partner when she had to fight for his estate. Here’s the message she wants every Aussie to read.

A grieving woman whose partner died suddenly of cancer has issued a powerful warning to millions of Australians after discovering the love of her life never penned a will.

Ajanta Judd spent a year locked in a bitter legal battle with her late partner Peter’s four kids over his estate when he died in 2017 after a short battle with an aggressive cancer.

“He was a bit of a procrastinator, he kept saying ‘I must do my will, I must do my will’,” she recalled of her late partner to news.com.au.

“He was diagnosed with esophageal cancer in January and died in March; and he kept saying it … even as he went through the dying process. But it didn’t happen.”

When Peter died, Ms Judd was left to deal with the “aftermath” alone, including packing up their Philip Island home – where the couple lived for 18 months – and figuring out how to complete the remainder of a book showcasing the late anthropologist’s life’s work, as she promised.

Peter had four adult children from two previous relationships, three in the United States and one in Melbourne.

Despite not formalising a will, Ms Judd claims she spoke with Peter’s adult children about the wishes he shared for her “to have this, that and the other” of his “little” assets before his death.

She claimed the eldest daughter promised they would “look after” her.

Then months into her grieving, Ms Judd was thrown into a “traumatic” legal battle over Peter’s estate when his Melbourne son applied for Letters of Administration.

Letters of Administration is the approval granted to a deceased person’s closest living next of kin by the Supreme Court that allows them to decide who inherits what when there is no will.

“I found out I wasn’t entitled to anything, because we weren’t together long enough,” Ms Judd said.

“When Peter died we’d been together just under two years; and, in Victoria, if you’ve been in a relationship less than two years you’re not entitled to anything.

“Once you hit two years you can be de facto and you’re entitled to what you would be if you’re married.”

What followed was a year-long legal battle for Ms Judd, during which she had to prove their relationship was real.

“I had to go through months and months of documents, download all of our photos, social media, cards, statutory declarations from friends … pages and pages of evidence on how far our relationship went back,” she said.

“I had to bare my soul. It felt like grieving all over again for someone who loved you and validated you, and you’re not being taken seriously.”

In the end, Ms Judd gave up the fight and walked away with a small portion of Peter’s estate – most of which went to paying legal fees and a barrister.

Millions of Australians at risk of same battle

Ms Judd has since planned her own will to avoid history repeating and she wants all Australians to take action on end-of-life planning.

Her warning comes as a new study from Australian end-of-life planning service Safewill revealed almost half of Australian adults are not ready for the inevitable.

A survey of 2000 adults found 48 per cent of respondents did not have a Will to lay out their final wishes, despite many of them having significant assets or dependants.

One in four Australian parents do not have a will, data shows; neither do almost a third (31 per cent) of adults with assets valued at $750,000 or more, nor do 26 per cent of those with at least $1.5 million in assets.

Altogether, it means almost 10 million Australians will leave their loved ones without any money or assets – and children without legally appointed guardians – when they die.

Safewill founder and CEO Adam Lubofsky said results not only showed a “staggering” number of Aussies may die intestate, but that we know very little about end-of-life planning.

The data showed almost eight in 10 (79 per cent) Australian adults don’t know what will happen to their estate if they die without a Will – they assume it will go directly to their next of kin, their partners or children, or to the government.

Meanwhile, two in five Aussies have no idea where to start with end-of-life planning and almost as many (37 per cent) have never considered getting a Will.

“There’s certainly a misconception that estate planning is more complicated and expensive than it is,” Mr Lubofsky told news.com.au.

He said it can be for those with complex circumstances, but for most Aussies: “it is totally safe and affordable to write a will in 15 to 20 minutes with Safewill.”

“The best way to limit the risk of a dispute over your estate is to lay out a plan that clearly states your wishes,” Mr Lubofsky said.

“If you don’t, your estate will be distributed according to a government statutory formula that may be completely different to what you want.”

Not having a will means having a say in the “really important decisions”, like leaving funeral notes, charitable donations or appointing guardians to children (or pets).

Mr Lubofsky said with a service as easy as Safewill, and an opportunity like Free wills Week: “there’s no reason not to have a will in place”.

Ms Judd echoed the call for action, and said she understands how confronting thinking about death can be, but has heard too many horror stories like hers.

“If you love the people around you, you would do your bloody best not to leave a mess for them,” she said.

“Not to do a will is irresponsible, it’s part of looking after yourself and the people you love.”