Elderly couple’s $900,000 pension problem sparks big debate

The plight of a retired couple with almost $1m in shares who are concerned about losing their pension has sparked a fierce response from fellow Aussies.

The plight of retired couple who are concerned about losing their pension due to their increasing wealth has struck a nerve with fellow Australians - sparking a major debate.

The couple are in their 90s and receive a part-age pension payment. They also have a share portfolio worth around $895,000, however, they are concerned about how they will be impacted if their fortune grows.

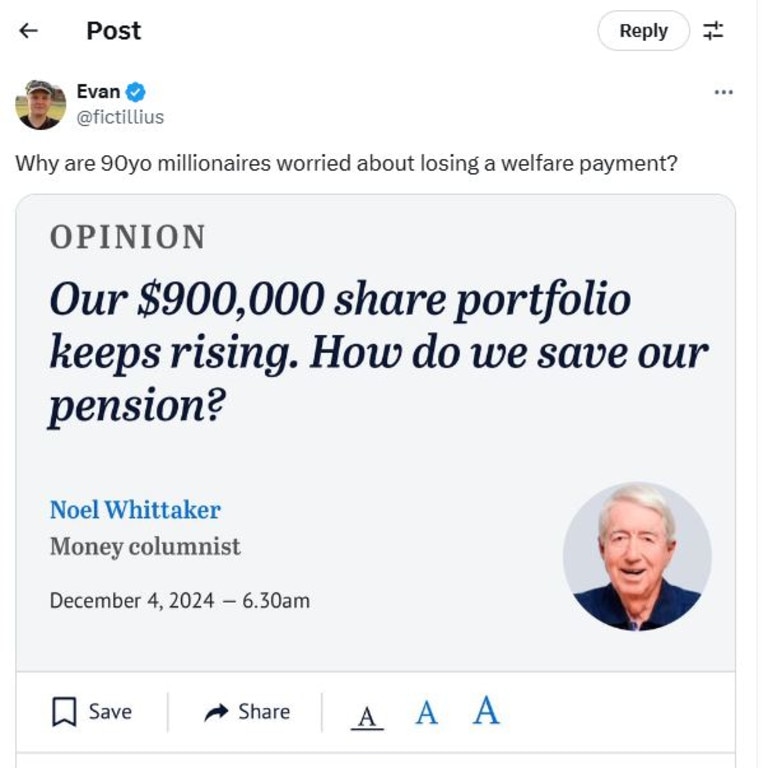

In a question to Sydney Morning Herald money columnist, Noel Whittaker, the couple’s child asked: “With the market going up as it has, they are worried that they will lose their pension and the benefits. Is there anything that they can do so they don’t lose the pension?”

In Australia you must be 67 years or older to be eligible for the pension. The maximum fortnightly payment for a single person is $1144.40 and $1725.20 for a couple.

The pension amount is reduced by 50 cents for every dollar over $212 a person receives in income per fortnight.

MORE:Can you use superannuation to buy a house?

A couple who are homeowners on a full pension can have $470,000 in combined assets before their pensions are impacted.

A couple who are homeowners on a part pension can have $1,045,500 in assets before their payments are cancelled.

In order to keep their total usable assets figure below the threshold, Whittaker suggested the couple get their furniture valued at “garage sale prices”, rather than replacement prices.

He also suggested reducing assets by prepaying for their funerals, renovating their home, and even making a gift of $10,000.

“If they gave a bigger sum of money to the children now, their pension would not be reduced as it would be held as a deprived asset for five years but would not increase in value,” the columnist suggested.

The article sparked a much bigger conversation when it was shared to X, formerly Twitter, by a Sydney local, who questioned: Why are 90yo millionaires worried about losing a welfare payment?”

The post quickly gained momentum, with people on both sides of the debate rushing to the comment section.

“If I go to work and earn money how can I do it and still keep my Centrelink payments please inform me!” one person joked.

Many branded the couple “greedy”, claiming they had more than enough to live on for the rest of their retirement.

“Firstly, stop being so greedy. Secondly, live off your money. Ffs,” one person said.

“I read that this morning, and was shocked at how greedy some people are. $900,000 is more than enough for anyone to live off during their retirement years,” another said.

Others suspected it was the child who was concerned, rather than the parents.

“It sounds like it’s the kids worrying they might have to spend their inheritance,” one said.

However, others pointed out that the couple’s concerns may not be solely related to the payments they are receiving.

One person pointed out that their pension payments likely weren’t very high anyway and suspected their main concern could be losing the medical benefits that pensioners get.

Another person pointed out that many older Australians saw, and still see, the age pension as a “long-term saving scheme for retirement”.

“They worked and paid tax all their life to earn their pension. Anything that retracts from that is seen as a loss,” they said.

According to the ATO, as of the 2021 financial year, the average super fund balance for women aged 65-69 was $403,038, and $453,075 for men.

According to the The Association of Superannuation Funds of Australia’s (ASFA) the superannuation balance needed to achieve a comfortable retirement standard for a single person is $595,000, or $690,000 for a couple.

Research from Finder has found that many Australians won’t be able to financially support themselves when they stop working.

Of the more than 1000 people surveyed, 23 per cent admitted to not having enough money in their super fund or other investments to get by in retirement.

A further 27 per cent said they weren’t sure if they would have enough money to survive once they leave the workforce.

Taylor Blackburn, personal finance specialist at Finder, said that Aussies need to take steps to boost up their super as soon as possible.

“Make sure you just have one super fund. You pay fees for each fund you have – it’s like having your savings split across three savings accounts and paying account-keeping fees on all of them,” he said.

“When you consolidate you spend less on fees, so more money stays in your name, working towards building your wealth.”

Mr Blackburn said those in a position to do so should also consider salary sacrificing into their super fund.

“Obviously once you put money into super you can’t touch it until retirement, so start small. Even $100 a month will make a difference thanks to compounding interest,” he said.